IRS 5330 2009 free printable template

Show details

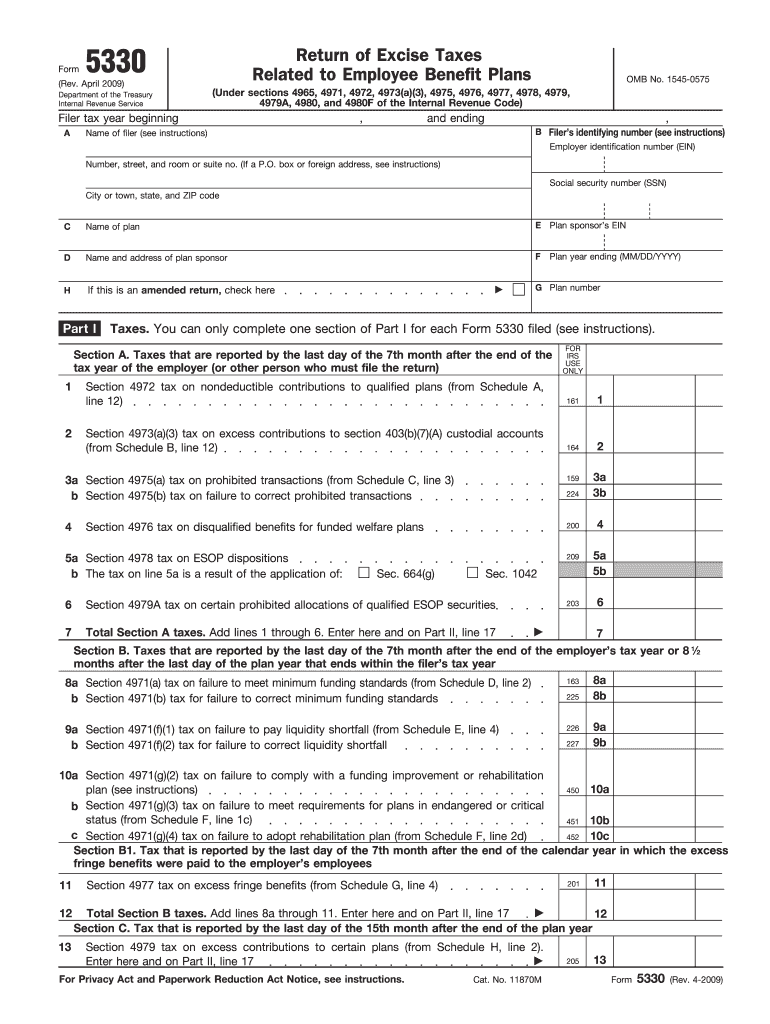

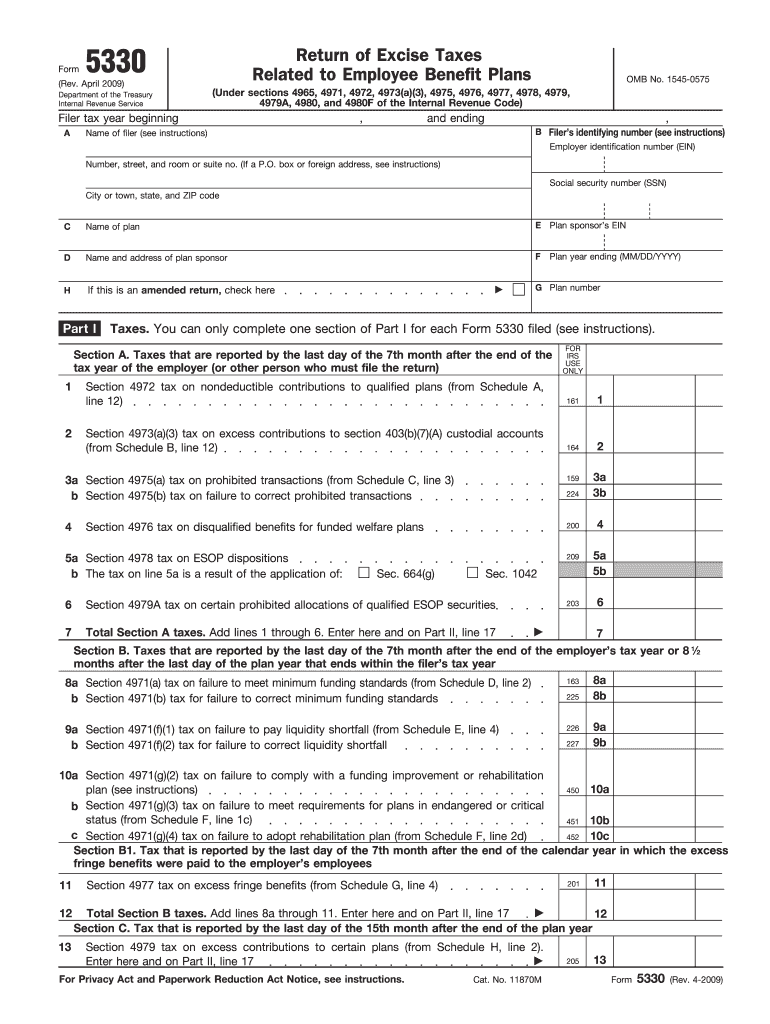

Cat. No. 11870M Rev. 4-2009 Form 5330 Rev. 4-2009 Page Name of Filer 14 Section 4980 tax on reversion of qualified plan assets to an employer from Schedule I line 3. Form Return of Excise Taxes Related to Employee Benefit Plans Rev. April 2009 Department of the Treasury Internal Revenue Service Filer tax year beginning A OMB No. 1545-0575 Under sections 4965 4971 4972 4973 a 3 4975 4976 4977 4978 4979 4979A 4980 and 4980F of the Internal Revenue ...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 5330

Edit your IRS 5330 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 5330 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 5330 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 5330. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 5330 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 5330

How to fill out IRS 5330

01

Obtain IRS Form 5330 from the IRS website or local IRS office.

02

Fill in your name, address, and identifying information in the top section of the form.

03

Indicate the type of return you are filing and the applicable tax year.

04

Complete Part I, providing information about the entity that is subject to the tax.

05

Fill out Part II, detailing the specific tax liability and any related calculations.

06

If applicable, complete any additional parts relevant to your situation.

07

Sign and date the form in the designated area.

08

Mail the completed form to the address specified in the form instructions.

Who needs IRS 5330?

01

Businesses or individuals who owe excise taxes on certain employee benefit plans.

02

Plan sponsors who need to report failures to meet the requirements of certain tax rules.

03

Taxpayers who have made excess contributions to a qualified retirement plan.

Fill

form

: Try Risk Free

People Also Ask about

What is form 5330 for lost earnings?

After remitting the late deposits and making the additional contributions to cover lost earnings, plan sponsors should complete the Internal Revenue Service (IRS) Form 5330 and pay the excise tax—equal to 15 percent of the lost earnings. The excise tax cannot be paid from the plan assets.

What is IRS form 5330 used for?

This form is used to report and pay the excise tax related to employee benefit plans.

What is Form 5330 for excise tax return?

