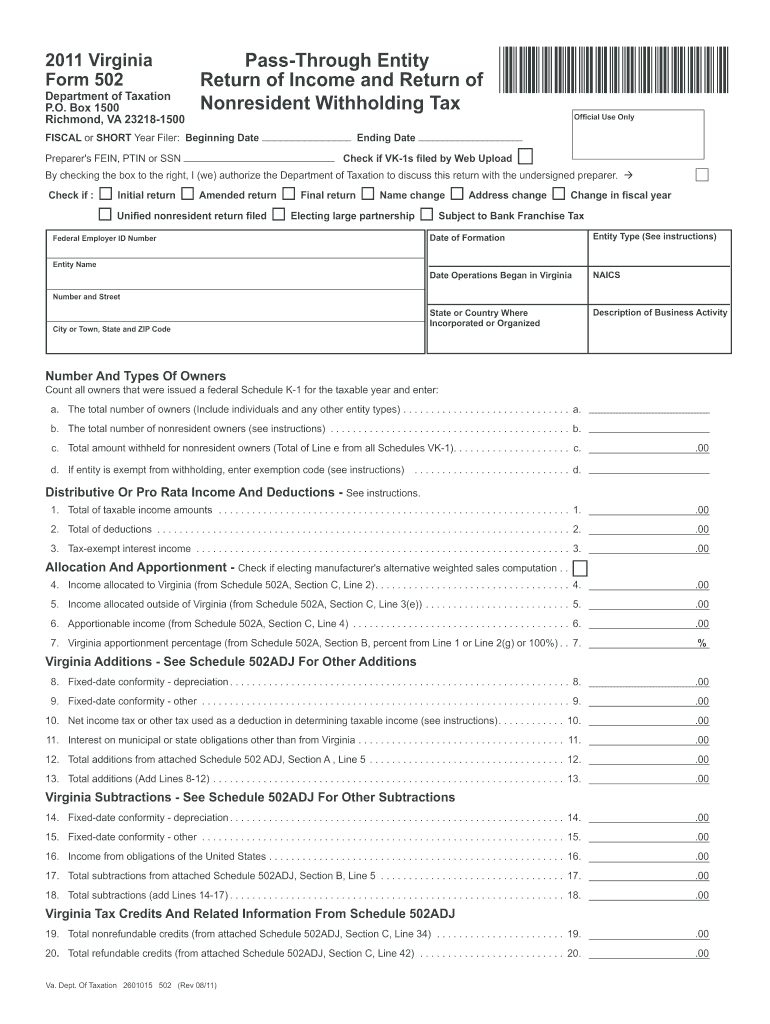

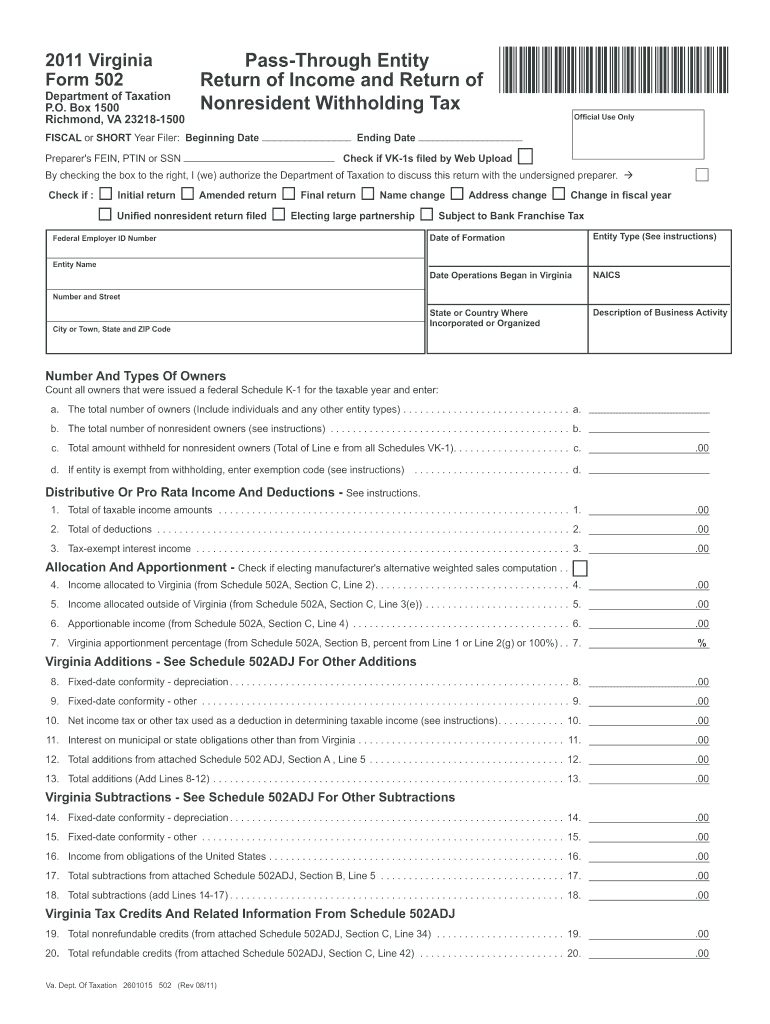

VA DoT 502 2011 free printable template

Show details

2011 Virginia Form 502 Department of Taxation P.O. Box 1500 Richmond, VA 23218-1500 Preparer's VEIN, PAIN or SSN Check if : Initial return Pass-Through Entity Return of Income and Return of Nonresident

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA DoT 502

Edit your VA DoT 502 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA DoT 502 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VA DoT 502 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit VA DoT 502. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT 502 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA DoT 502

How to fill out VA DoT 502

01

Obtain a copy of VA DoT 502 from the official VA website or at your local VA office.

02

Begin by filling out the applicant's information in the designated fields, including name, address, and contact details.

03

Provide details about your service history, including dates of service and branch of the military.

04

Complete the section regarding your disability claims and specify the nature of your claims.

05

Include any supporting documentation as required, such as medical records or service records.

06

Review the form for accuracy and completeness.

07

Sign and date the application at the designated area.

08

Submit the completed form either online through the VA portal or by mail to the appropriate VA office.

Who needs VA DoT 502?

01

Veterans seeking to apply for disability benefits or compensation from the Department of Veterans Affairs.

02

Individuals who have experienced service-related injuries or illnesses and want to formalize their claims.

03

Surviving family members of veterans who are applying for benefits associated with the veteran's service.

Fill

form

: Try Risk Free

People Also Ask about

Is there a penalty for filing partnership return late?

Prepare to pay a penalty. The penalty for filing late is 5% of the taxes you owe per month for the first five months – up to 25% of your tax bill. The IRS will also charge you interest until you pay off the balance.

Do I have to file a Virginia non resident tax return?

Virginia law imposes individual income tax filing requirements on virtually all Virginia residents, as well as on nonresidents who receive income from Virginia sources.

What is the penalty for filing taxes late in Virginia?

The extension penalty is assessed on the balance of tax due with the return at a rate of 2% per month or part of a month, from the original due date until the date the return is filed. The maximum penalty is 12% of the tax due.

