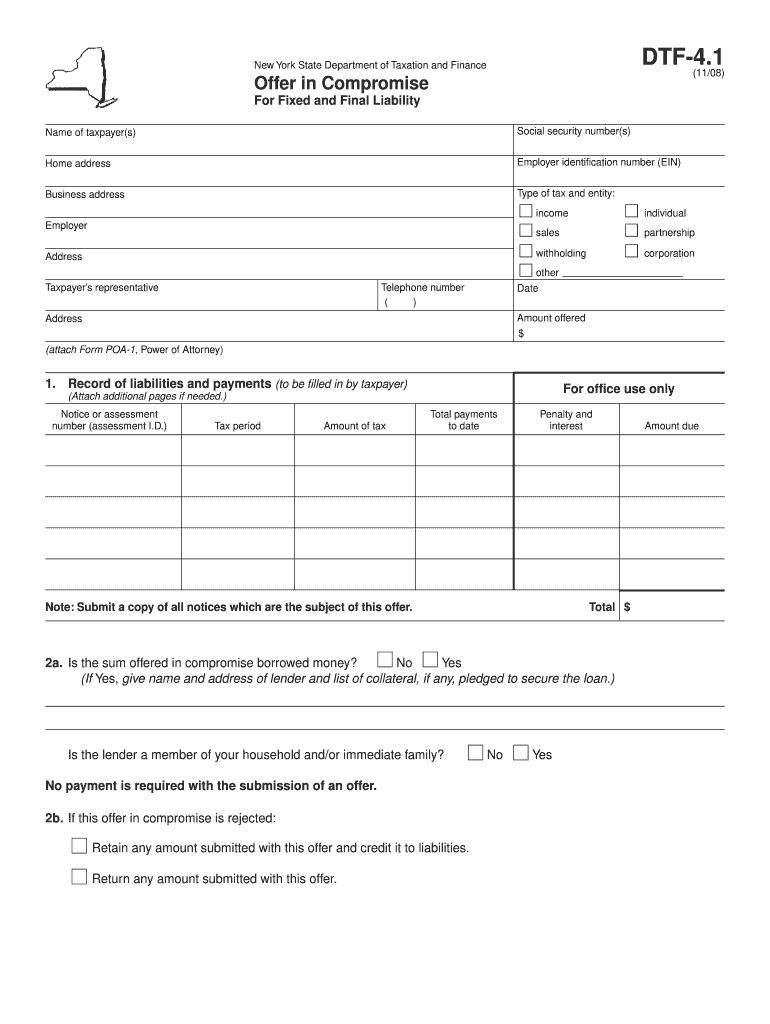

Who needs a form DT — 4.1?

Form DT — 4.1 or Offer in Compromise for Fixed and Final Liability is filled by a taxpayer.

What is form DT — 4.1 for?

Form DT — 4.1 serves a plea on a taxpayer's behalf to pay less tax amount than initially required. This form may be a legitimate option for a taxpayer to minimize taxation if it leads to financial hardship, or if the taxpayer is unable to pay full tax amount. The reasons for submitting form DT — 4.1 may be as follows:

- Liability in doubt

- Collect ability in doubt

- Special circumstances when collect ability is in doubt

- Effective tax administration

However, offer in compromise may be rejected due to the insufficient number of proof of a taxpayer's inability to pay. Thus, before submitting form DT — 4.1 make sure you have thoroughly explored all payment options or that you've hired a true tax expert to help you file the form.

Is form DT — 4.1 accompanied by other forms?

Form DT — 4.1 is accompanied by the Statement of Financial Condition and Other Information that is form DT — 5.

When is form DT — 4.1 due?

Form DT — 4.1 is due the end of the year.

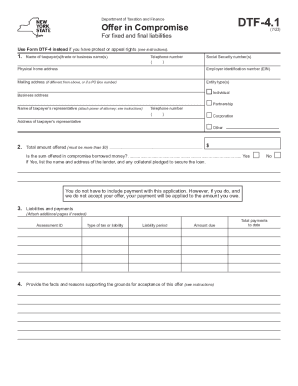

How do I fill out form DT — 4.1?

Form DT — 4.1 contains 3 pages with a number of fields to be filled by the taxpayer and for the office use only. First, a taxpayer enters his/her contact information including:

- Name

- Home address

- Business address

- Employer

- Tax payer`s representative and his/her address

- Employer identification number

- Type of tax and entity

Part called “Record of liabilities and payments” is alsphifi by a taxpayer. This sections consists of such fields and columns:

- Notice of assessment number

- Tax period

- Amount of tax

- Total payments to date

- The sum offered in compromise borrowed money if any

Page 2 contains information about facts and reasons for the offer. A taxpayer should confirm them by the signature. Page 3 includes instructions to guide a taxpayer through the filing process.

Where do I send form DT — 4.1?

Form DT -4.1 is sent to the New York State Department of Taxation and Finance.