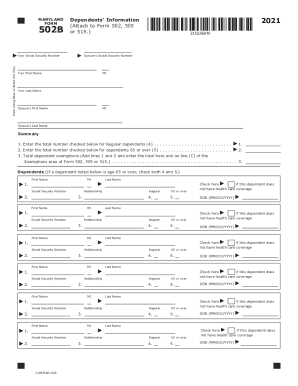

IRS 5330 2021 free printable template

Show details

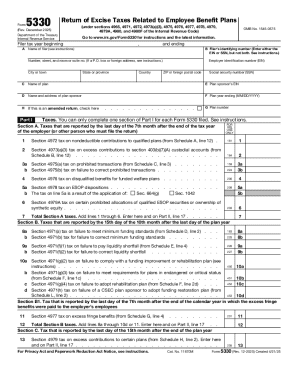

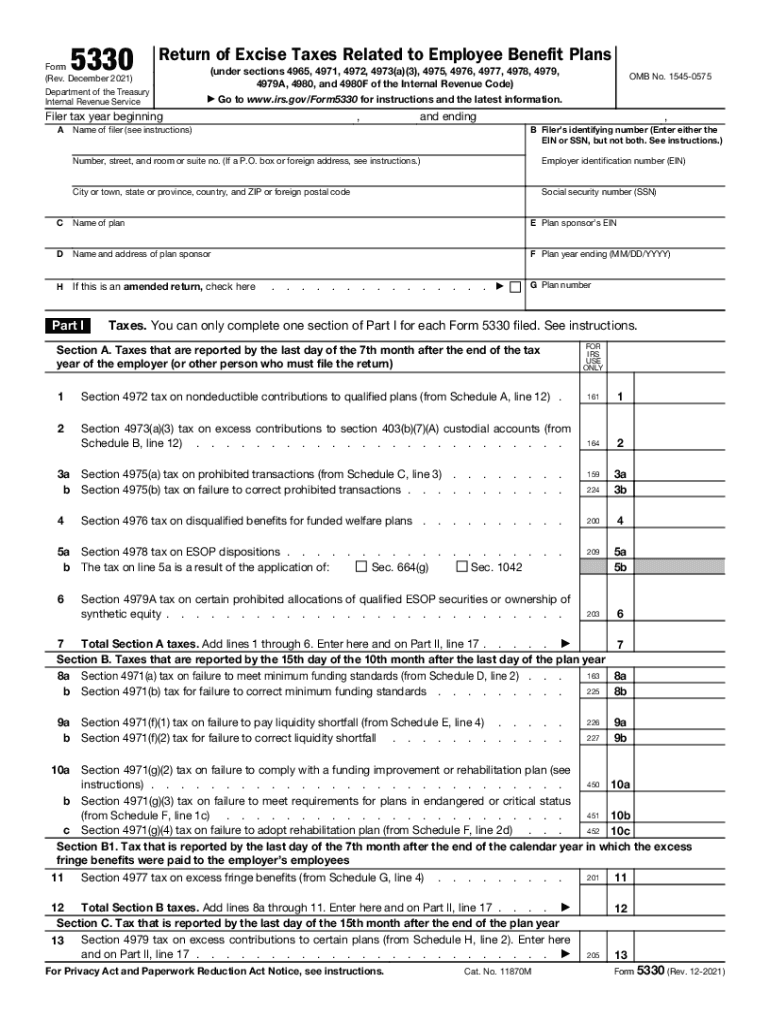

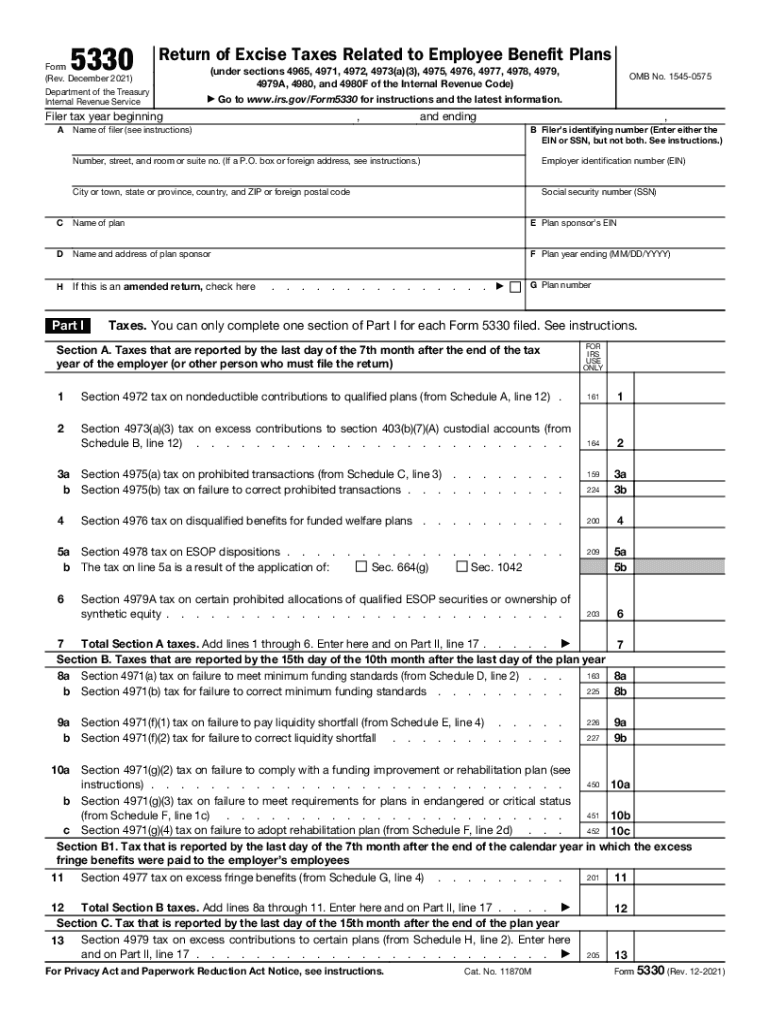

G Plan number Taxes. You can only complete one section of Part I for each Form 5330 filed see instructions. For Privacy Act and Paperwork Reduction Act Notice see instructions. Cat. No. 11870M 10b 10c year in which the excess Rev. 12-2013 Form 5330 Rev. 12-2013 Page Name of Filer line 3. Form Rev. December 2013 Department of the Treasury Internal Revenue Service Return of Excise Taxes Related to Employee Benefit Plans Under sections 4965 4971 4972 4973 a 3 4975 4976 4977 4978 4979 4979A 4980...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 5330

Edit your IRS 5330 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 5330 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 5330 online

Follow the steps below to benefit from a competent PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS 5330. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 5330 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 5330

How to fill out IRS 5330

01

Obtain Form 5330 from the IRS website or request a copy from the IRS.

02

Read the instructions carefully to understand each section of the form.

03

Fill out personal information, including your name, address, and taxpayer identification number.

04

Indicate the type of plan or account that is associated with the excise tax.

05

Calculate and enter the amount of excise tax owed, if applicable.

06

Complete any additional sections relevant to the specific reason for filing the form.

07

Review the completed form for accuracy before submission.

08

Submit the form to the IRS by the due date, along with any payment for the excise tax owed.

Who needs IRS 5330?

01

Individuals or entities that are required to pay excise taxes on certain retirement plans or accounts.

02

Plan sponsors or administrators who have incurred certain tax liabilities related to retirement plans.

03

Trustees of pension or profit-sharing plans that have made excess contributions or failed to meet certain requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is form 5330 for lost earnings?

