UT TC-49 2006 free printable template

Show details

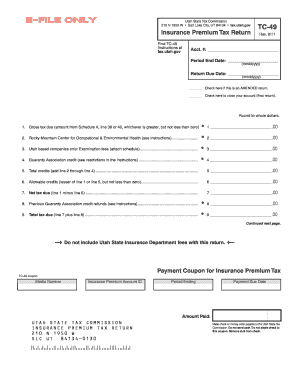

Clear form Print Form Utah State Tax Commission 210 N 1950 W SLC, UT 84134 www.tax.utah.gov TC49 Rev. 12/06 Insurance Premium Tax Return VEIN/Account Number Find TC49 Instructions at this site. Name

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-49

Edit your UT TC-49 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-49 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT TC-49 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT TC-49. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-49 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-49

How to fill out UT TC-49

01

Gather necessary documents such as identification and proof of residency.

02

Obtain the UT TC-49 form from the Texas Comptroller's website or your local tax office.

03

Fill in your personal information at the top of the form, including your name, address, and contact details.

04

Complete the sections related to property details, including property description and any applicable exemptions.

05

Review the form for accuracy and completeness.

06

Sign and date the form at the designated section.

07

Submit the form to the appropriate local tax office before the submission deadline.

Who needs UT TC-49?

01

Property owners in Texas who are applying for property tax exemptions or seeking to appeal property assessments.

02

Individuals or entities interested in claiming special valuation or adjustment based on specific circumstances.

Fill

form

: Try Risk Free

People Also Ask about

Are returns of premiums taxable?

Money you receive from a return of premium life insurance policy is considered a refund, not an income payment. Therefore, it isn't taxable.

Are health insurance premium rebates taxable income?

Are rebates taxable? In general, rebates are taxable if you pay health insurance premiums with pre-tax dollars or you received tax benefits by deducting premiums you paid on your tax return. Talk with your tax preparer to determine if you need to report your rebate as income when you file your next tax return.

Are premiums taxable to the employee?

If an employee pays the premiums on personally owned health insurance or incurs medical costs and is reimbursed by the employer, the reimbursement generally is excluded from the employee's gross income and not taxed under both federal and state tax law.

What is Utah insurance premium tax?

The tax rate is 0.45% of total premiums received, including premiums for the assumption of risk and the charge for abstracting titles, title searching, etc. Workers' compensation insurers shall pay a premium assessment of between 1% and 8% of net written premiums before reductions for any deductible amount.

When can I expect my Utah state tax refund?

If you filed your refund electronically, you should have your refund in 7 to 21 days. If you mailed a paper return on or near April 15, your refund may take considerably longer. The Utah Tax Commission does not issue refund checks or direct deposits on refunds. All refunds are issued by the State Department of Finance.

Are premium returns taxable?

One of them is that withdrawals made from the policy are considered a return of premiums already paid, and are therefore not subject to taxation.

Are life insurance premium refunds taxable?

You get back the whole amount you paid in, with no interest, if you outlive the coverage. The money isn't taxable because it's simply a return of the payments you made.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the UT TC-49 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your UT TC-49 in minutes.

How do I fill out UT TC-49 using my mobile device?

Use the pdfFiller mobile app to fill out and sign UT TC-49. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How can I fill out UT TC-49 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your UT TC-49. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is UT TC-49?

UT TC-49 is a tax form used in the state of Utah for reporting transaction details related to sales and use tax.

Who is required to file UT TC-49?

Businesses and individuals in Utah that engage in taxable sales, purchases, or leases of tangible personal property are required to file UT TC-49.

How to fill out UT TC-49?

To fill out UT TC-49, taxpayers must provide their business information, detail the taxable transactions, report the tax collected, and ensure accurate calculation of total sales and use tax owed.

What is the purpose of UT TC-49?

The purpose of UT TC-49 is to enable the Utah State Tax Commission to collect accurate sales and use tax data from businesses and ensure compliance with state tax laws.

What information must be reported on UT TC-49?

The information that must be reported on UT TC-49 includes the seller's and buyer's details, transaction dates, description of items sold, total sales amounts, exemptions claimed, and taxes collected.

Fill out your UT TC-49 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-49 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.