NY DTF MT-903 (Formerly MT-903-MN) 2015 free printable template

Show details

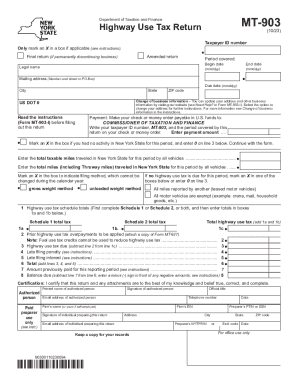

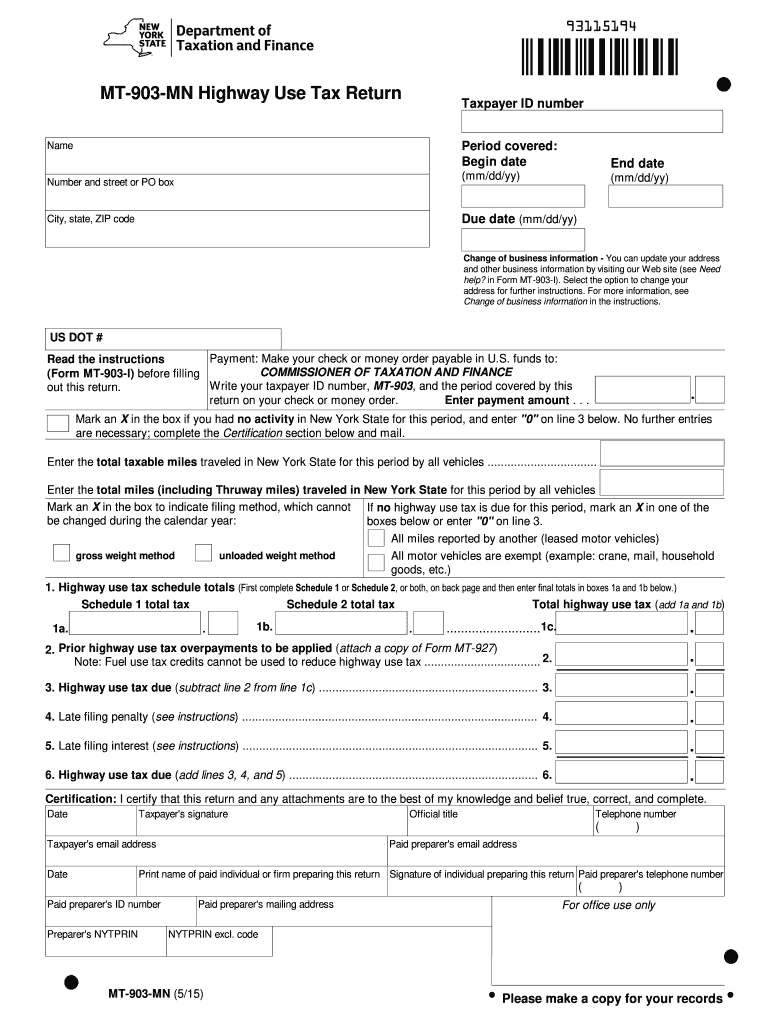

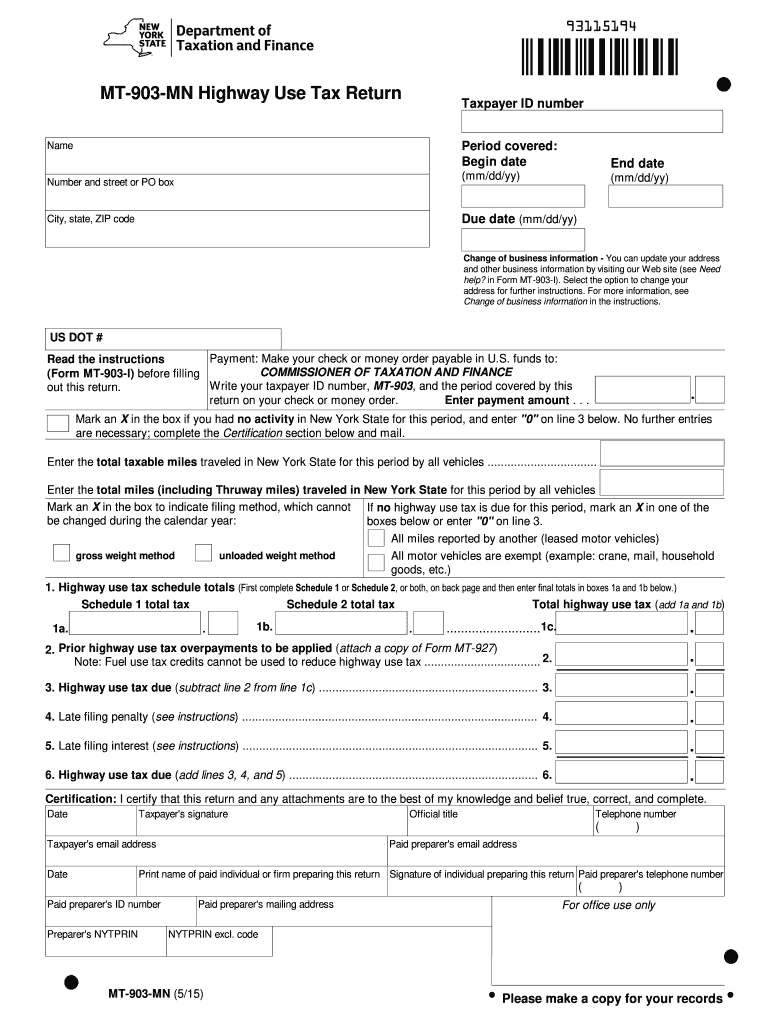

Be sure to use the proper tables for your reporting method. If you have any questions please see Need help in Form MT-903-I. 93115194 MT-903-MN Highway Use Tax Return Taxpayer ID number Period covered Begin date Number and street or PO box End date mm/dd/yy Name Due date mm/dd/yy City state ZIP code Change of business information - You can update your address and other business information by visiting our Web site see Need help in Form MT-903-I. Date Taxpayer s signature Official title...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mt 903 - tax

Edit your mt 903 - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mt 903 - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mt 903 - tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mt 903 - tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF MT-903 (Formerly MT-903-MN) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mt 903 - tax

How to fill out NY DTF MT-903 (Formerly MT-903-MN)

01

Obtain the NY DTF MT-903 form from the New York State Department of Taxation and Finance website or request a paper form.

02

Fill in your name, address, and other personal information in the designated fields.

03

Indicate your taxpayer identification number (Social Security Number or Employer Identification Number).

04

Provide the details of the income or transactions that the form pertains to.

05

Specify any deductions, credits, or exemptions that apply to your situation.

06

Carefully review all the information entered to ensure its accuracy.

07

Sign and date the form in the appropriate section.

08

Submit the completed form to the relevant tax authority by the specified due date.

Who needs NY DTF MT-903 (Formerly MT-903-MN)?

01

Individuals or businesses that have conducted certain transactions or earned income that necessitates reporting to the New York State Department of Taxation and Finance.

02

Taxpayers who qualify for specific deductions or credits associated with the income or transactions reported on the form.

Fill

form

: Try Risk Free

People Also Ask about

What is MT 903 form?

You must file Form MT-903, Highway Use Tax Return, if you have been issued a certificate of registration (certificate) or if you operate a motor vehicle (as defined in Tax Law Article 21) in New York State.

What is the phone number for NYS highway use tax?

518-457-5149—Para español, oprima el dos. 8:30 a.m. – 4:30 p.m. 8:30 a.m. – 4:30 p.m.

How is NYS highway use tax calculated?

The highway use tax is computed by multiplying the number of miles traveled on New York State public highways (excluding toll-paid portions of the New York State Thruway) by a tax rate. The tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax.

