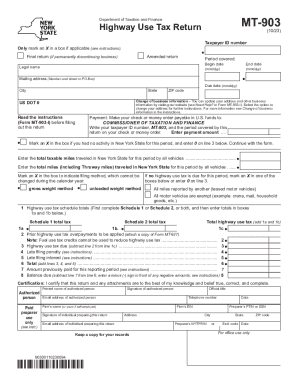

NY DTF MT-903 (Formerly MT-903-MN) 2007 free printable template

Show details

New York State Department of Taxation and Finance MT903MN Highway Use Tax Return Taxpayer ID number Period covered Begin date (mm/dd/by) Name End date (mm/dd/by) Number and street or PO box Due date

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF MT-903 Formerly MT-903-MN

Edit your NY DTF MT-903 Formerly MT-903-MN form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF MT-903 Formerly MT-903-MN form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF MT-903 Formerly MT-903-MN online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY DTF MT-903 Formerly MT-903-MN. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF MT-903 (Formerly MT-903-MN) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF MT-903 Formerly MT-903-MN

How to fill out NY DTF MT-903 (Formerly MT-903-MN)

01

Obtain the NY DTF MT-903 form from the New York State Department of Taxation and Finance website.

02

Fill in your personal information, including your name, address, and contact information.

03

Indicate the type of income that requires reporting on the form.

04

Provide the necessary details regarding your tax withholdings and credits.

05

Review your entries for accuracy to ensure all required fields are completed.

06

Sign and date the form where indicated.

07

Submit the completed form to the New York State Department of Taxation and Finance by the specified due date.

Who needs NY DTF MT-903 (Formerly MT-903-MN)?

01

Individuals who have been issued a refund check from New York State and need to report taxable income.

02

Taxpayers who received overpayments, adjustments, or credits related to their state taxes.

03

Anyone required to report specific withholding amounts for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is MT 903 form?

You must file Form MT-903, Highway Use Tax Return, if you have been issued a certificate of registration (certificate) or if you operate a motor vehicle (as defined in Tax Law Article 21) in New York State.

What is the phone number for NYS highway use tax?

518-457-5149—Para español, oprima el dos. 8:30 a.m. – 4:30 p.m. 8:30 a.m. – 4:30 p.m.

How is NYS highway use tax calculated?

The highway use tax is computed by multiplying the number of miles traveled on New York State public highways (excluding toll-paid portions of the New York State Thruway) by a tax rate. The tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax.

How do I get a NY State Hut sticker?

Order your temporary HUT and AFC credentials online at OSCAR or through a permit service company approved by the Tax Department. Print Form TR-8, Temporary Credential or Receipt of Application, and carry it in the motor vehicle until the Tax Department issues a certificate of registration and decal.

How do I speak to a live person at NYS tax Department?

518-457-5149—Para español, oprima el dos. 8:30 a.m. – 4:30 p.m. 8:30 a.m. – 4:30 p.m.

How do I file NYS highway use tax?

0:43 8:24 Highway Use Tax Web File Demonstration - YouTube YouTube Start of suggested clip End of suggested clip From the services menu. Select other taxes. Then select highway use tax web. File.MoreFrom the services menu. Select other taxes. Then select highway use tax web. File.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NY DTF MT-903 Formerly MT-903-MN?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the NY DTF MT-903 Formerly MT-903-MN. Open it immediately and start altering it with sophisticated capabilities.

How do I make edits in NY DTF MT-903 Formerly MT-903-MN without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your NY DTF MT-903 Formerly MT-903-MN, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I sign the NY DTF MT-903 Formerly MT-903-MN electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your NY DTF MT-903 Formerly MT-903-MN in minutes.

What is NY DTF MT-903 (Formerly MT-903-MN)?

NY DTF MT-903 is a tax form used for the reporting of the New York State motor fuel sales and usage tax. It was formerly known as MT-903-MN.

Who is required to file NY DTF MT-903 (Formerly MT-903-MN)?

Individuals or businesses that buy and sell motor fuel in New York State are required to file NY DTF MT-903, including distributors, wholesalers, and retailers.

How to fill out NY DTF MT-903 (Formerly MT-903-MN)?

To fill out NY DTF MT-903, taxpayers must provide details about their sales and purchases of motor fuel, including the type and amount of fuel, the sales tax collected, and any applicable deductions.

What is the purpose of NY DTF MT-903 (Formerly MT-903-MN)?

The purpose of NY DTF MT-903 is to document and report motor fuel sales and usage, ensuring compliance with state tax regulations and facilitating the collection of motor fuel taxes.

What information must be reported on NY DTF MT-903 (Formerly MT-903-MN)?

Information that must be reported on NY DTF MT-903 includes details of fuel purchases and sales, the total tax due, any tax exemptions claimed, and signature of the authorized person.

Fill out your NY DTF MT-903 Formerly MT-903-MN online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF MT-903 Formerly MT-903-MN is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.