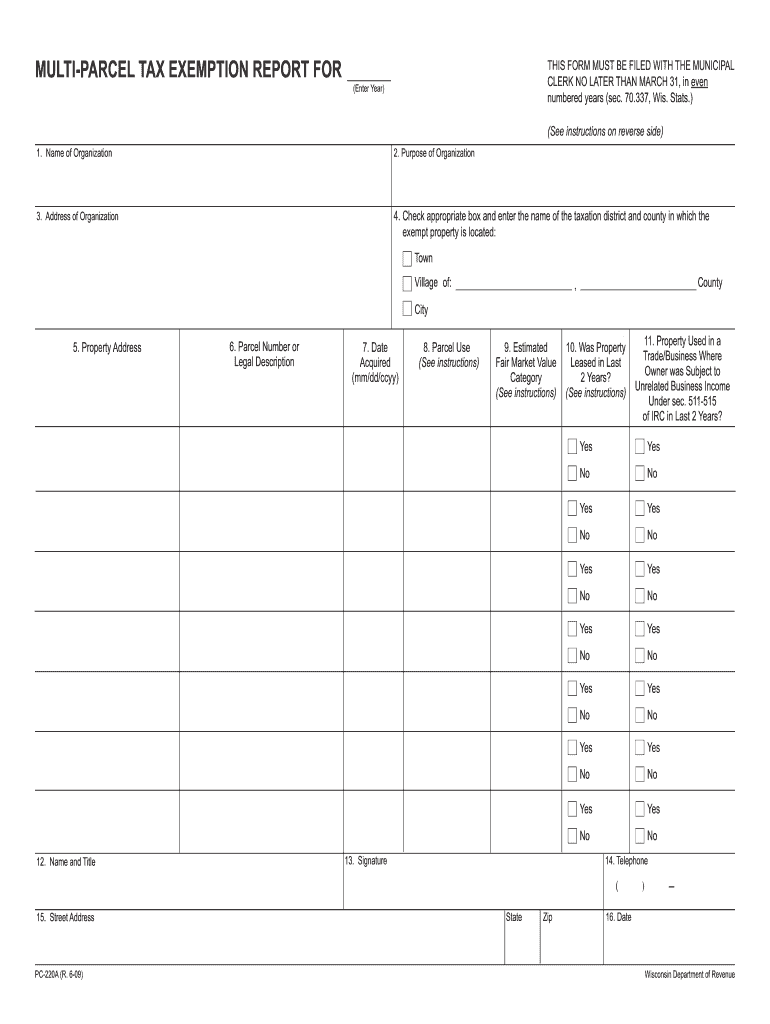

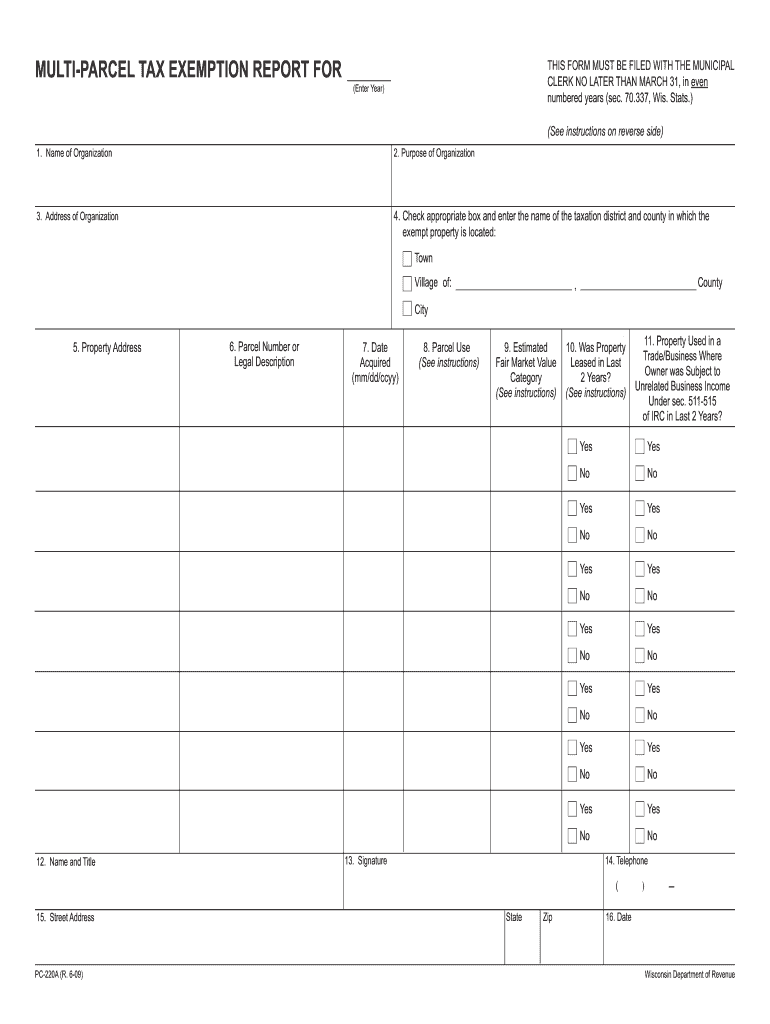

WI PC-220A 2009 free printable template

Show details

City of Sun Prairie. Standard Specifications for Public Works Improvements. STANDARD ...... 73-74. 503.5.3 Horizontal and Vertical. Alignment Requirements.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI PC-220A

Edit your WI PC-220A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI PC-220A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WI PC-220A online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI PC-220A. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI PC-220A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI PC-220A

How to fill out WI PC-220A

01

Begin by downloading the WI PC-220A form from the Wisconsin Department of Revenue website.

02

Fill in your personal information at the top of the form, including your name, address, and social security number.

03

Indicate your filing status by checking the appropriate box (e.g., single, married filing jointly).

04

Enter your income details in the specified sections, ensuring that you include all relevant sources of income.

05

Calculate your deductions and credits applicable to your situation, and enter these amounts in the designated areas.

06

Review your entries for accuracy and completeness.

07

Sign and date the form to certify the information provided.

08

Submit the completed form by mailing it to the appropriate address or filing electronically if available.

Who needs WI PC-220A?

01

Individuals who are residents of Wisconsin and need to report their income for tax purposes.

02

Taxpayers who are claiming deductions or credits under Wisconsin state tax laws.

03

Any person or entity that needs to reconcile their income tax obligations with the state of Wisconsin.

Fill

form

: Try Risk Free

People Also Ask about

Does Wisconsin have a property tax exemption?

Yes. The Property Tax Exemption Reqeust form (PR-230) must be filed with the local assessor on or before March 1 of the year for which exemption is sought. What if I miss the deadline? March 1 is a statutory deadline that must be met to obtain the benefit of property tax exemption.

At what age can you stop paying property taxes in Wisconsin?

At least one owner of the property must be at least 65 years of age.

What is the form for property tax exemption in California?