What is the penalty for filing a partnership return late in Virginia?

Late Filing Penalty The law provides for the penalty to be assessed at a rate of 6% per month or part of month from the due date of the return until the return is filed, or until the maximum penalty of 30% has accrued.

Who must file Virginia Form 502?

S Corporations, Partnerships, and Limited Liability Companies. Every pass-through entity (PTE) that does business in Virginia or receives income from Virginia sources must file an annual Virginia income tax return on Form 502 or Form 502PTET.

What is the schedule 502A apportionment method?

Schedule 502A is used to show the amount of allocated income and to determine the apportionment percentage. If the PTE's income is all from Virginia, then the entity does not allocate and apportion income; the Virginia apportionment percentage is 100%, and Schedule 502A is not required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my VA DoT 502 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your VA DoT 502 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit VA DoT 502 on an iOS device?

Create, modify, and share VA DoT 502 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit VA DoT 502 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share VA DoT 502 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is VA DoT 502?

VA DoT 502 is a form used by the Virginia Department of Taxation to report and remit the tax on certain transactions related to Virginia's taxes, typically involving the sale of tangible goods.

Who is required to file VA DoT 502?

Individuals or businesses that engage in sales of tangible personal property in Virginia and meet certain thresholds of taxable sales are required to file VA DoT 502.

How to fill out VA DoT 502?

To fill out VA DoT 502, taxpayers must provide accurate information regarding their sales, report the total taxable sales amount, calculate the tax due, and include any relevant business identification and contact information.

What is the purpose of VA DoT 502?

The purpose of VA DoT 502 is to ensure compliance with Virginia tax laws by accurately reporting sales transactions and remitting the appropriate amount of sales tax to the state.

What information must be reported on VA DoT 502?

The information reported on VA DoT 502 includes the taxpayer's identification information, total taxable sales, the total amount of sales tax collected, and any adjustments or allowances related to the tax calculation.

Fill out your VA DoT 502 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA DoT 502 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.