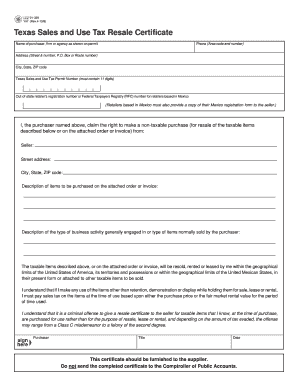

Who Files the Texas Sale and Use Tax Resale Certificate?

The sale of a taxable thing that is aimed at resale may be tax-exempt. It refers to the sales in Texas. For example, when you manage a shop, you may buy the equipment tax-exempt from a wholesale as you are going to sell the products to the clients and withhold the tax on these sales. For this purpose you must file the Texas Sale and Use Tax Resale Certificate.

What is the Texas Sale and Use Tax Resale Certificate for?

This certificate is basically the seller’s guarantee that you are aimed at reselling the goods and that the tax on the sales will not be collected during this purchase. The seller will charge you, unless the document is provided.

When is the Texas Sale and Use Tax Resale Certificate Due?

The certificate must be submitted every time the purchase of items is made. The sellers are not eligible to sell the items tax-free unless the original resale certificate is properly filled.

Is the Texas Sale and Use Tax Resale Certificate Accompanied by Other Forms?

No special forms are required. However, it may be necessary to attach the receipts confirming the sale.

What Information do I Include in the Certificate?

The following information must be included in the Texas Sale and Use Tax Resale Certificate:

- Name of purchaser, agency or firm;

- Phone and address;

- Texas sale and use tax permit number (11 digits);

- Registration number of the out-of-state retailer;

The certificate requires the purchaser’s signature, date and title.

Where do I Send the Texas Sale and Use Tax Resale Certificate?

The certificate must be sent to the supplier.