WA DoR 84 0001Be 2015 free printable template

Show details

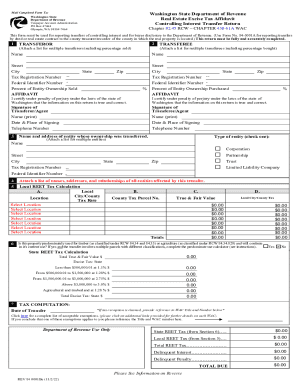

Reset Form Button Mail Completed Form To: Washington State Department of Revenue Real Estate Excise Tax Affidavit Controlling Interest Transfer Return Washington State Department of Revenue Special

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WA DoR 84 0001Be

Edit your WA DoR 84 0001Be form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WA DoR 84 0001Be form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WA DoR 84 0001Be online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WA DoR 84 0001Be. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA DoR 84 0001Be Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WA DoR 84 0001Be

How to fill out WA DoR 84 0001Be

01

Obtain a copy of the WA DoR 84 0001Be form from the Washington Department of Revenue website or your local office.

02

Read the instructions provided at the top of the form to understand the requirements.

03

Fill in your business name and contact information in the designated fields.

04

Provide the required business identification numbers, such as your Unified Business Identifier (UBI) number.

05

Indicate the type of business entity you have (e.g., LLC, Corporation, Sole Prop).

06

Fill out the sections related to your specific tax reporting needs, including any applicable exemptions or special provisions.

07

Review all entered information for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed form to the appropriate Department of Revenue office, either via mail or electronically if available.

Who needs WA DoR 84 0001Be?

01

Any business operating in Washington State that is required to report and remit taxes.

02

Businesses applying for or renewing an existing business license.

03

Those needing to request a tax exemption, credit, or other specific tax-related adjustments.

Fill

form

: Try Risk Free

People Also Ask about

Who pays Washington state excise tax?

All sales of real property in the state are subject to REET unless a specific exemption is claimed. The seller of the property typically pays the real estate excise tax, although the buyer is liable for the tax if it is not paid. Unpaid tax can become a lien on the transferred property.

How much is excise tax in Washington state?

Graduated REET Structure effective Jan. 1, 2023 for the state portion of REET Sale price thresholdsTax rate$525,000 or less1.10%$525,000.01 - $1,525,0001.28%$1,525,000.01 - $3,025,0002.75%$3,025,000.01 or more3%

What is Washington vehicle excise tax?

There is no statewide vehicle excise tax in Washington, but local Puget Sound drivers may be subject to a 1.1% excise tax. Learn more here. What is an excise tax in Washington?

What is Form 84 0001A Washington?

This form must be used for reporting transfers of controlling interest and for buyer disclosure to the Department of Revenue. (Use Form No. 84-0001A for reporting transfers by deed or real estate contract to the county treasurer/recorder of the county in which the real property is located.)

What is Snohomish County excise tax?

Tax Rates and Information Real Estate Excise TaxEffective Dates (updated quarterly as needed)January 1, 2018State Tax0.0128Local Tax0.0050Total Tax Rate0.0178

What is the excise tax in Cowlitz County?

25%, except inside the city limits of Woodland. Woodland City, tax code 900, has a local tax portion of . 50%. All affidavits have a processing fee of $5.00.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit WA DoR 84 0001Be online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your WA DoR 84 0001Be to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How can I fill out WA DoR 84 0001Be on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your WA DoR 84 0001Be. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit WA DoR 84 0001Be on an Android device?

You can edit, sign, and distribute WA DoR 84 0001Be on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is WA DoR 84 0001Be?

WA DoR 84 0001Be is a form used by the Washington State Department of Revenue for certain types of business tax reporting and compliance.

Who is required to file WA DoR 84 0001Be?

Businesses operating in Washington State that meet specific criteria regarding tax obligations are required to file WA DoR 84 0001Be.

How to fill out WA DoR 84 0001Be?

To fill out WA DoR 84 0001Be, you should provide accurate business information, financial data, and follow the specific instructions outlined on the form.

What is the purpose of WA DoR 84 0001Be?

The purpose of WA DoR 84 0001Be is to ensure compliance with Washington State tax laws and to report the appropriate tax information by businesses.

What information must be reported on WA DoR 84 0001Be?

Information that must be reported on WA DoR 84 0001Be typically includes business identification details, revenue figures, deductions, and any applicable credits.

Fill out your WA DoR 84 0001Be online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WA DoR 84 0001be is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.