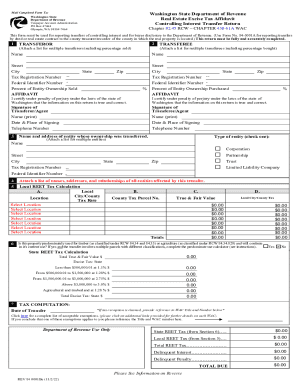

WA DoR 84 0001Be 2012 free printable template

Show details

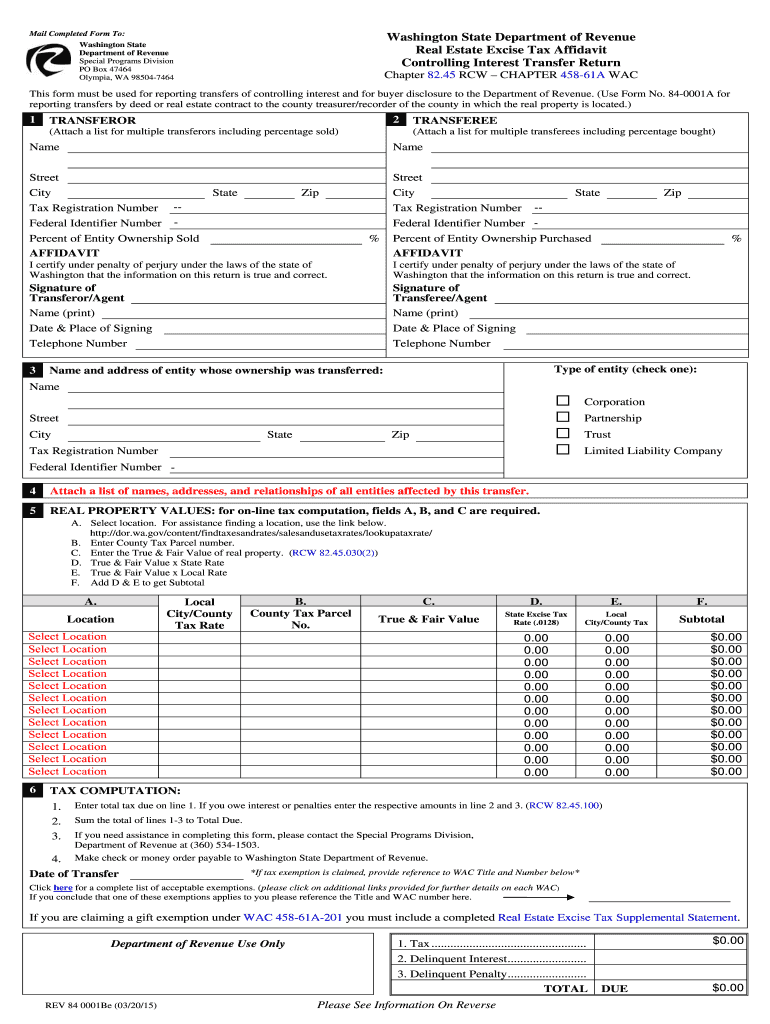

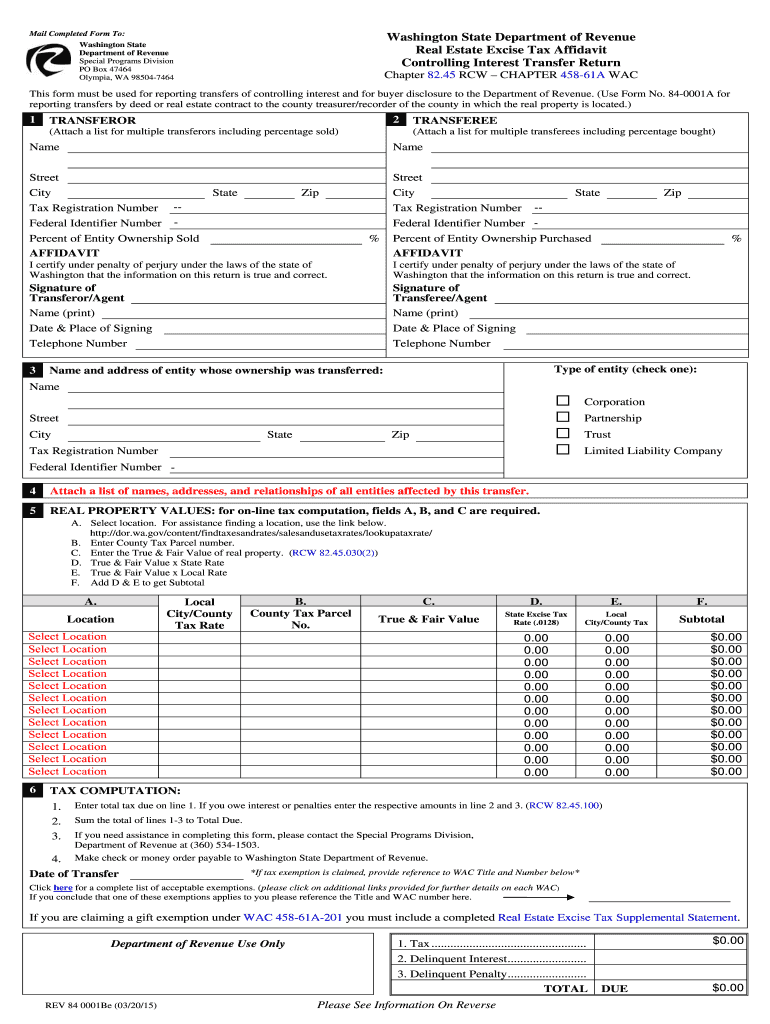

Reset Form Button Mail Completed Form To: Washington State Department of Revenue Special Programs Division PO Box 47464 Olympia, WA 98504-7464 Chapter 82.45 RCW CHAPTER 458-61A WAC Washington State

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WA DoR 84 0001Be

Edit your WA DoR 84 0001Be form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WA DoR 84 0001Be form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WA DoR 84 0001Be online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit WA DoR 84 0001Be. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA DoR 84 0001Be Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WA DoR 84 0001Be

How to fill out WA DoR 84 0001Be

01

Obtain the WA DoR 84 0001Be form from the Washington Department of Revenue website or your local office.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide any business identification numbers if applicable.

04

Specify the type of transaction or tax you are reporting in the relevant section.

05

Input the accurate monetary amounts where required, ensuring all figures are correct.

06

Review all sections of the form for completeness and accuracy.

07

Sign and date the form to certify that the information provided is true.

08

Submit the form according to the instructions provided, either electronically or via postal mail.

Who needs WA DoR 84 0001Be?

01

Individuals or businesses operating in Washington state who need to report certain tax information.

02

Those who are required to document specific tax transactions for compliance with Washington tax laws.

Fill

form

: Try Risk Free

People Also Ask about

Who pays state and local transfer taxes?

Who Pays Transfer Taxes: Buyer or Seller? Depending on the location of the property, the transfer tax can be paid either by the buyer or seller. The two parties must determine which side will cover the cost of the transfer tax as part of the negotiation around the sale.

What is Form 84 0001A Washington?

This form must be used for reporting transfers of controlling interest and for buyer disclosure to the Department of Revenue. (Use Form No. 84-0001A for reporting transfers by deed or real estate contract to the county treasurer/recorder of the county in which the real property is located.)

What is the new excise tax in Washington state?

Background. Passed by the 2021 Washington State Legislature, ESSB 5096 (RCW 82.87) created a 7% tax on any gain in excess of $250,000 in a calendar year from the sale or exchange of certain long-term capital assets such as stocks, bonds, business interests, or other investments and tangible assets.

