NZ IR 595 2013 free printable template

Show details

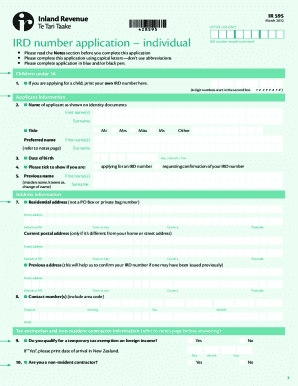

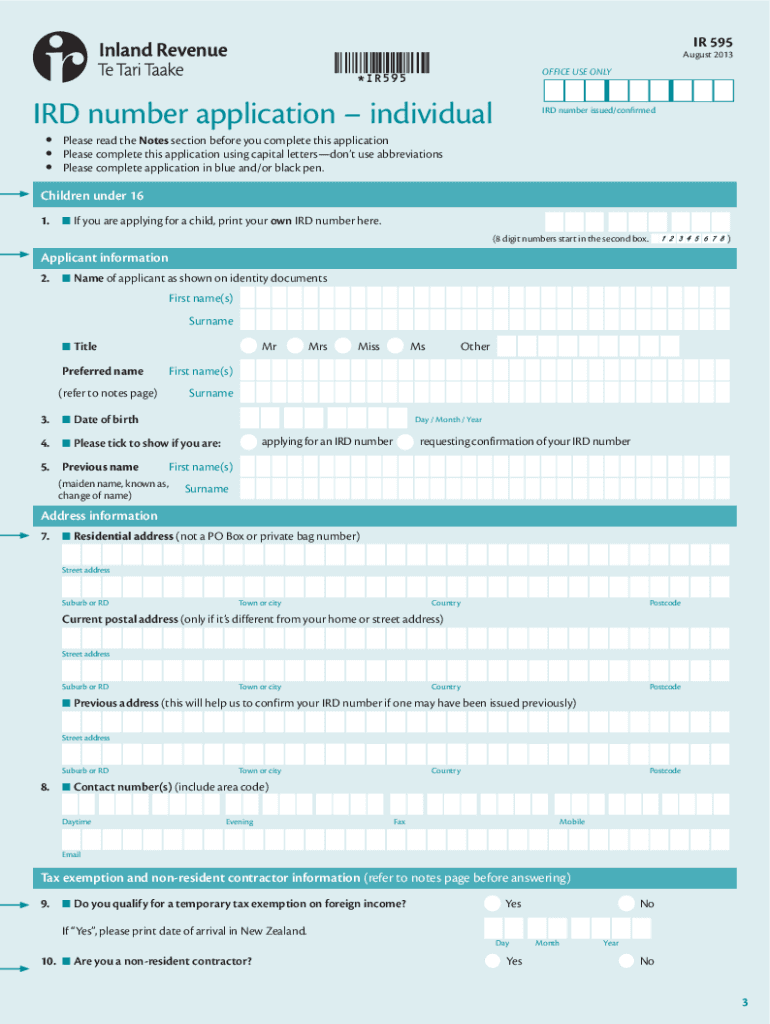

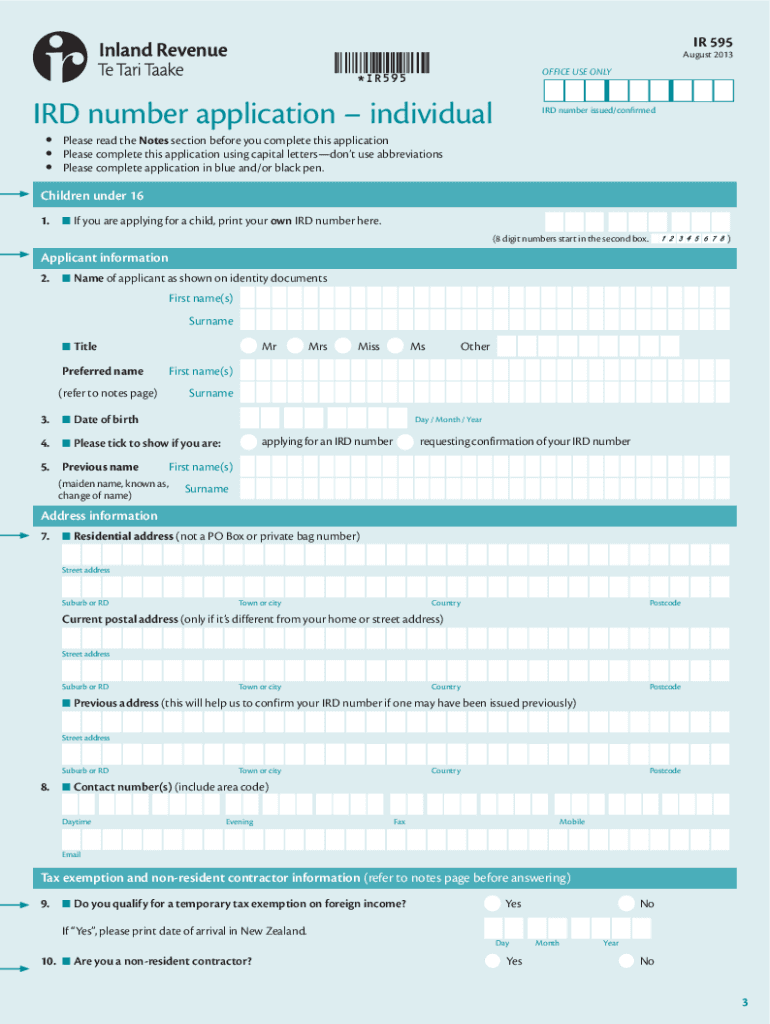

IR 595 April 2012 IRD number application individual To apply for an IRD number for you or for a child in your care 1. Complete the form on page 3 and sign the declaration on page 4. Take the form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign NZ IR 595

Edit your NZ IR 595 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NZ IR 595 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NZ IR 595 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NZ IR 595. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ IR 595 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NZ IR 595

How to fill out NZ IR 595

01

Obtain the NZ IR 595 form from the Inland Revenue website or your local tax office.

02

Provide your personal details, including your full name, address, and IRD number at the top of the form.

03

Indicate the type of income you are reporting in the relevant sections.

04

Fill in the income details accurately, ensuring that all figures are correct and match your records.

05

Complete any additional information required in the form, such as deductions or other pertinent financial details.

06

Review the completed form for any errors or omissions.

07

Sign and date the form at the designated section.

08

Submit the form either electronically through the Inland Revenue portal or as a hard copy to the appropriate office.

Who needs NZ IR 595?

01

NZ IR 595 is needed by individuals and businesses who are required to report income and calculate their tax liabilities in New Zealand.

Fill

form

: Try Risk Free

People Also Ask about

Can you apply for IRD number before arriving in NZ?

If you hold a visa from Immigration NZ: There will be a final date by which you must arrive in New Zealand. It's also the date you must apply for an IRD number if you want to use this process. If you wait until after this date, you'll need to apply for an IRD number as 'living in New Zealand and not a new arrival'.

How do I get an IRD number in New Zealand?

Apply for an IRD number If you're an NZ citizen. You can apply online or complete a paper application. If you have a resident visa or a student or work visa. You can apply online or complete a paper application if you have a NZ resident, student or work visa or an Australian passport. If you live outside NZ.

How can I find my NZ IRD number?

You can also find your IRD number: in myIR. on payslips. on letters or statements we've sent you. on your KiwiSaver statement. on income details from your employer. by calling us.

