VA DoT 502 2019 free printable template

Show details

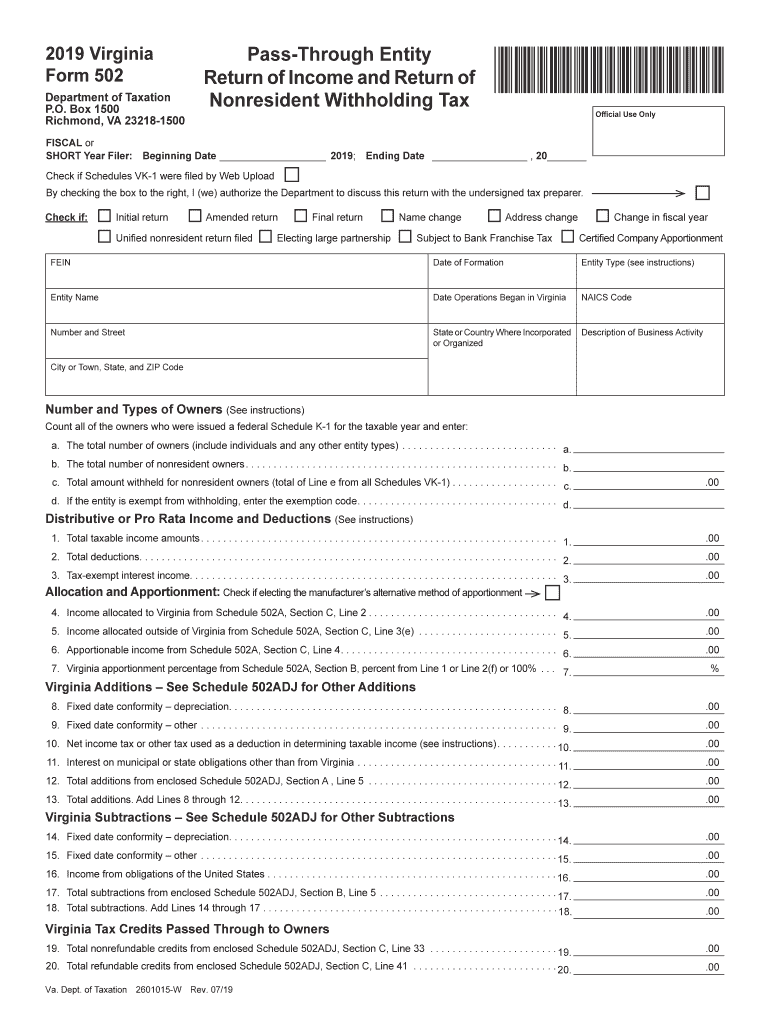

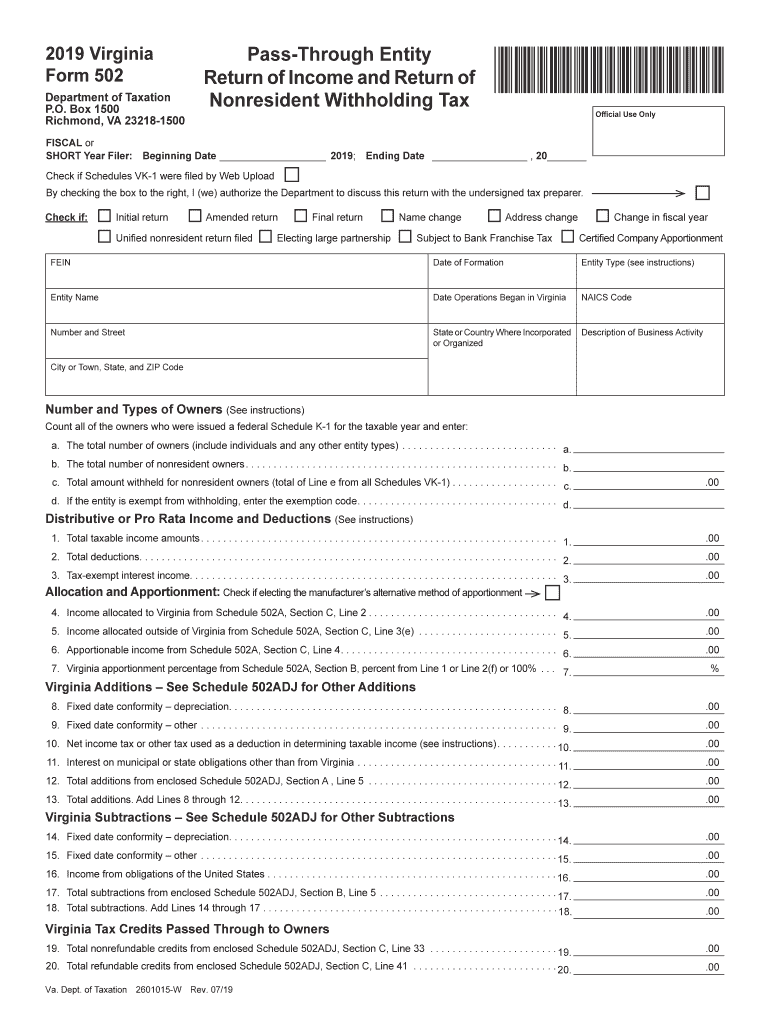

2019 Virginia Form 502 Department of Taxation P.O. Box 1500 Richmond, VA 232181500PassThrough Entity Return of Income and Return of Nonresident Withholding Tax×VA0PTE119888* Official Use OnlyFISCAL

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA DoT 502

Edit your VA DoT 502 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA DoT 502 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VA DoT 502 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit VA DoT 502. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT 502 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA DoT 502

How to fill out VA DoT 502

01

Obtain the VA DoT 502 form from the official VA website or your local VA office.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Fill out the personal information section, including your name, address, and contact details.

04

Provide details about your military service, including dates of service and branch.

05

Include any medical information required, ensuring to specify conditions and treatments related to your claim.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submitting it.

Who needs VA DoT 502?

01

Veterans seeking benefits related to service-connected disabilities.

02

Individuals applying for compensation for specific medical conditions due to their military service.

Fill

form

: Try Risk Free

People Also Ask about

What is the withholding rate for Form 502 in Virginia?

The PTE is required to withhold 5% of the share of taxable income from Virginia sources that is allocable to each nonresident owner. The amount of withholding tax may be reduced by any tax credits that were earned by the PTE and allowable by the Code of Virginia that pass through to nonresident owners.

What is Virginia Schedule 502A?

More about the Virginia Form 502A This form is for income earned in tax year 2022, with tax returns due in April 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the Virginia government.

What is the withholding rate for bonuses in Virginia?

The percentage method is used if your bonus comes in a separate check from your regular paycheck. Your employer withholds a flat 22% (or 37% if over $1 million).

