UT TC-49 2011-2025 free printable template

Show details

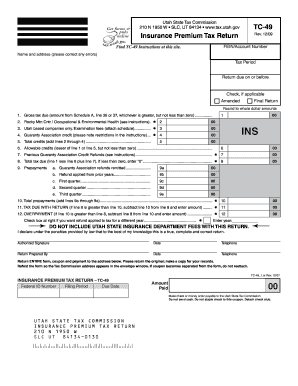

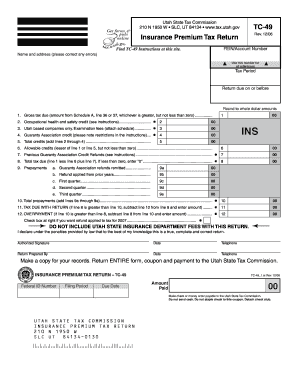

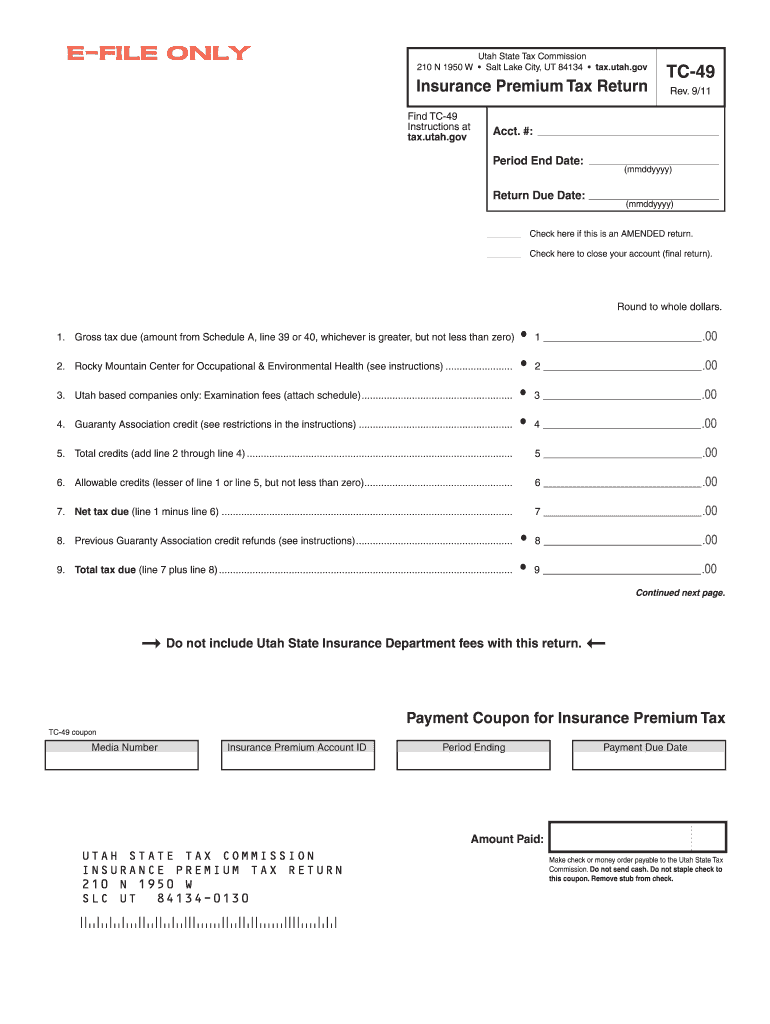

49001 Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84134 tax. utah. gov Insurance Premium Tax Return Find TC-49 Instructions at tax. Utah. gov TC-49 Rev. 9/11 Acct. Period End Date mmddyyyy Return Due Date Check here if this is an AMENDED return. Check here to close your account final return. Continued next page. Do not include Utah State Insurance Department fees with this return. Payment Coupon for Insurance Premium Tax TC-49 coupon Media Number Period Ending Payment Due Date...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 49 insurance form

Edit your utah form tc 49 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your utah insurance return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit utah tc 49 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit utah tc 49 template form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-49 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out utah form tc 49 blank

How to fill out UT TC-49

01

Obtain the UT TC-49 form from the relevant state department website or office.

02

Fill out the top section with your name, address, and contact information.

03

Provide details about the vehicle, including the make, model, year, and VIN.

04

Indicate the reason for completing the UT TC-49 (e.g., exemption claim, tax purposes).

05

Attach any necessary documentation that supports your claim or reason for filing.

06

Review all information for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the completed form either in person or via the specified mailing address.

Who needs UT TC-49?

01

Individuals or businesses seeking a tax exemption related to motor vehicles.

02

Owners of vehicles that qualify for specific exemptions as defined by state law.

03

Residents who are applying for a refund on taxes previously paid for certain vehicles.

Fill

utah tc 49 form

: Try Risk Free

People Also Ask about utah form tc 49 online

What is the state tax rate in Utah?

How does Utah's tax code compare? Utah has a flat 4.85 percent individual income tax rate. Utah also has a flat 4.85 percent corporate income tax. Utah has a 6.10 percent state sales tax rate, a max local sales tax rate of 2.95 percent, and an average combined state and local sales tax rate of 7.19 percent.

Is there a Utah withholding form?

Report Utah withholding tax from the following forms: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

Does Utah require a state tax form?

ing to Utah Instructions for Form TC-40, you must file a Utah income tax return if: You were a resident or part year resident of Utah that must file a federal return.

Do I have to file a Utah return?

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or. want a refund of any income tax overpaid.

What is the PTE tax rate in Utah?

Here's how it works when you authorize a PTE to pay a tax on behalf of pass-through entity taxpayers who are individuals. Pass-through entities in Utah pay the standard state income tax rate which is 4.95%, which is the same as the individual state income rate.

What is the tax rate for insurance premiums in Utah?

The tax rate is 0.45% of total premiums received, including premiums for the assumption of risk and the charge for abstracting titles, title searching, etc.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send utah tax rev1208 to be eSigned by others?

utah premium tax is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get utah form premium?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the utah tc 49 search in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out utah premium tax fill on an Android device?

Complete your utah premium tax template and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is UT TC-49?

UT TC-49 is a tax form used in Utah to report certain financial information to the state tax authorities.

Who is required to file UT TC-49?

Individuals and businesses that engage in specific transactions that fall under the reporting requirements set by the Utah state tax authorities are required to file UT TC-49.

How to fill out UT TC-49?

To fill out UT TC-49, gather the necessary financial information, complete the form accurately by entering the required data, and submit it to the Utah state tax authorities by the specified deadline.

What is the purpose of UT TC-49?

The purpose of UT TC-49 is to provide the state with information related to certain financial transactions for tax assessment and compliance purposes.

What information must be reported on UT TC-49?

UT TC-49 requires reporting information such as income, deductions, credits, and other relevant financial data as specified in the form instructions.

Fill out your tc 49 print 2011-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Utah 49 Insurance Edit is not the form you're looking for?Search for another form here.

Keywords relevant to utah premium instructions fillable

Related to utah insurance return fill

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.