VA 763-S 2019 free printable template

Show details

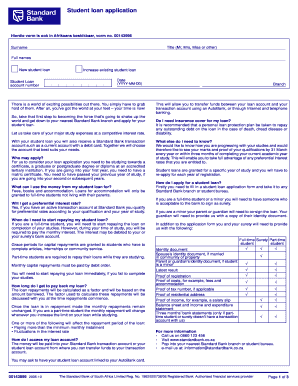

Va. Dept. of Taxation 763S F 2601046 Rev. 03/19 STEP III - Avoid delays If you are a Resident of a State with an Individual Income Tax enclose a complete copy of your State of Residence Income Tax Return and check this box. If the Direct Deposit section below is not completed your refund will be issued by check. DIRECT BANK DEPOSIT Domestic Accounts Only No International Deposits Your Bank Routing Transit Number Account Number Checking Savings Due by May 1 2019. Mail to the Department of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA 763-S

Edit your VA 763-S form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA 763-S form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit VA 763-S online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit VA 763-S. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA 763-S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA 763-S

How to fill out VA 763-S

01

Obtain VA Form 763-S from the official VA website or your local VA office.

02

Fill out the applicant's personal information, including name, address, and social security number.

03

Provide details about the veteran's service, including dates of service, branch of service, and discharge status.

04

Indicate the specific benefits or services being requested.

05

Include any additional relevant information or documentation, such as dependency information or medical records.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form in the designated area.

08

Submit the form via mail or in person to the appropriate VA office.

Who needs VA 763-S?

01

Veterans seeking to apply for VA benefits or services, particularly those related to educational assistance or training programs.

02

Dependents of veterans who may be eligible for benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is VA Form 763S?

2022 Form 763S, Virginia Special Nonresident Claim For Individual Income Tax Withheld.

What is a VA 760 form?

2022 Virginia Resident Form 760 Individual Income Tax Return.

What is a 763 form in Virginia?

What is a 763 form? File Form 763, the nonresident return, to report the Virginia source income received as a nonresident. Nonresidents File Form 763. Generally, nonresidents with income from Virginia sources must file a Virginia return if their income is at or above the filing threshold.

Do I have to pay Virginia state taxes if I live in another state?

Unless you have established residency in another state, you will still be considered a domiciliary resident of Virginia, and will be required to file Virginia income tax returns. A domiciliary resident of Virginia is one whose legal domicile in the technical sense is in Virginia.

What is a 760 760PY or 763 Virginia return?

File Form 760PY to report the income attributable to your period of Virginia residency. File Form 763, the nonresident return, to report the Virginia source income received as a nonresident.

What do you need to have completed before you fill out your Virginia state income tax form?

Generally, you will need a copy of your completed federal income tax return (Form 1040, 1040A, or 1040EZ), any supporting federal schedules (A, C, D, E, F), your W-2 wage forms and 1099 income forms showing Virginia tax withheld, Virginia Schedule ADJ, and Virginia Schedule CR.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit VA 763-S from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including VA 763-S, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete VA 763-S online?

With pdfFiller, you may easily complete and sign VA 763-S online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out VA 763-S on an Android device?

Use the pdfFiller mobile app to complete your VA 763-S on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is VA 763-S?

VA 763-S is a tax form used in Virginia for reporting and filing certain tax information related to businesses or individuals.

Who is required to file VA 763-S?

Any taxpayer who has specific income or transactions that need to be reported, particularly those involving certain types of businesses or income sources, is required to file VA 763-S.

How to fill out VA 763-S?

To fill out VA 763-S, taxpayers must provide their identifying information, report applicable income, and follow the instructions outlined by the Virginia Department of Taxation to ensure accurate reporting.

What is the purpose of VA 763-S?

The purpose of VA 763-S is to collect tax information from individuals or businesses for the state of Virginia, ensuring compliance with state tax laws.

What information must be reported on VA 763-S?

Information that must be reported on VA 763-S includes taxpayer information, types of income earned, deductions, and any relevant transactions that influence tax liability.

Fill out your VA 763-S online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA 763-S is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.