IRS 5305-SA 2002 free printable template

Show details

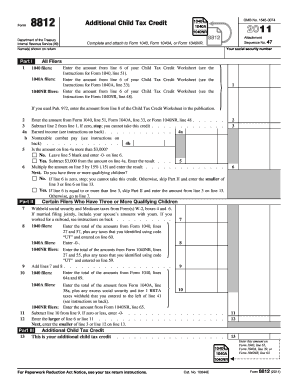

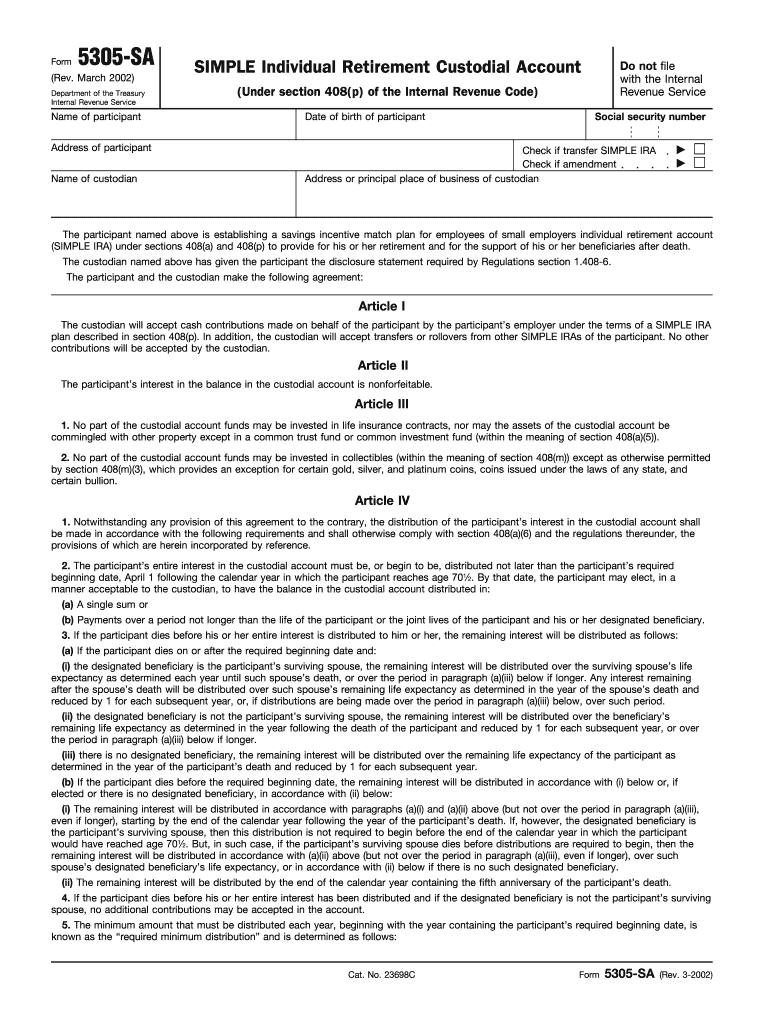

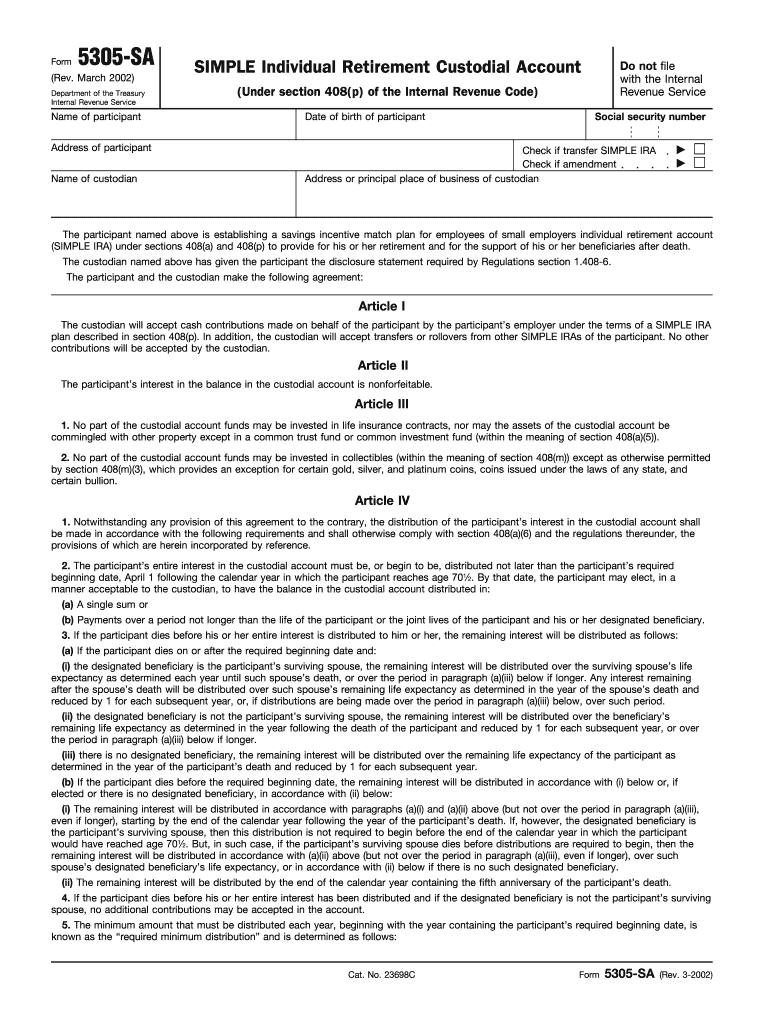

Custodian s signature Witness signature Use only if signature of the participant or the custodian is required to be witnessed. General Instructions Section references are to the Internal Revenue Code unless otherwise noted. Purpose of Form Form 5305-SA is a model custodial account agreement that meets the requirements of sections 408 a and 408 p and has been pre-approved by the IRS. A SIMPLE individual retirement account SIMPLE IRA is established after the form is fully executed by both the...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 5305-SA

Edit your IRS 5305-SA form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 5305-SA form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 5305-SA online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 5305-SA. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 5305-SA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 5305-SA

How to fill out IRS 5305-SA

01

Obtain IRS Form 5305-SA from the IRS website or an authorized provider.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide the name of your Health Savings Account (HSA) trustee or custodian.

04

Indicate the type of account, specifying if it is a Health Savings Account.

05

Certify that you meet the eligibility requirements by signing the form.

06

Submit the completed form to the HSA trustee or custodian to establish your HSA.

Who needs IRS 5305-SA?

01

Individuals who wish to open a Health Savings Account (HSA) and meet the eligibility requirements.

02

Taxpayers who are covered under a high-deductible health plan (HDHP) and want to save for qualified medical expenses.

Instructions and Help about IRS 5305-SA

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of Form 5305?

Form 5305-SEP (Model SEP) is used by an employer to make an agreement to provide benefits to all eligible employees under a simplified employee pension (SEP) described in section 408(k). Do not file Form 5305-SEP with the IRS. Instead, keep it with your records.

Is an individual retirement trust the same as an IRA?

IRAs prepare you for retirement and provide tax advantages, allowing you to choose whether to make contributions tax-free (traditional) or receive your distributions tax-free (Roth). A trust is an estate planning tool that allows you to set aside funds for specific beneficiaries to receive when you pass away.

What is the difference between 5304 and 5305?

