OK Form 501 2013 free printable template

Show details

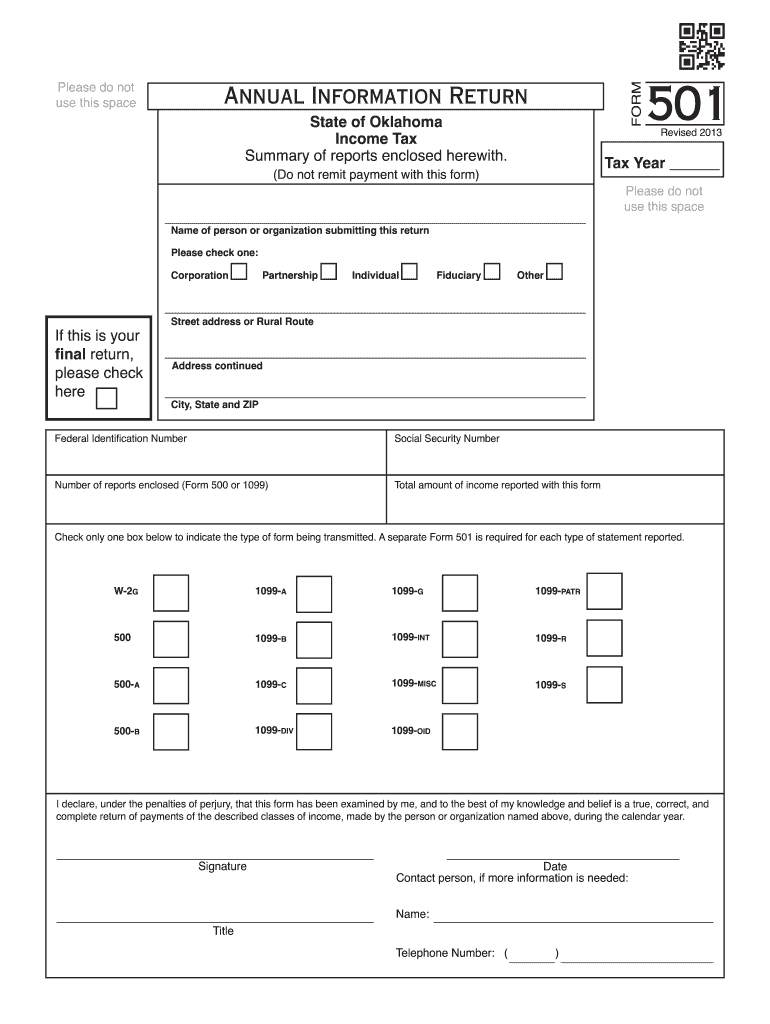

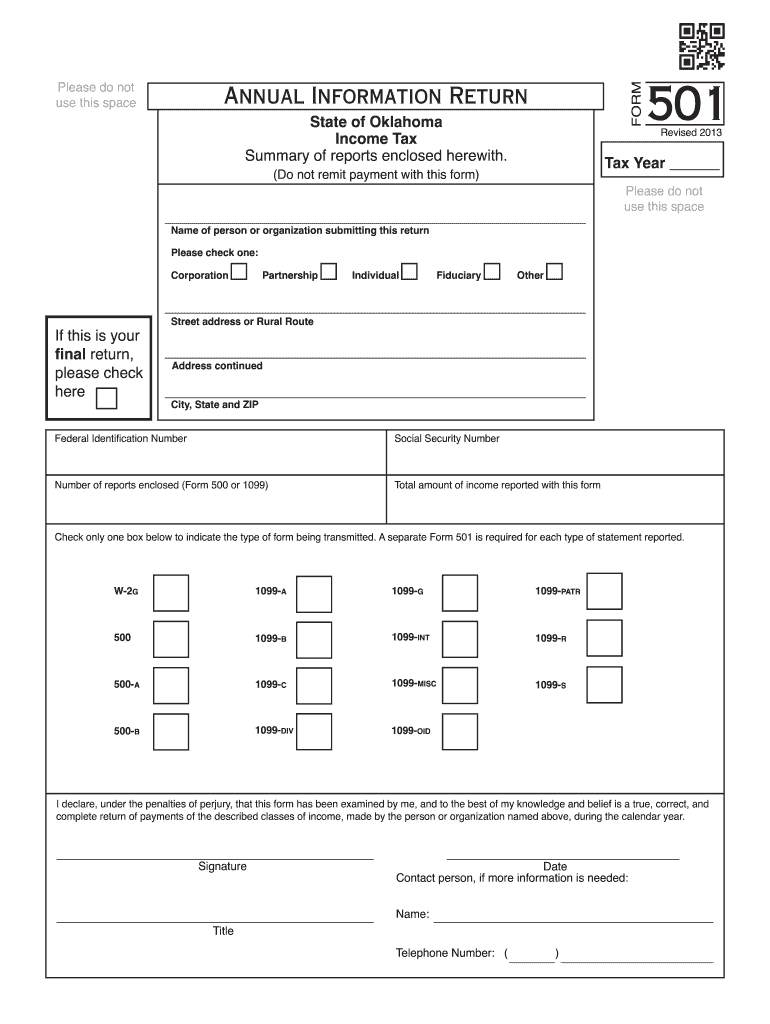

Form 501 Instructions All payors including but not limited to churches charitable organizations labor unions lodges fraternities sororities school districts state county and municipal departments cooperatives and any other tax exempt organization shall report these payments. Due Dates. This return together with the reports enclosed must be furnished to the Oklahoma Tax Commission by February 28 of the succeeding calendar year except where indicated below. Please do not use this space FORM...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 501 oklahoma 2013

Edit your form 501 oklahoma 2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 501 oklahoma 2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 501 oklahoma 2013 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 501 oklahoma 2013. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK Form 501 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 501 oklahoma 2013

How to fill out OK Form 501

01

Begin by downloading the OK Form 501 from the official website.

02

Fill out the top section with your personal details, including your name, address, and contact information.

03

In the following sections, provide the required financial information as prompted.

04

Ensure that all the information is accurate and complete to avoid delays.

05

Review the form thoroughly before signing it at the bottom.

06

Submit the completed form as instructed, either online or by mailing it to the appropriate agency.

Who needs OK Form 501?

01

Individuals who are applying for certain state benefits or assistance programs in Oklahoma.

02

Residents seeking to report financial information for state tax purposes.

03

Anyone required to submit this form as part of a legal or governmental process.

Fill

form

: Try Risk Free

People Also Ask about

Where do I mail my OK Form 501?

The Oklahoma Tax Commission is not required to notify taxpayers of changes in any state tax law. Please forward this return and accompanying reports to: Oklahoma Tax Commission, 2501 North Lincoln Blvd., Oklahoma City, Oklahoma 73194-0009.

Do I have to pay Oklahoma state income tax if I live in Texas?

If you earn income in one state while living in another, you should expect to file a tax return for the state where you are living (your “resident” state). You may also be required to file a state tax return where your employer is located or any state where you have a source of income.

