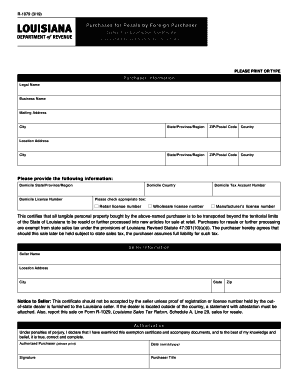

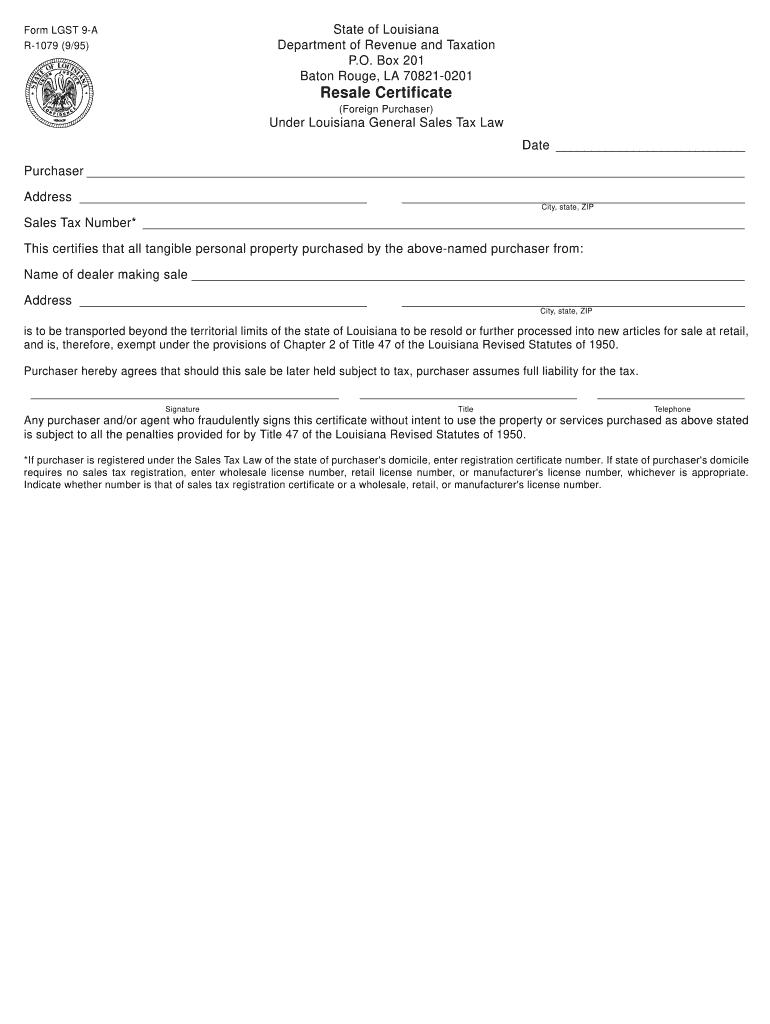

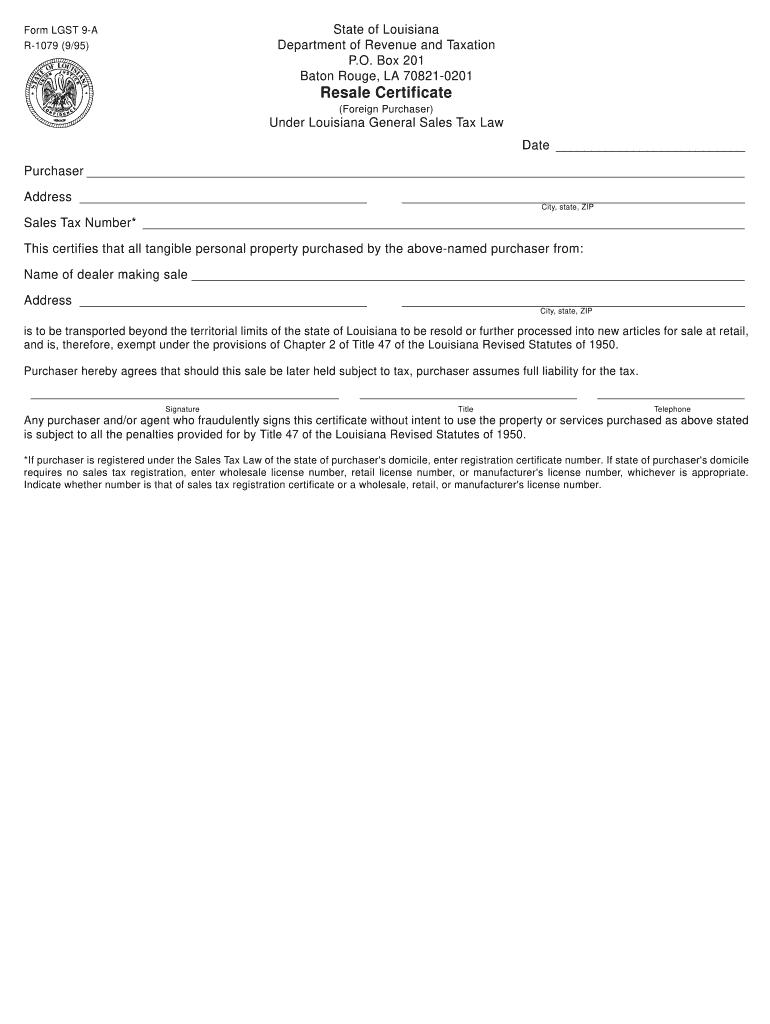

LA R-1079 1995 free printable template

Show details

State of Louisiana Department of Revenue and Taxation P. O. Box 201 Baton Rouge LA 70821-0201 Form LGST 9-A R-1079 9/95 Resale Certificate Foreign Purchaser Under Louisiana General Sales Tax Law Date Purchaser Address City state ZIP Sales Tax Number This certifies that all tangible personal property purchased by the above-named purchaser from Name of dealer making sale is to be transported beyond the territorial limits of the state of Louisiana to be resold or further processed into new...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign louisiana resale certificate example

Edit your louisiana resale certificate example form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your louisiana resale certificate example form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit louisiana resale certificate example online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit louisiana resale certificate example. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA R-1079 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out louisiana resale certificate example

How to fill out LA R-1079

01

Begin with personal information: Enter your full name, address, and contact information in the designated fields.

02

Provide your Social Security Number (SSN) in the appropriate section.

03

Indicate your filing status: Select whether you are filing as single, married filing jointly, married filing separately, etc.

04

Fill in your income details: Report all income sources as required, including wages, tips, and other income.

05

Deductible expenses: List any deductions you are claiming and provide necessary documentation.

06

Compute your total tax liability: Follow the instructions to calculate the amount of tax you owe.

07

Review for accuracy: Double-check all information for errors or omissions.

08

Sign and date the form: Ensure the form is signed and dated to validate your submission.

09

Submit the form: Send the completed form to the appropriate tax authority based on your location.

Who needs LA R-1079?

01

Individuals who are residents or part-year residents of Louisiana and need to file a state income tax return.

02

Anyone who has income sourced from Louisiana and is required to report it for tax purposes.

03

Taxpayers who are claiming deductions or seeking a refund of overpaid taxes may also need to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a copy of my resale certificate Louisiana?

How can I get a copy of my Louisiana Resale Certificate(s)? Businesses may reprint their Louisiana Resale Certificate through LaTAP on the LDR website. If a business does not have a LaTAP account, they may also request a copy by completing a Form R-7004, Tax Information Disclosure Authorization.

How do I print my Louisiana resale certificate?

Businesses may reprint their Louisiana Resale Certificate through LaTAP on the LDR website. If a business does not have a LaTAP account, they may also request a copy by completing a Form R-7004, Tax Information Disclosure Authorization.

How much does a resale certificate cost in Louisiana?