Does everyone have an IRD number NZ?

You may also need an IRD number if you're buying, selling or transferring New Zealand property. You have to pay tax on any income you earn. If you do not have an IRD number, tax will be deducted at the non-declaration rate, which is higher than the normal rates.

How much does it cost to get an IRD number NZ?

Your IRD number identifies you for all the tax related events in your life. Your IRD number is unique to you, and you keep the same IRD number for life. There is no cost when you apply for an IRD number with us.

What is an example IRD number NZ?

The IRD number format used by Inland Revenue is an eight or nine digit number in the format 99999999 or 999999999 (depending on when it was first issued).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NZ IR 595 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your NZ IR 595 into a dynamic fillable form that you can manage and eSign from anywhere.

How can I get NZ IR 595?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific NZ IR 595 and other forms. Find the template you need and change it using powerful tools.

How do I edit NZ IR 595 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your NZ IR 595 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

What is NZ IR 595?

NZ IR 595 is an income tax return form used in New Zealand for individuals and certain entities to report their financial income and calculate their tax obligations.

Who is required to file NZ IR 595?

Individuals and entities in New Zealand who receive income, such as salaries, wages, business income, or investment income, are generally required to file NZ IR 595.

How to fill out NZ IR 595?

To fill out NZ IR 595, you need to gather your income information, complete the relevant sections regarding your income sources, deductions, and tax credits, and then submit the form to the New Zealand Inland Revenue Department.

What is the purpose of NZ IR 595?

The purpose of NZ IR 595 is to provide the New Zealand tax authorities with the necessary information to assess an individual's or entity's tax liability based on their income and other financial factors.

What information must be reported on NZ IR 595?

NZ IR 595 requires reporting information on sources of income, allowable deductions, tax credits, and other relevant financial data that affect your taxable income and tax calculations.

Fill out your NZ IR 595 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NZ IR 595 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.