What is a 502 form in Virginia?

Pass-Through Entities Required to File Every pass-through entity (PTE) doing business in Virginia or having income from Virginia sources is required to electronically file a Form 502 for each taxable year.

What is the VA withholding tax rate?

2023 Virginia (VA) State Payroll Taxes Tax rates range from 2.0% – 5.75%. Since the top tax bracket begins at just $17,000 in taxable income per year, most Virginia taxpayers will pay the top rate.

Who must file Virginia Form 502?

S Corporations, Partnerships, and Limited Liability Companies. Every pass-through entity (PTE) that does business in Virginia or receives income from Virginia sources must file an annual Virginia income tax return on Form 502 or Form 502PTET.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit VA DoT 502 online?

With pdfFiller, the editing process is straightforward. Open your VA DoT 502 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I edit VA DoT 502 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing VA DoT 502 right away.

How do I complete VA DoT 502 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your VA DoT 502. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is VA DoT 502?

VA DoT 502 is a form used in Virginia for reporting various types of taxes owed by businesses, specifically related to the Department of Taxation.

Who is required to file VA DoT 502?

Businesses operating in Virginia that are subject to specific taxes outlined by the Virginia Department of Taxation are required to file VA DoT 502.

How to fill out VA DoT 502?

To fill out VA DoT 502, gather the necessary financial information related to your business taxes, enter the details accurately in the provided fields, and ensure all required signatures are included before submission.

What is the purpose of VA DoT 502?

The purpose of VA DoT 502 is to collect information on taxable activities and ensure compliance with state tax laws for businesses operating in Virginia.

What information must be reported on VA DoT 502?

The VA DoT 502 requires reporting of income, tax credits, deductions, and any other relevant financial information pertinent to the tax obligations of the business.

Fill out your VA DoT 502 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA DoT 502 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.