There is no cost to apply for a Louisiana resale certificate. Keep in mind that there are other costs associated with starting a business. It costs $100 to register an LLC and $75 to register a corporation in the state. There is no registration or fee to form a sole proprietorship or partnership.

How much does it cost to get a resale license in Louisiana?

There is no cost to apply for a Louisiana resale certificate. Keep in mind that there are other costs associated with starting a business. It costs $100 to register an LLC and $75 to register a corporation in the state. There is no registration or fee to form a sole proprietorship or partnership.

Do I need a Louisiana resale certificate?

If you paid state sales tax on a purchase for resale, you will need to provide a valid Louisiana resale certificate to the dealer who made the sale to receive a refund or credit. By providing the seller a valid Louisiana resale exemption certificate at the time of purchase, you should not be charged state sales tax.

How long does it take to get a resale certificate in Louisiana?

Normally, applications take 2-3 days for processing. Applications reported as “Success” have been approved and can be printed from LaTAP. LDR will also mail Resale Certificate renewals 7 – 10 business days after the application is approved.

Does Louisiana require a resale certificate?

Louisiana requires registration with the state for a resale certificate.

What do you need to get a resale license Louisiana?

Locations and mailing addresses for all business locations. Current NAICS code. A valid e-mail address. Last 2 years of resale inventory purchase amounts (for consolidated filers, purchase amounts should consist of the combined purchases of all members of the consolidation)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit louisiana resale certificate example online?

The editing procedure is simple with pdfFiller. Open your louisiana resale certificate example in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I sign the louisiana resale certificate example electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your louisiana resale certificate example in seconds.

How can I fill out louisiana resale certificate example on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your louisiana resale certificate example by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is LA R-1079?

LA R-1079 is a tax form used for reporting certain financial information to the state tax authorities in Louisiana.

Who is required to file LA R-1079?

Entities or individuals who have specific tax obligations or have generated certain income types are required to file LA R-1079.

How to fill out LA R-1079?

LA R-1079 must be filled out by providing accurate financial information as per the form's guidelines, including details about income, deductions, and credits relevant to the reporting period.

What is the purpose of LA R-1079?

The purpose of LA R-1079 is to help the Louisiana Department of Revenue collect information necessary for tax assessment and compliance.

What information must be reported on LA R-1079?

The information that must be reported on LA R-1079 includes total income, types of income, applicable deductions, and any credits claimed during the tax year.

Fill out your louisiana resale certificate example online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Louisiana Resale Certificate Example is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.