VA DoT 502 2021 free printable template

Show details

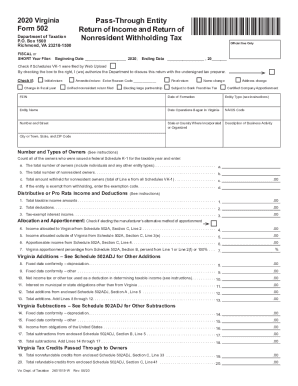

2021 Virginia Form 502PassThrough Entity Return of Income and Return of Nonresident Withholding Department of Taxation P.O. Box 1500 Richmond, VA 232181500×VA0PTE121888* Official Use OnlyFISCAL or

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA DoT 502

Edit your VA DoT 502 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA DoT 502 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VA DoT 502 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit VA DoT 502. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT 502 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA DoT 502

How to fill out VA DoT 502

01

Start by downloading the VA Form DoT 502 from the official VA website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out your personal information in the designated sections, including your full name, address, and contact details.

04

Provide your military service details, including branch, dates of service, and relevant identification numbers.

05

Complete any additional sections required for the specific purpose of the form, as outlined in the instructions.

06

Review all the information entered to ensure accuracy and completeness.

07

Sign and date the form at the bottom as required.

08

Submit the completed form according to the instructions, whether online or via mail.

Who needs VA DoT 502?

01

Veterans applying for specific benefits or services related to their military service may need to complete VA Form DoT 502.

02

Individuals seeking verification of their military service for eligibility in programs and benefits are also required to fill out this form.

03

Family members or dependents of veterans who are applying for benefits on behalf of the veteran may need to use this form.

Fill

form

: Try Risk Free

People Also Ask about

What is VA Form 502?

The Form 502 should (1) report nonresident withholding only for income attributable to ineligible owners who are also nonresident owners subject to the withholding requirements (e.g., the nonresident corporate owners of the PTE) and (2) attach Schedules VK-1 to Form 502 only for such ineligible owners.

What is Virginia spouse tax adjustment?

If a couple elects to use the Spouse Tax Adjustment, they calculate their income tax separately using the Spouse Tax Adjustment worksheet. As a result, the first $17,000 of each of their incomes will be taxed at the lower rates. Consequently, using the Spouse Tax Adjustment can result in a tax savings of up to $259.

What is the penalty for filing a partnership return late in Virginia?

Late Filing Penalty The law provides for the penalty to be assessed at a rate of 6% per month or part of month from the due date of the return until the return is filed, or until the maximum penalty of 30% has accrued.

Who must file Virginia Form 502?

S Corporations, Partnerships, and Limited Liability Companies. Every pass-through entity (PTE) that does business in Virginia or receives income from Virginia sources must file an annual Virginia income tax return on Form 502 or Form 502PTET.

What does Virginia adjusted gross income mean?

The tax is based on the Federal Adjusted Gross Income. In most cases, your federal adjusted gross income (line 21 on form 1040A; and line 37 on form 1040) plus any Virginia additions and minus any Virginia subtractions computed on Schedule ADJ, is called Virginia Adjusted Gross Income.

What is the spouse tax adjustment for VA Form 760?

Married couples who file a joint Form 760 may be eligible for an adjustment of up to $259 against their joint income tax liability if each spouse received income during the taxable year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my VA DoT 502 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your VA DoT 502 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit VA DoT 502 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your VA DoT 502 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out VA DoT 502 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your VA DoT 502. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is VA DoT 502?

VA DoT 502 is a form used by the Virginia Department of Taxation to report the sale or transfer of a vehicle.

Who is required to file VA DoT 502?

Individuals or entities that sell or transfer ownership of a vehicle in Virginia are required to file VA DoT 502.

How to fill out VA DoT 502?

To fill out VA DoT 502, provide details such as the seller's and buyer's information, vehicle description, date of sale, and odometer reading.

What is the purpose of VA DoT 502?

The purpose of VA DoT 502 is to document the sale or transfer of a vehicle and ensure all necessary taxes are reported and collected.

What information must be reported on VA DoT 502?

Information that must be reported includes the vehicle's VIN, make, model, year, sale price, odometer reading, and the names and addresses of both the seller and buyer.

Fill out your VA DoT 502 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA DoT 502 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.