UT TC-49 2009 free printable template

Show details

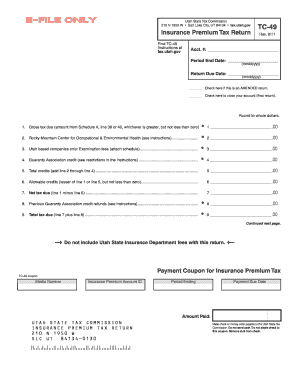

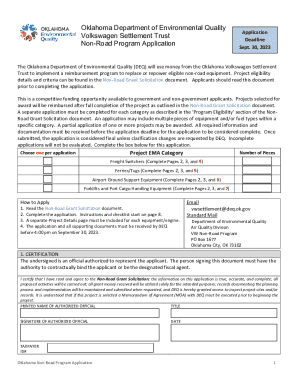

Clear form Print Form Utah State Tax Commission 210 N 1950 W SLC UT 84134 www. tax. utah. gov TC-49 Rev. 12/09 Insurance Premium Tax Return FEIN/Account Number Find TC-49 Instructions at this site. If coupon becomes separated from the form do not reattach. TC-491. ai Rev. 12/07 INSURANCE PREMIUM TAX RETURN TC-49 Federal ID Number Filing Period Due Date Amount Paid Make check or money order payable to the Utah State Tax Commission. Do not send ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-49

Edit your UT TC-49 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-49 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT TC-49 online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT TC-49. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-49 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-49

How to fill out UT TC-49

01

Obtain Form UT TC-49 from the official website or your local tax office.

02

Fill in your personal details, including name, address, and Social Security number.

03

Provide information about the property or vehicle relevant to the tax being reported.

04

Complete the income and expense sections if applicable.

05

Review the form for accuracy and completeness.

06

Sign and date the form.

07

Submit the form according to the instructions provided, either by mail or online.

Who needs UT TC-49?

01

Individuals or businesses who own property or vehicles subject to tax reporting.

02

Tax professionals assisting clients with property or vehicle taxes.

03

Anyone seeking to report changes in ownership or value of taxable assets.

Fill

form

: Try Risk Free

People Also Ask about

What is the state tax rate in Utah?

How does Utah's tax code compare? Utah has a flat 4.85 percent individual income tax rate. Utah also has a flat 4.85 percent corporate income tax. Utah has a 6.10 percent state sales tax rate, a max local sales tax rate of 2.95 percent, and an average combined state and local sales tax rate of 7.19 percent.

Is there a Utah withholding form?

Report Utah withholding tax from the following forms: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

Does Utah require a state tax form?

ing to Utah Instructions for Form TC-40, you must file a Utah income tax return if: You were a resident or part year resident of Utah that must file a federal return.

Do I have to file a Utah return?

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or. want a refund of any income tax overpaid.

What is the PTE tax rate in Utah?

Here's how it works when you authorize a PTE to pay a tax on behalf of pass-through entity taxpayers who are individuals. Pass-through entities in Utah pay the standard state income tax rate which is 4.95%, which is the same as the individual state income rate.

What is the tax rate for insurance premiums in Utah?

The tax rate is 0.45% of total premiums received, including premiums for the assumption of risk and the charge for abstracting titles, title searching, etc.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit UT TC-49 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including UT TC-49, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make edits in UT TC-49 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing UT TC-49 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for the UT TC-49 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your UT TC-49 and you'll be done in minutes.

What is UT TC-49?

UT TC-49 is a tax form used in Utah for reporting information related to certain tax credits or adjustments.

Who is required to file UT TC-49?

Taxpayers who are claiming specific tax credits or adjustments as outlined by the Utah State Tax Commission are required to file UT TC-49.

How to fill out UT TC-49?

To fill out UT TC-49, provide the required taxpayer information, complete the relevant sections based on the credits being claimed, and ensure all amounts are accurately reported.

What is the purpose of UT TC-49?

The purpose of UT TC-49 is to provide a formal mechanism for taxpayers to report and claim specific tax credits or adjustments on their state tax return.

What information must be reported on UT TC-49?

Information that must be reported on UT TC-49 includes the taxpayer's identification details, the type of credits or adjustments being claimed, and the relevant financial amounts associated with those claims.

Fill out your UT TC-49 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-49 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.