IRS 5305-SA 2016 free printable template

Show details

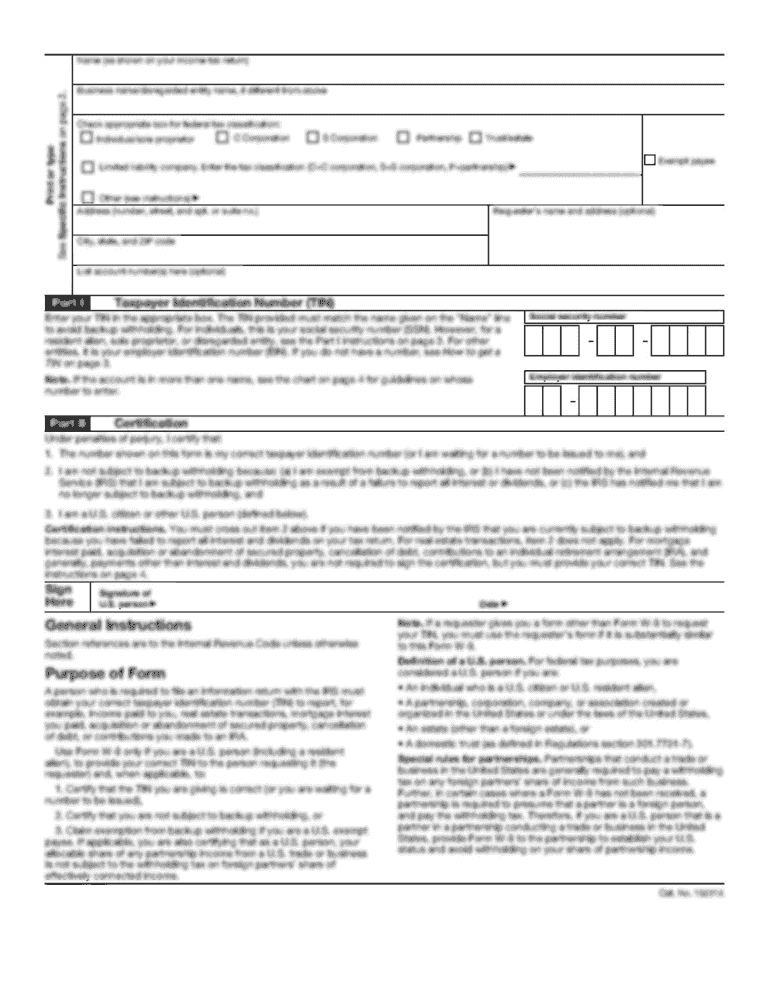

Form5305SA(Rev. October 2016)

Department of the Treasury

Internal Revenue ServiceSIMPLE Individual Retirement Custodial Account

(Under section 408(p) of the Internal Revenue Code)Name of participant

Address

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 5305-SA

Edit your IRS 5305-SA form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 5305-SA form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 5305-SA online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 5305-SA. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 5305-SA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 5305-SA

How to fill out IRS 5305-SA

01

Start with your personal information at the top of the form, including your name and Social Security number.

02

If applicable, fill in your spouse's name and Social Security number.

03

Indicate the year for which you are completing the form.

04

Provide details about your Health Savings Account (HSA), including the name of the trustee or custodian and the account number.

05

Make sure to check the box if you or your spouse is covered by a High Deductible Health Plan (HDHP).

06

Sign and date the form to certify that the information is correct.

07

Keep a copy for your records and submit the form to your HSA trustee or custodian.

Who needs IRS 5305-SA?

01

Individuals who are eligible to establish a Health Savings Account (HSA) and want to inform their HSA trustee or custodian about their eligibility.

02

Those who are covered by a High Deductible Health Plan (HDHP) and wish to take advantage of tax benefits associated with HSAs.

Instructions and Help about IRS 5305-SA

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of Form 5305?

Form 5305-SEP (Model SEP) is used by an employer to make an agreement to provide benefits to all eligible employees under a simplified employee pension (SEP) described in section 408(k). Do not file Form 5305-SEP with the IRS. Instead, keep it with your records.

Is an individual retirement trust the same as an IRA?

IRAs prepare you for retirement and provide tax advantages, allowing you to choose whether to make contributions tax-free (traditional) or receive your distributions tax-free (Roth). A trust is an estate planning tool that allows you to set aside funds for specific beneficiaries to receive when you pass away.

What is the difference between 5304 and 5305?

An employer should use Form 5304-SIMPLE if it allows each plan participant to select the financial institution for receiving the participant's SIMPLE IRA plan contributions. An employer should use Form 5305-SIMPLE if it will deposit all SIMPLE IRA plan contributions at an employer-designated financial institution.

What is a 5305 simple form?

∎ IRS Form 5305-SIMPLE, Savings Incentive Match Plan for Employees of Small Employers (SIMPLE) - for Use with a Designated Financial Institution, if you require that all contributions under the SIMPLE IRA plan be initially deposited with a designated financial institution.

What is IRS Form 5305?

Form 5305-RA is a model custodial account agreement that meets the requirements of section 408A and has been pre-approved by the IRS. A Roth individual retirement account (Roth IRA) is established after the form is fully executed by both the individual (depositor) and the custodian.

What is a Form 5305 traditional individual retirement trust account?

Traditional IRA for Nonworking Spouse - Form 5305-A may be used to establish the IRA custodial account for a nonworking spouse. Contributions to an IRA custodial account for a nonworking spouse must be made to a separate IRA custodial account established by the nonworking spouse.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 5305-SA in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign IRS 5305-SA and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an electronic signature for the IRS 5305-SA in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your IRS 5305-SA in seconds.

How do I fill out IRS 5305-SA on an Android device?

On Android, use the pdfFiller mobile app to finish your IRS 5305-SA. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is IRS 5305-SA?

IRS 5305-SA is a form that establishes a Health Savings Account (HSA) for an individual. It is an Earnings Claim Agreement that outlines the terms under which a financial institution will administer the HSA.

Who is required to file IRS 5305-SA?

Individuals who wish to set up a Health Savings Account (HSA) must file IRS 5305-SA with a qualified financial institution, which will then hold the funds and manage the account.

How to fill out IRS 5305-SA?

To fill out IRS 5305-SA, individuals need to provide their personal information, including name, address, and Social Security number, choose a trustee to administer the account, and sign the form to agree to the terms.

What is the purpose of IRS 5305-SA?

The purpose of IRS 5305-SA is to document the establishment of a Health Savings Account, allowing for tax-free contributions and withdrawals for qualified medical expenses.

What information must be reported on IRS 5305-SA?

The IRS 5305-SA requires reporting of the account holder's name, address, date of birth, Social Security number, the name of the financial institution, and the signature of the accountholder.

Fill out your IRS 5305-SA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 5305-SA is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.