VA 763-S 1996 free printable template

Show details

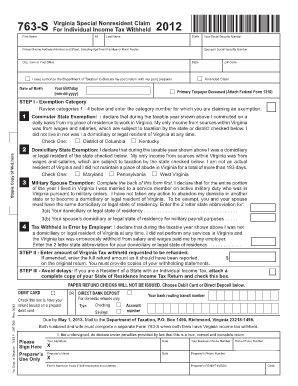

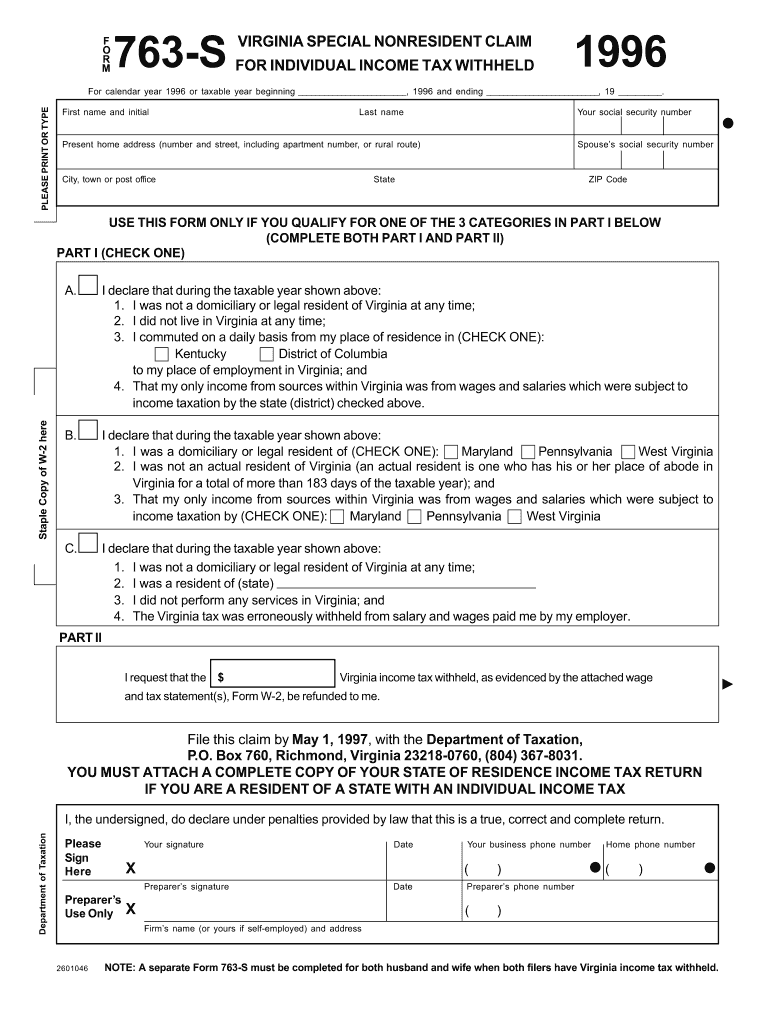

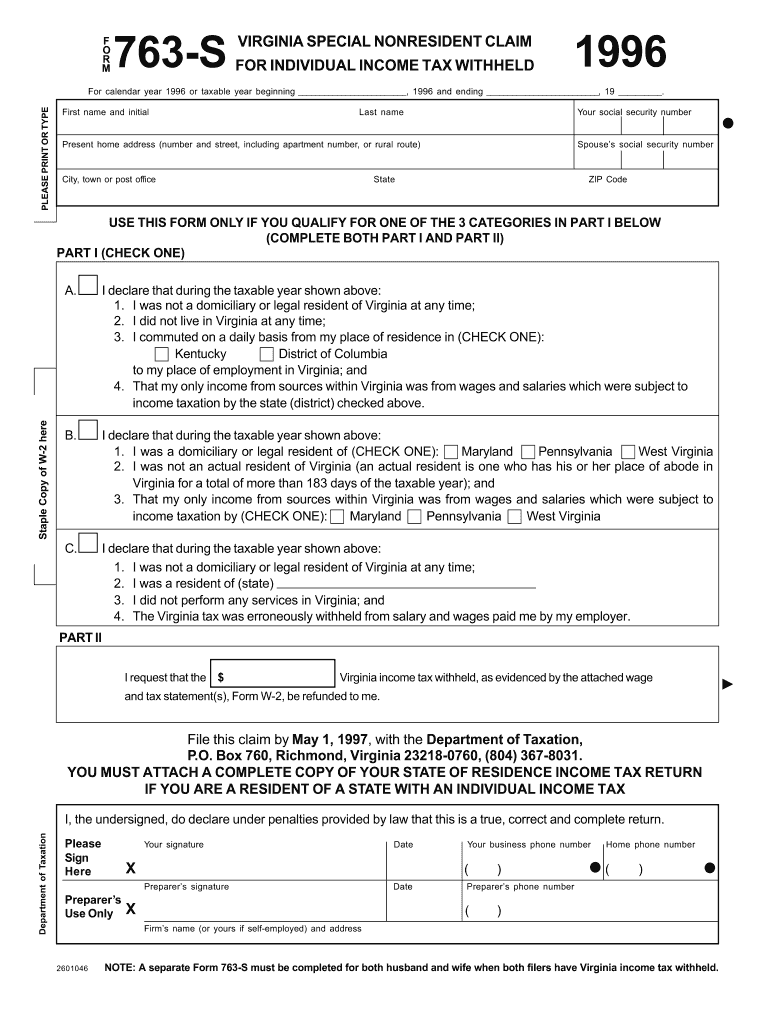

F O R M 763-S VIRGINIA SPECIAL NONRESIDENT CLAIM FOR INDIVIDUAL INCOME TAX WITHHELD PLEASE PRINT OR TYPE For calendar year 1996 or taxable year beginning 1996 and ending 19. First name and initial Last name Your social security number Present home address number and street including apartment number or rural route City town or post office w Spouse s social security number State ZIP Code USE THIS FORM ONLY IF YOU QUALIFY FOR ONE OF THE 3 CATEGORIES IN PART I BELOW COMPLETE BOTH PART I AND PART...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 763 s virginia

Edit your form 763 s virginia form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 763 s virginia form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 763 s virginia online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 763 s virginia. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA 763-S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 763 s virginia

How to fill out VA 763-S

01

Obtain the VA Form 763-S from the Department of Veterans Affairs website or your local VA office.

02

Enter your personal information in the designated fields, including your full name, Social Security number, and contact information.

03

Fill out the sections related to your military service, including branch, service number, and dates of service.

04

Complete the employment history section, providing details about your previous jobs.

05

If applicable, list any disabilities or medical conditions that you are claiming.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to the appropriate VA office, either by mail or electronically.

Who needs VA 763-S?

01

Veterans who are seeking compensation or benefits related to their military service.

02

Family members or dependents applying for survivor benefits.

03

Individuals who are filing a claim for service-connected disabilities.

Fill

form

: Try Risk Free

People Also Ask about

What is form 763S Virginia?

2022 Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld.

Do I have to pay Virginia state taxes if I work remotely?

State Tax Obligations A worker may have tax obligations in any state where they reside and possibly the state where their employer's worksite is located. A permanent remote worker will file their personal income taxes in their state of residence, whether they are a W-2 employee or a 1099-NEC independent contractor.

Am I subject to Virginia withholding?