What is form 5330? The Form 5330 has one job – to accompany remittances of certain excise taxes that are associated with qualified retirement plans and 403(b) plans.

Can you electronically file form 5330?

Form 5330 can be filed electronically using the IRS Modernized e-File (MeF) System through an IRS Authorized Form 5330 e-file Provider. All filers are encouraged to file Form 5330 electronically.

Can you electronically file Form 5330?

Form 5330 can be filed electronically using the IRS Modernized e-File (MeF) System through an IRS Authorized Form 5330 e-file Provider. All filers are encouraged to file Form 5330 electronically.

Who prepares form 5330?

An employer or an individual required to file an excise tax return related to employee benefit plans can file Form 5330 electronically. All filers are encouraged to file Form 5330 electronically because it is safe, easy to complete, and you have an immediate record that the return was filed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 5330 to be eSigned by others?

When your IRS 5330 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make edits in IRS 5330 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit IRS 5330 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out IRS 5330 on an Android device?

Complete IRS 5330 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is IRS 5330?

IRS Form 5330 is used to report and pay the excise tax on certain retirement plans and arrangements that violate the Internal Revenue Code provisions.

Who is required to file IRS 5330?

Any plan sponsor or administrator of a retirement plan who has incurred an excise tax due to certain violations, such as excess contributions, must file IRS 5330.

How to fill out IRS 5330?

To fill out IRS 5330, you need to provide details about the plan, the nature of the excise tax, the amount owed, and complete the relevant sections according to the instructions provided by the IRS.

What is the purpose of IRS 5330?

The purpose of IRS 5330 is to report and pay excise taxes owed on certain transactions related to retirement plans that do not comply with IRS rules.

What information must be reported on IRS 5330?

IRS 5330 requires reporting of the type of plan involved, details of the transactions that resulted in excise tax, the amount of tax owed, and any corrections made.

Fill out your IRS 5330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 5330 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.