What is Washington state transfer tax?

How much are transfer taxes in Washington? The REET in Washington State is: 1.1% on homes less than $500,000. 1.28% on homes between $500,000 and $1,500,000. 2.75% on homes between $1,500,000 and $3,000,000.

What is a controlling interest transfer return in Washington state?

What is a controlling interest transfer? A controlling interest transfer occurs when there is a 50% or more change of ownership in an entity. If that entity owns real property in Washington, a controlling interest transfer return is required to be completed within 5 days of the completed transfer.

Who pays the transfer tax in Washington state?

Sellers are required to pay the transfer tax in Washington State. But there's an important caveat for buyers. They are liable for the tax if it's not paid. Sometimes sellers and buyers can come to a deal on who will pay this tax and how much.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send WA DoR 84 0001Be for eSignature?

When you're ready to share your WA DoR 84 0001Be, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my WA DoR 84 0001Be in Gmail?

Create your eSignature using pdfFiller and then eSign your WA DoR 84 0001Be immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit WA DoR 84 0001Be on an iOS device?

Create, edit, and share WA DoR 84 0001Be from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is WA DoR 84 0001Be?

WA DoR 84 0001Be is a form used by the Washington State Department of Revenue for reporting and paying certain taxes, specifically related to businesses.

Who is required to file WA DoR 84 0001Be?

Businesses operating in Washington State that are subject to the specific tax obligations outlined in the form are required to file WA DoR 84 0001Be.

How to fill out WA DoR 84 0001Be?

To fill out WA DoR 84 0001Be, provide the required business information, report the applicable tax amounts, and follow the instructions specified in the form regarding calculations and submission.

What is the purpose of WA DoR 84 0001Be?

The purpose of WA DoR 84 0001Be is to facilitate the reporting and payment of certain taxes owed by businesses to the Washington State Department of Revenue.

What information must be reported on WA DoR 84 0001Be?

Information that must be reported on WA DoR 84 0001Be includes business identification details, taxable income, and any applicable deductions or credits as specified in the form instructions.

Fill out your WA DoR 84 0001Be online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WA DoR 84 0001be is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.