Virginia withholding is generally required on any payment for which federal withholding is required. This includes most wages, pensions and annuities, gambling winnings, vacation pay, bonuses, and certain expense reimbursements.

Can you file taxes in one state and live in another?

If both states collect income taxes and don't have a reciprocity agreement, you'll have to pay taxes on your earnings in both states: First, file a nonresident return for the state where you work. You'll need information from this return to properly file your return in your home state.

Do I have to pay Virginia state taxes if I live in another state?

Unless you have established residency in another state, you will still be considered a domiciliary resident of Virginia, and will be required to file Virginia income tax returns. A domiciliary resident of Virginia is one whose legal domicile in the technical sense is in Virginia.

What forms do I need to file with my Virginia state taxes?

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 763 s virginia directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your form 763 s virginia as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an eSignature for the form 763 s virginia in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your form 763 s virginia right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete form 763 s virginia on an Android device?

Use the pdfFiller app for Android to finish your form 763 s virginia. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is VA 763-S?

VA 763-S is a Virginia tax form used for the reporting of sales and use tax for specific transactions.

Who is required to file VA 763-S?

Any business or individual conducting sales of tangible personal property in Virginia that are subject to sales and use tax must file VA 763-S.

How to fill out VA 763-S?

To fill out VA 763-S, gather all relevant sales data, provide identification details, report the total sales amount, and calculate the appropriate sales tax due before submitting the form.

What is the purpose of VA 763-S?

The purpose of VA 763-S is to ensure compliance with Virginia's sales and use tax laws by properly reporting taxable transactions.

What information must be reported on VA 763-S?

The information that must be reported on VA 763-S includes the seller's identification, total sales amount, type of transactions, exemptions claimed, and calculated sales tax.

Fill out your form 763 s virginia online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 763 S Virginia is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.