IRS 5330 2013 free printable template

Show details

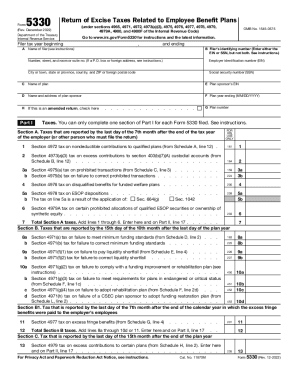

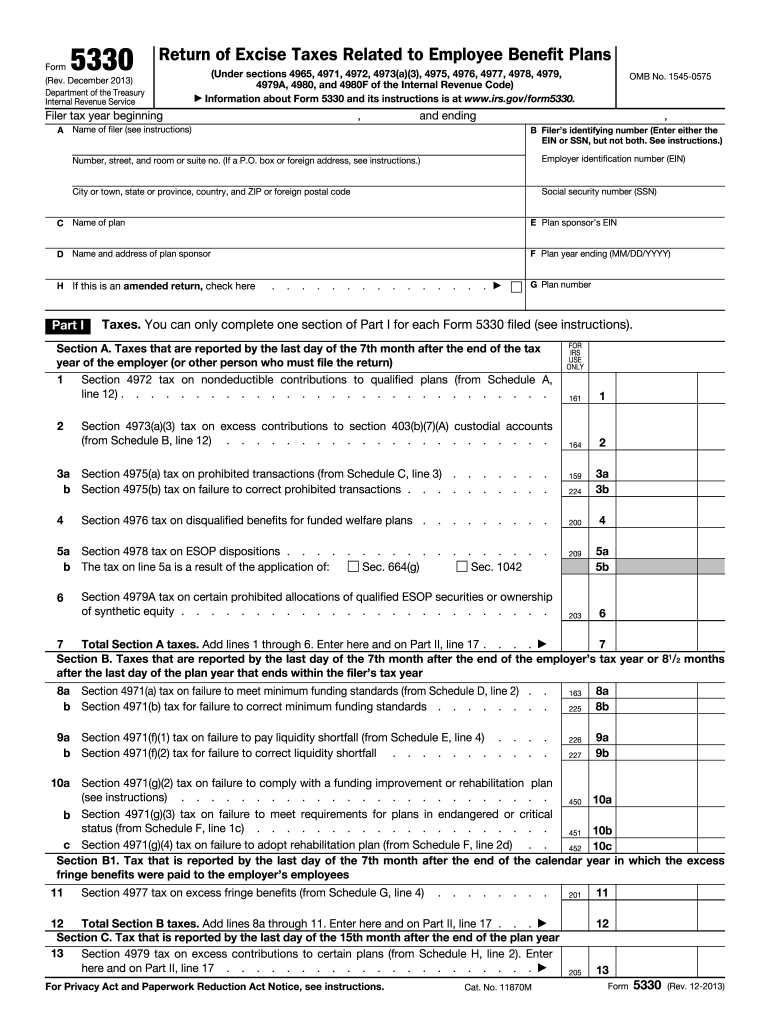

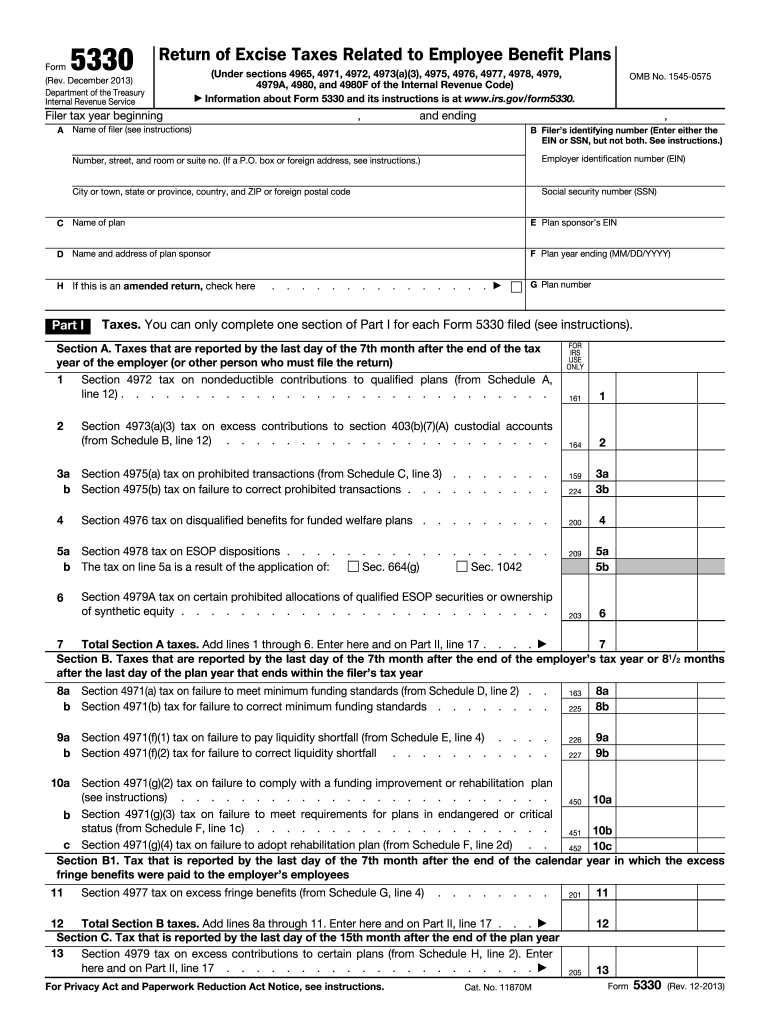

G Plan number Taxes. You can only complete one section of Part I for each Form 5330 filed see instructions. For Privacy Act and Paperwork Reduction Act Notice see instructions. Cat. No. 11870M 10b 10c year in which the excess Rev. 12-2013 Form 5330 Rev. 12-2013 Page Name of Filer line 3. Form Rev. December 2013 Department of the Treasury Internal Revenue Service Return of Excise Taxes Related to Employee Benefit Plans Under sections 4965 4971 4972 4973 a 3 4975 4976 4977 4978 4979 4979A 4980...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 5330

Edit your IRS 5330 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 5330 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 5330 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS 5330. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 5330 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 5330

How to fill out IRS 5330

01

Obtain IRS Form 5330 from the official IRS website or a tax professional.

02

Fill in the name, address, and employer identification number (EIN) of your plan.

03

Indicate the plan type and its year-end date.

04

Complete Part I by reporting any taxes due.

05

Fill out Part II if there are any exceptions that apply.

06

Review all entries for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form to the IRS by the deadline.

Who needs IRS 5330?

01

Plan administrators of tax-qualified retirement plans.

02

Employers sponsoring a 403(b) plan.

03

Individuals who owe excise taxes related to employee benefit plans.

Fill

form

: Try Risk Free

People Also Ask about

What is form 5330 for lost earnings?

After remitting the late deposits and making the additional contributions to cover lost earnings, plan sponsors should complete the Internal Revenue Service (IRS) Form 5330 and pay the excise tax—equal to 15 percent of the lost earnings. The excise tax cannot be paid from the plan assets.

What is IRS form 5330 used for?

This form is used to report and pay the excise tax related to employee benefit plans.

What is Form 5330 for excise tax return?

What is form 5330? The Form 5330 has one job – to accompany remittances of certain excise taxes that are associated with qualified retirement plans and 403(b) plans.

Can you electronically file form 5330?

Form 5330 can be filed electronically using the IRS Modernized e-File (MeF) System through an IRS Authorized Form 5330 e-file Provider. All filers are encouraged to file Form 5330 electronically.

