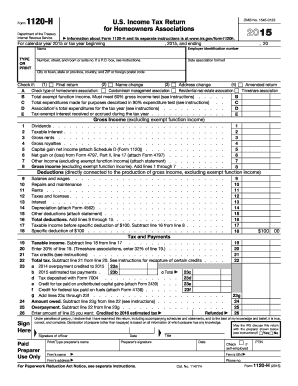

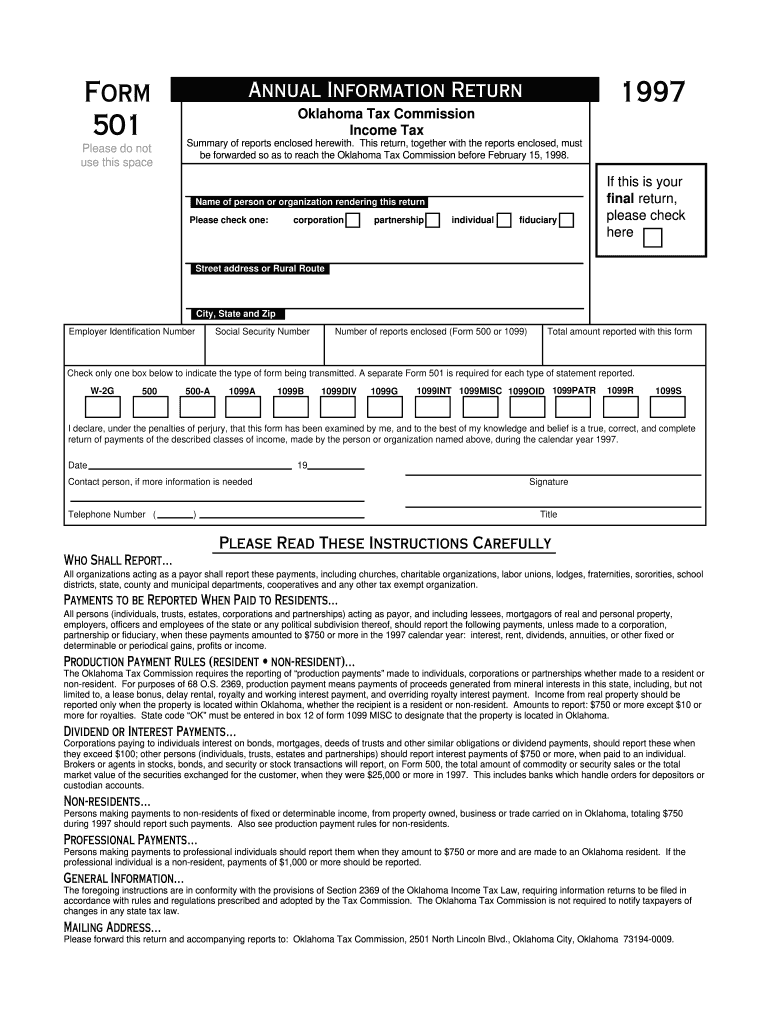

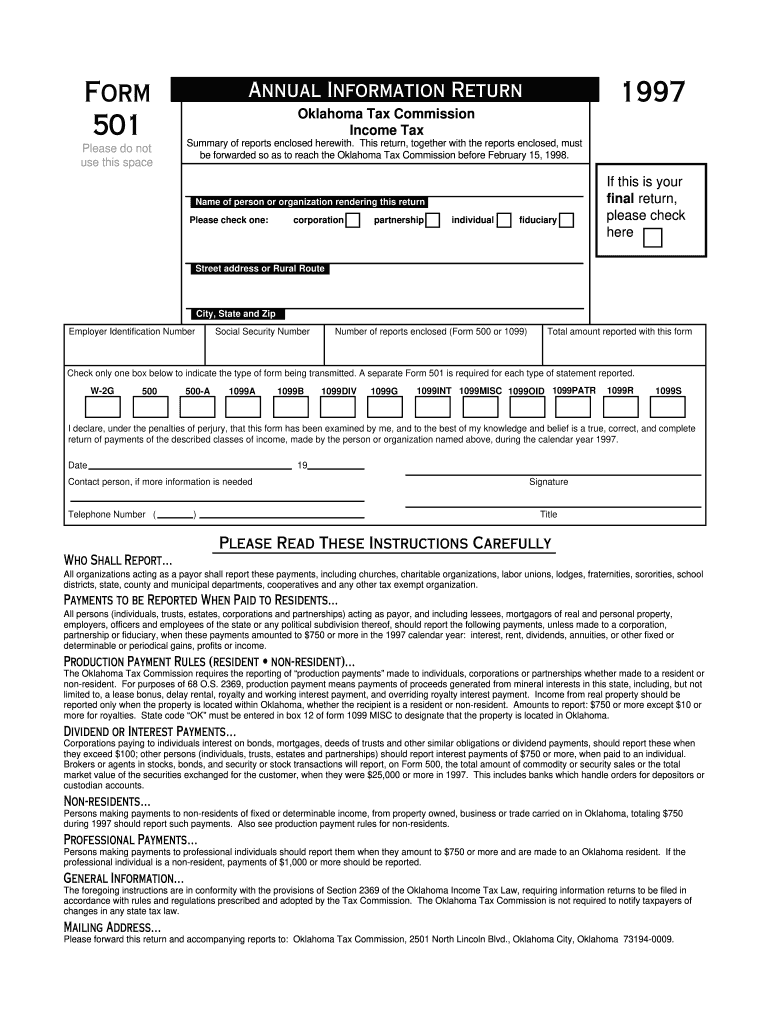

OK Form 501 1997 free printable template

Show details

This return together with the reports enclosed must be forwarded so as to reach the Oklahoma Tax Commission before February 15 1998. Name of person or organization rendering this return Please check one corporation partnership individual fiduciary If this is your final return please check here Street address or Rural Route City State and Zip Employer Identification Number Social Security Number Number of reports enclosed Form 500 or 1099 Total amount reported with this form Check only one box...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 501 oklahoma 1997

Edit your form 501 oklahoma 1997 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 501 oklahoma 1997 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 501 oklahoma 1997 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 501 oklahoma 1997. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK Form 501 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 501 oklahoma 1997

How to fill out OK Form 501

01

Obtain a copy of OK Form 501 from the appropriate agency or website.

02

Ensure you have all necessary information on hand, such as personal details, relevant dates, and other required documentation.

03

Begin filling out the form by providing your name and contact information in the designated fields.

04

Complete the sections regarding the purpose of the form, ensuring all required fields are filled out accurately.

05

Review any instructions provided with the form to ensure compliance with submission guidelines.

06

Double-check all entered information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form according to the instructions, whether by mail, email, or in person.

Who needs OK Form 501?

01

Individuals or entities who are applying for specific benefits or services that require documentation as outlined by the agency managing OK Form 501.

02

Those who need to report information related to eligibility for assistance programs or benefits.

Fill

form

: Try Risk Free

People Also Ask about

What are the residency rules for Oklahoma income tax?

An Oklahoma resident is a person domiciled in this state for the entire tax year. “Domicile” is the place established as a person's true, fixed, and permanent home. It is the place you intend to return whenever you are away (as on vacation abroad, business assignment, educational leave or military assignment).

How do I file for an Oklahoma tax extension?

Oklahoma Tax Extension Form: To request an Oklahoma extension, file Form 504 by the original due date of your return. NOTE: If you have an approved Federal tax extension (IRS Form 4868), you will automatically be granted an Oklahoma tax extension.

