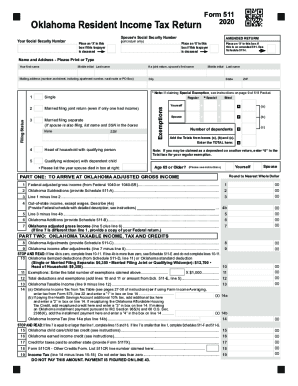

OK Form 501 2020 free printable template

Show details

Form 501 Instructions All payors including but not limited to churches charitable organizations labor unions lodges fraternities sororities school districts state county and municipal departments cooperatives and any other tax exempt organization shall report these payments. Due Dates. This return together with the reports enclosed must be furnished to the Oklahoma Tax Commission by February 28 of the succeeding calendar year except where indicated below. Revised 2017 Tax Year Do not remit...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign oklahoma form 501

Edit your oklahoma form 501 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma form 501 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oklahoma form 501 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit oklahoma form 501. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK Form 501 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out oklahoma form 501

How to fill out OK Form 501

01

Start by obtaining the OK Form 501 from the appropriate governing body or website.

02

Review the form instructions completely before filling it out.

03

Enter the required personal information such as name, address, and contact details in the designated fields.

04

Provide any necessary identification numbers, such as Social Security Number or tax identification number, if applicable.

05

Fill in the relevant sections regarding your specific situation, ensuring to follow any prompts or guidelines provided.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form through the specified submission method, whether by mail, online, or in person.

Who needs OK Form 501?

01

Individuals or entities in Oklahoma who are required to report specific information for tax, regulatory, or legal purposes.

02

Organizations needing to apply for state assistance or permits may also need to fill out the OK Form 501.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to get a 501c3 in Oklahoma?

What It Costs to Form an Oklahoma Nonprofit. Oklahoma's Secretary of State charges a $25 filing fee for non-profit Certificates of Incorporation. A name reservation fee is $10. An Initial Registration Statement is required before you solicit funds, and this costs $15.

How do you get tax exempt status in Oklahoma?

501(c)(3) qualify to be exempt from sales tax in Oklahoma. To qualify for an exemption you must complete the application and provide the necessary documentation listed under the exemption for which you are applying. Supporting documentation required.

How do I know if I can file exempt on my taxes?

You can only file as exempt for the tax year if both of the following are true: You owed no federal income taxes the previous year; and. You expect to owe no federal income taxes for the current year.

Do I need to file an Oklahoma state tax return?

standard deduction plus personal exemption is required to file an Oklahoma income tax return. resident. During the period of nonresidency, an Oklahoma return is also required if the Oklahoma part-year resident has gross income from Oklahoma sources of $1,000 or more.

What form do I need to file Oklahoma state taxes?

Use Form 511-NR. Except as otherwise provided for in the Pass-Through Entity Tax Equity Act of 2019, every nonresident with gross income from Oklahoma sources of $1,000 or more is required to file an Oklahoma income tax return.

Is it a good idea to claim exempt?

There is no downside to a tax exemption. Federal, state, and local governments create them to provide a benefit to specific people, businesses, or other entities in special situations.

Do I need to send a copy of my federal return with my Oklahoma state return?

If I e-file the OK-511, do I have to send a copy of the Federal return to the state? State DOR requests that you include a copy of your Federal return. If you paper-file the OK-511, you should include a copy of the Federal return and if applicable, the federal child care credit schedule.

Who Must File Oklahoma partnership tax return?

If federal and Oklahoma distributive net incomes are the same, you may complete Part Three, Columns A and B, line 15; then complete Part Five. A copy of your Federal Form 1065 and K-1s must be provided with your Oklahoma return. An Oklahoma return must be filed by all partnerships having Oklahoma source income.

What qualifies you to file exempt?

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

How do I file as exempt?

To claim exempt, you must submit a W-4 Form. Do not complete lines 5 and 6. Enter “Exempt” on line 7. Note: You must submit a new W-4 Form by February 15 each year to continue your exemption.

Can you use the same form for state and federal taxes?

While residents of all states use the same forms to file their federal income tax returns, state income tax forms differ from state to state. As a result, you'll need to use the appropriate forms to file your state income tax return.

Does a partnership need to file a return if no activity?

A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal tax purposes.

How do I file my state taxes in Oklahoma?

The regular deadline to file an Oklahoma state income tax return is April 15, but Oklahoma offers a special deadline date for electronically filed returns.You have the following options to pay your tax: Pay by Direct Debit from bank account. Mail in a check. Send e-payment through state website.

Where do I mail form 501 in Oklahoma?

Please forward this return and accompanying reports to: Oklahoma Tax Commission, 2501 North Lincoln Blvd., Oklahoma City, Oklahoma 73194-0009.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get oklahoma form 501?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific oklahoma form 501 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I sign the oklahoma form 501 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your oklahoma form 501.

How can I edit oklahoma form 501 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing oklahoma form 501, you need to install and log in to the app.

What is OK Form 501?

OK Form 501 is a tax form used in the state of Oklahoma for reporting certain financial information to the state's tax authorities.

Who is required to file OK Form 501?

Individuals and businesses that meet specific income thresholds or have particular types of income are required to file OK Form 501.

How to fill out OK Form 501?

To fill out OK Form 501, taxpayers must provide accurate financial details including their income, deductions, and any other relevant tax information as instructed in the form.

What is the purpose of OK Form 501?

The purpose of OK Form 501 is to report income and calculate the tax liability owed to the state of Oklahoma.

What information must be reported on OK Form 501?

The information that must be reported on OK Form 501 includes personal identification details, sources of income, deductions taken, and any applicable credits.

Fill out your oklahoma form 501 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Form 501 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.