Do I have to pay Oklahoma state income tax?

The state of Oklahoma requires you to pay taxes if you're a resident or nonresident that receives income from an Oklahoma source. The state income tax rates range from 0% to 5%, and the sales tax rate is 4.5%.

Do you have to pay state taxes in Oklahoma?

Every resident individual whose gross income from both within and outside of Oklahoma exceeds the standard deduction plus personal exemption is required to file an Oklahoma income tax return.

How do I file an amended Oklahoma state tax return?

How to File an Oklahoma Tax Amendment. If you need to change or amend an accepted Oklahoma State Income Tax Return for the current or previous Tax Year, you need to complete Form 511 (residents) or Form 511NR (nonresidents and part-year residents). Forms 511 and 511NR are Forms used for the Tax Amendment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute form 501 oklahoma 2013 online?

pdfFiller has made it simple to fill out and eSign form 501 oklahoma 2013. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit form 501 oklahoma 2013 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit form 501 oklahoma 2013.

How can I fill out form 501 oklahoma 2013 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your form 501 oklahoma 2013. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is OK Form 501?

OK Form 501 is a tax form used by individuals and entities in Oklahoma to report certain income details and calculate their tax liability.

Who is required to file OK Form 501?

Individuals and entities who earn income in Oklahoma and need to report it for tax purposes are required to file OK Form 501.

How to fill out OK Form 501?

To fill out OK Form 501, gather all relevant income documents, follow the instructions on the form, enter your personal information, report your income, and complete any calculations as required.

What is the purpose of OK Form 501?

The purpose of OK Form 501 is to report taxable income in Oklahoma and ensure that the correct amount of tax is calculated and reported to the state.

What information must be reported on OK Form 501?

OK Form 501 requires reporting of personal details, specific income types, deductions, credits, and any other relevant financial information related to tax liability.

Fill out your form 501 oklahoma 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 501 Oklahoma 2013 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.