Do I need to file an Oklahoma tax extension?

If you owe OK income taxes, you will either have to submit a OK tax return or extension by the April 18, 2023 tax deadline in order to avoid late filing penalties. The extension will only avoid late filing penalties until Oct. 16, 2023.

Do I have to pay Oklahoma state income tax?

Every resident individual whose gross income from both within and outside of Oklahoma exceeds the standard deduction plus personal exemption is required to file an Oklahoma income tax return.

Does Oklahoma require an individual extension?

Oklahoma Requires: The state grants an extension if you already have an approved federal extension rather than requesting an extension using the state extension Form. Alternatively, Individuals can file Form 504-I to request an Extension for Form 511 if they don't have an approved federal tax extension.

Do you have to include federal return with Oklahoma State?

State DOR requests that you include a copy of your Federal return. If you paper-file the OK-511, you should include a copy of the Federal return and if applicable, the federal child care credit schedule. If you e-file, the note does not apply and no further action is needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 501 oklahoma 1997 directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign form 501 oklahoma 1997 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an eSignature for the form 501 oklahoma 1997 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your form 501 oklahoma 1997 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit form 501 oklahoma 1997 on an iOS device?

Create, modify, and share form 501 oklahoma 1997 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is OK Form 501?

OK Form 501 is a tax form used in Oklahoma for reporting and reconciling income tax withholdings for employers.

Who is required to file OK Form 501?

Employers who withhold state income tax from their employees' wages in Oklahoma are required to file OK Form 501.

How to fill out OK Form 501?

To fill out OK Form 501, employers need to provide information about their business, total wages paid, total income tax withheld, and any adjustments from prior periods.

What is the purpose of OK Form 501?

The purpose of OK Form 501 is to report the amount of state income tax withheld from employees' paychecks and ensure that these amounts are properly reconciled with the state tax authority.

What information must be reported on OK Form 501?

OK Form 501 must report the employer's identification information, total wages paid to employees, total state income tax withheld, and any applicable credits or adjustments.

Fill out your form 501 oklahoma 1997 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 501 Oklahoma 1997 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.