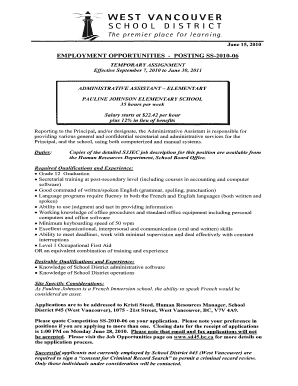

VA 763-S 2019 free printable template

Show details

Va. Dept. of Taxation 763S F 2601046 Rev. 03/19 STEP III - Avoid delays If you are a Resident of a State with an Individual Income Tax enclose a complete copy of your State of Residence Income Tax Return and check this box. If the Direct Deposit section below is not completed your refund will be issued by check. DIRECT BANK DEPOSIT Domestic Accounts Only No International Deposits Your Bank Routing Transit Number Account Number Checking Savings Due by May 1 2019. Mail to the Department of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 763 s virginia

Edit your 763 s virginia form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 763 s virginia form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 763 s virginia online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 763 s virginia. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA 763-S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 763 s virginia

How to fill out VA 763-S

01

Obtain the VA 763-S form from the official VA website or your local VA office.

02

Read the instructions carefully before filling out the form.

03

Provide your personal information including your name, address, and contact details.

04

Specify your relationship to the veteran if applicable, and provide their details.

05

Fill out the section regarding the purpose of the request, clearly stating why you need the information or services.

06

Review the eligibility criteria and ensure you meet them before submitting the form.

07

Sign and date the form at the bottom to certify that the information you provided is true and correct.

08

Attach any required supporting documents that may be requested for your application.

09

Submit the completed form either by mail or online, depending on the instructions provided.

Who needs VA 763-S?

01

Veterans seeking to obtain benefits or services.

02

Family members or guardians of veterans who wish to access information on behalf of the veteran.

03

Individuals who require evidence of military service for any legal or personal purpose.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to attach my W-2 to my Virginia state tax return?

You are also required to attach all W-2 and 1099 forms, showing Virginia tax withheld with a single staple at the left center of page 1 of the return.

What is VA form 763S?

2022 Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld.

What is the S corporation tax in Virginia?

S-corporations: Corporations that have elected S status for federal purposes are automatically treated as S-corporations for Virginia purposes, and must file Form 502. Refer to the Pass-Through Entities page for information about S-corporation filing requirements. The tax rate is 6% of Virginia taxable income.

Does Virginia require a state tax form?

You must file an income tax return in Virginia if: you are a resident of Virginia, part-year resident, or a nonresident, and.

What forms do I need to file with my Virginia state taxes?

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 763 s virginia directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your 763 s virginia as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I edit 763 s virginia on an iOS device?

Create, edit, and share 763 s virginia from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete 763 s virginia on an Android device?

Use the pdfFiller mobile app and complete your 763 s virginia and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is VA 763-S?

VA 763-S is a form used by the Virginia Department of Taxation for individuals to report certain income and claim tax credits related to their specific circumstances.

Who is required to file VA 763-S?

Individuals who have earned income in Virginia and are eligible for certain tax credits or deductions must file VA 763-S to accurately report their tax situation.

How to fill out VA 763-S?

To fill out VA 763-S, taxpayers should collect their income information, complete personal identification details, report relevant income figures, and claim any applicable credits or deductions as instructed on the form.

What is the purpose of VA 763-S?

The purpose of VA 763-S is to facilitate the reporting of income and tax credits for individuals residing in Virginia, ensuring accurate tax calculations and compliance with state tax laws.

What information must be reported on VA 763-S?

VA 763-S requires reporting personal identification details, total income, applicable tax credits, deductions, and any other financial information pertinent to the individual's tax situation.

Fill out your 763 s virginia online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

763 S Virginia is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.