Can you electronically file Form 5330?

Form 5330 can be filed electronically using the IRS Modernized e-File (MeF) System through an IRS Authorized Form 5330 e-file Provider. All filers are encouraged to file Form 5330 electronically.

Who prepares form 5330?

An employer or an individual required to file an excise tax return related to employee benefit plans can file Form 5330 electronically. All filers are encouraged to file Form 5330 electronically because it is safe, easy to complete, and you have an immediate record that the return was filed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS 5330?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific IRS 5330 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I sign the IRS 5330 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your IRS 5330 in minutes.

How do I complete IRS 5330 on an Android device?

On Android, use the pdfFiller mobile app to finish your IRS 5330. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is IRS 5330?

IRS Form 5330 is the Return of Excise Taxes Related to Employee Benefit Plans. It is used by certain retirement plans and tax-exempt organizations to report and pay excise taxes imposed by the Internal Revenue Code.

Who is required to file IRS 5330?

Entities that are required to file IRS Form 5330 include qualified retirement plans, IRAs, and tax-exempt organizations that have engaged in certain transactions or failed to fulfill certain requirements under the Employee Retirement Income Security Act (ERISA) or the Internal Revenue Code.

How to fill out IRS 5330?

To fill out IRS Form 5330, taxpayers must provide information about the plan, the type of excise tax being reported, and any additional details related to the transaction that triggered the tax. Instructions can be found in the IRS guidelines accompanying the form.

What is the purpose of IRS 5330?

The purpose of IRS Form 5330 is to report and pay excise taxes owed by retirement plans and tax-exempt organizations for violations of specific tax rules, ensuring compliance with the Internal Revenue Code and ERISA.

What information must be reported on IRS 5330?

IRS Form 5330 requires reporting of information such as the organization's name and taxpayer identification number, details of the tax and the year it pertains to, any applicable exemptions, and calculations of the excise tax owed.

Fill out your IRS 5330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 5330 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.