WA DoR 84 0001Be 2021 free printable template

Show details

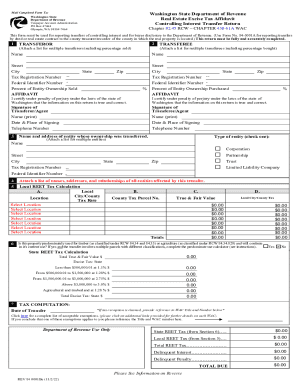

Reset This Form Mail Completed Form To:Washington State Department of Revenue Real Estate Excise Tax Affidavit Controlling Interest Transfer Return Washington State Department of Revenue Taxpayer

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WA DoR 84 0001Be

Edit your WA DoR 84 0001Be form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WA DoR 84 0001Be form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WA DoR 84 0001Be online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WA DoR 84 0001Be. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA DoR 84 0001Be Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WA DoR 84 0001Be

How to fill out WA DoR 84 0001Be

01

Download the WA DoR 84 0001Be form from the official website.

02

Fill in your personal information, including your name, address, and phone number.

03

Indicate the type of application you are submitting.

04

Provide any necessary identification numbers or account information.

05

Sign and date the form at the designated section.

06

Double-check all information for accuracy before submission.

07

Submit the completed form according to the instructions provided, either by mail or electronically.

Who needs WA DoR 84 0001Be?

01

Individuals or businesses registering a vehicle in Washington State.

02

People applying for a title to a vehicle that is not currently registered.

03

Anyone needing to update their vehicle information with the Washington State Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

Who pays Washington state excise tax?

All sales of real property in the state are subject to REET unless a specific exemption is claimed. The seller of the property typically pays the real estate excise tax, although the buyer is liable for the tax if it is not paid. Unpaid tax can become a lien on the transferred property.

How much is excise tax in Washington state?

Graduated REET Structure effective Jan. 1, 2023 for the state portion of REET Sale price thresholdsTax rate$525,000 or less1.10%$525,000.01 - $1,525,0001.28%$1,525,000.01 - $3,025,0002.75%$3,025,000.01 or more3%

What is Washington vehicle excise tax?

There is no statewide vehicle excise tax in Washington, but local Puget Sound drivers may be subject to a 1.1% excise tax. Learn more here. What is an excise tax in Washington?

What is Form 84 0001A Washington?

This form must be used for reporting transfers of controlling interest and for buyer disclosure to the Department of Revenue. (Use Form No. 84-0001A for reporting transfers by deed or real estate contract to the county treasurer/recorder of the county in which the real property is located.)

What is Snohomish County excise tax?

Tax Rates and Information Real Estate Excise TaxEffective Dates (updated quarterly as needed)January 1, 2018State Tax0.0128Local Tax0.0050Total Tax Rate0.0178

What is the excise tax in Cowlitz County?

25%, except inside the city limits of Woodland. Woodland City, tax code 900, has a local tax portion of . 50%. All affidavits have a processing fee of $5.00.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit WA DoR 84 0001Be in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing WA DoR 84 0001Be and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit WA DoR 84 0001Be on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign WA DoR 84 0001Be right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Can I edit WA DoR 84 0001Be on an Android device?

With the pdfFiller Android app, you can edit, sign, and share WA DoR 84 0001Be on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is WA DoR 84 0001Be?

WA DoR 84 0001Be is a form used by the Washington State Department of Revenue for the purpose of reporting unclaimed property held by businesses.

Who is required to file WA DoR 84 0001Be?

Businesses that hold unclaimed property, such as abandoned bank accounts, uncashed checks, and other types of unclaimed financial assets, are required to file WA DoR 84 0001Be.

How to fill out WA DoR 84 0001Be?

To fill out WA DoR 84 0001Be, businesses must provide information about the unclaimed property being reported, including descriptions, amounts, and owner's last known address, along with any supporting documentation.

What is the purpose of WA DoR 84 0001Be?

The purpose of WA DoR 84 0001Be is to ensure that unclaimed property is reported to the state so that it can be held for the rightful owners, in accordance with Washington state law.

What information must be reported on WA DoR 84 0001Be?

The information that must be reported on WA DoR 84 0001Be includes the type of unclaimed property, the value, the last known owner information, and any relevant documentation that supports the claim of unclaimed property.

Fill out your WA DoR 84 0001Be online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WA DoR 84 0001be is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.