An employer should use Form 5304-SIMPLE if it allows each plan participant to select the financial institution for receiving the participant's SIMPLE IRA plan contributions. An employer should use Form 5305-SIMPLE if it will deposit all SIMPLE IRA plan contributions at an employer-designated financial institution.

What is a 5305 simple form?

∎ IRS Form 5305-SIMPLE, Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) - for Use with a Designated Financial Institution, if you require that all contributions under the SIMPLE IRA plan be initially deposited with a designated financial institution.

What is IRS Form 5305?

Form 5305-RA is a model custodial account agreement that meets the requirements of section 408A and has been pre-approved by the IRS. A Roth individual retirement account (Roth IRA) is established after the form is fully executed by both the individual (depositor) and the custodian.

What is a Form 5305 traditional individual retirement trust account?

Traditional IRA for Nonworking Spouse - Form 5305-A may be used to establish the IRA custodial account for a nonworking spouse. Contributions to an IRA custodial account for a nonworking spouse must be made to a separate IRA custodial account established by the nonworking spouse.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 5305-SA to be eSigned by others?

When you're ready to share your IRS 5305-SA, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit IRS 5305-SA in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing IRS 5305-SA and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit IRS 5305-SA on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign IRS 5305-SA right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is IRS 5305-SA?

IRS 5305-SA is a form used to establish a Health Savings Account (HSA) and to provide certain disclosures to account holders.

Who is required to file IRS 5305-SA?

Individuals who wish to open a Health Savings Account (HSA) and institutions that offer HSAs are required to use IRS 5305-SA.

How to fill out IRS 5305-SA?

To fill out IRS 5305-SA, provide personal information such as the account holder's name, address, Social Security number, and details regarding the HSA provider.

What is the purpose of IRS 5305-SA?

The purpose of IRS 5305-SA is to formally create an HSA and ensure compliance with IRS regulations, as well as to inform account holders of their rights and responsibilities.

What information must be reported on IRS 5305-SA?

The information that must be reported includes the account holder's personal details, the name and address of the HSA trustee or custodian, and the terms and conditions of the account.

Fill out your IRS 5305-SA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 5305-SA is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.