The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor. A person filing for the first time on a property may file anytime after the property or claimant becomes eligible, but no later than February 15 to receive the full exemption for that year.

How do I file for property tax exemption in Wisconsin?

To apply for an exemption, you must complete a Wisconsin Department of Revenue application form, which may be obtained from the local assessor. The form must be filed for any property that was taxed in the previous year but, because of a change in the use, occupancy, or ownership, may now qualify for exemption.

Is there a property tax exemption for seniors in California?

The State Controller's Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria, including at least 40 percent equity in the home and an annual household income of $51,762 or less

How does Prop 19 work for seniors?

Prop 19 allows seniors 55 and older to move anywhere in California, up to three times, and keep their property tax basis.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute WI PC-220A online?

pdfFiller has made filling out and eSigning WI PC-220A easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I edit WI PC-220A on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute WI PC-220A from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out WI PC-220A on an Android device?

Complete WI PC-220A and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is WI PC-220A?

WI PC-220A is a form used in Wisconsin for reporting the income and expenses of partnerships for state tax purposes.

Who is required to file WI PC-220A?

Partnerships conducting business in Wisconsin or having income sourced from Wisconsin are required to file the WI PC-220A.

How to fill out WI PC-220A?

To fill out WI PC-220A, you need to provide information regarding the partnership's income, deductions, credits, and other relevant financial details on the form.

What is the purpose of WI PC-220A?

The purpose of WI PC-220A is to report the income and expenses of a partnership and to determine the partnership's tax obligations to the state of Wisconsin.

What information must be reported on WI PC-220A?

The information that must be reported on WI PC-220A includes partnership identification details, income, deductions, credits, partner information, and any other relevant financial information.

Fill out your WI PC-220A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI PC-220a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.