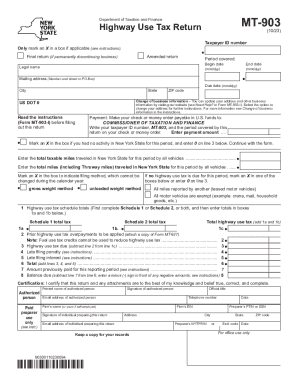

NY DTF MT-903 (Formerly MT-903-MN) 2011 free printable template

Show details

Date Taxpayer s signature Official title Telephone number Taxpayer s email address Paid preparer s email address Print name of paid individual or firm preparing this return Signature of individual preparing this return Paid preparer s telephone number For office use only Mail to NYS TAX DEPARTMENT MT-903-MN 3/11 RPC-HUT PO BOX 15166 ALBANY NY 12212-5166 Please make a copy for your records To compute the tax due on the schedules below see the Tax rate tables for highway use tax on page 4 of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ny highway use tax

Edit your ny highway use tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ny highway use tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ny highway use tax online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ny highway use tax. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF MT-903 (Formerly MT-903-MN) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ny highway use tax

How to fill out NY DTF MT-903 (Formerly MT-903-MN)

01

Obtain the NY DTF MT-903 form from the official New York State Department of Taxation and Finance website.

02

Fill in your personal information including name, address, and taxpayer identification number.

03

Provide details about the tax period for which you are filing.

04

Indicate the type of income or deduction you are reporting on the form.

05

Calculate the total amount due or refundable, ensuring all calculations are accurate.

06

Sign and date the form to certify that the information provided is correct.

07

Submit the form by the due date either electronically or via mail as instructed.

Who needs NY DTF MT-903 (Formerly MT-903-MN)?

01

Individuals or businesses that have paid certain taxes and are seeking a refund.

02

Taxpayers who need to report specific income, deductions, or claims related to tax credits.

03

Any resident or non-resident individuals who are required to report income and file taxes in New York State.

Fill

form

: Try Risk Free

People Also Ask about

Why am I getting letters from NYS tax and Finance?

Common reasons we send RFI letters include: We need to verify you reported the correct amount of wages and withholding for New York State, New York City, and Yonkers (see Checklist for acceptable proof of wages and withholding). We need to verify you lived or worked in New York State, New York City, or Yonkers.

What is a DTF 978 form?

Form DTF-978 — This is a notice to a judgment debtor or obligor, and it means the state intends to levy your assets.

Why would the Department of Taxation and Finance send me a letter?

The Franchise Tax Board will send a notice or letter for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

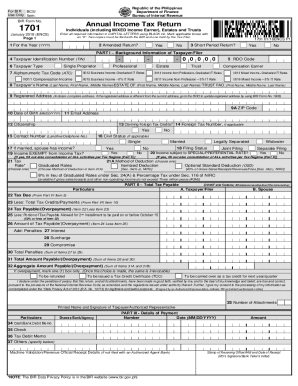

What is the difference between NYS IT-201 and 203?

If one of you was a New York State resident and the other was a nonresident or part-year resident, you must each file a separate New York return. The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203.

What is line 19a on NYS tax return?

Line 19a: Recomputed federal adjusted gross income Were you required to report any adjustments on Form IT-558, New York State Adjustments due to Decoupling from the IRC? Note: This form is reserved for a limited group of taxpayers. For more information, see the instructions for Form IT-558.

Which NYS tax form do I use?

Form IT-201, Resident Income Tax Return.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ny highway use tax directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ny highway use tax and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit ny highway use tax from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including ny highway use tax, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I sign the ny highway use tax electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your ny highway use tax in minutes.

What is NY DTF MT-903 (Formerly MT-903-MN)?

NY DTF MT-903 is a tax form used by the New York State Department of Taxation and Finance for reporting certain transactions related to the sale of tangible personal property. It was formerly known as MT-903-MN.

Who is required to file NY DTF MT-903 (Formerly MT-903-MN)?

Any seller of tangible personal property that has made sales subject to New York sales tax needs to file NY DTF MT-903.

How to fill out NY DTF MT-903 (Formerly MT-903-MN)?

To fill out NY DTF MT-903, provide the necessary details about the seller, the nature of the transactions, sales dates, and amounts. Ensure all relevant fields are completed accurately to avoid issues.

What is the purpose of NY DTF MT-903 (Formerly MT-903-MN)?

The purpose of NY DTF MT-903 is to report sales tax due to the New York State Tax Department from the sales of tangible personal property by sellers.

What information must be reported on NY DTF MT-903 (Formerly MT-903-MN)?

The information that must be reported includes the seller's identification details, transaction dates, total sales amount, taxable amount, and the calculated sales tax.

Fill out your ny highway use tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ny Highway Use Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.