How do I get a NY State Hut sticker?

Order your temporary HUT and AFC credentials online at OSCAR or through a permit service company approved by the Tax Department. Print Form TR-8, Temporary Credential or Receipt of Application, and carry it in the motor vehicle until the Tax Department issues a certificate of registration and decal.

How do I speak to a live person at NYS tax Department?

518-457-5149—Para español, oprima el dos. 8:30 a.m. – 4:30 p.m. 8:30 a.m. – 4:30 p.m.

How do I file NYS highway use tax?

0:43 8:24 Highway Use Tax Web File Demonstration - YouTube YouTube Start of suggested clip End of suggested clip From the services menu. Select other taxes. Then select highway use tax web. File.MoreFrom the services menu. Select other taxes. Then select highway use tax web. File.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mt 903 - tax directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your mt 903 - tax along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an electronic signature for signing my mt 903 - tax in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your mt 903 - tax and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit mt 903 - tax on an Android device?

With the pdfFiller Android app, you can edit, sign, and share mt 903 - tax on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is NY DTF MT-903 (Formerly MT-903-MN)?

NY DTF MT-903 is a tax form used by New York State taxpayers to report and reconcile the credit for the tax paid to other jurisdictions. It was formerly known as MT-903-MN.

Who is required to file NY DTF MT-903 (Formerly MT-903-MN)?

Taxpayers who have received a credit for tax paid to another jurisdiction and wish to claim it on their New York State tax return are required to file NY DTF MT-903.

How to fill out NY DTF MT-903 (Formerly MT-903-MN)?

To fill out NY DTF MT-903, taxpayers must provide their identification information, the details of the taxes paid to other jurisdictions, and the credit being claimed. Complete the form by following the instructions provided on the form.

What is the purpose of NY DTF MT-903 (Formerly MT-903-MN)?

The purpose of NY DTF MT-903 is to allow taxpayers to claim a credit for taxes paid to other states or jurisdictions, thus avoiding double taxation on the same income.

What information must be reported on NY DTF MT-903 (Formerly MT-903-MN)?

The information that must be reported includes taxpayer identification, the name of the other jurisdiction, the amount of tax paid to that jurisdiction, and the period for which the tax was paid.

Fill out your mt 903 - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mt 903 - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.