After remitting the late deposits and making the additional contributions to cover lost earnings, plan sponsors should complete the Internal Revenue Service (IRS) Form 5330 and pay the excise tax—equal to 15 percent of the lost earnings. The excise tax cannot be paid from the plan assets.

What is IRS form 5330 used for?

This form is used to report and pay the excise tax related to employee benefit plans.

What is Form 5330 for excise tax return?

What is form 5330? The Form 5330 has one job – to accompany remittances of certain excise taxes that are associated with qualified retirement plans and 403(b) plans.

Can you electronically file form 5330?

Form 5330 can be filed electronically using the IRS Modernized e-File (MeF) System through an IRS Authorized Form 5330 e-file Provider. All filers are encouraged to file Form 5330 electronically.

Can you electronically file Form 5330?

Form 5330 can be filed electronically using the IRS Modernized e-File (MeF) System through an IRS Authorized Form 5330 e-file Provider. All filers are encouraged to file Form 5330 electronically.

Who prepares form 5330?

An employer or an individual required to file an excise tax return related to employee benefit plans can file Form 5330 electronically. All filers are encouraged to file Form 5330 electronically because it is safe, easy to complete, and you have an immediate record that the return was filed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 5330 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your IRS 5330 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for signing my IRS 5330 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your IRS 5330 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out IRS 5330 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IRS 5330 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is IRS 5330?

IRS Form 5330 is a form used by pension plan administrators to report and pay excise taxes on certain prohibited transactions and other issues related to employee benefit plans.

Who is required to file IRS 5330?

Any plan administrator or fiduciary of a tax-advantaged retirement plan must file Form 5330 if they are aware of any excise taxes owed due to prohibited transactions or if required for recovery of excess contributions.

How to fill out IRS 5330?

To fill out IRS Form 5330, obtain the form from the IRS website, follow the provided instructions to report relevant information regarding the excise tax owed, and include details related to the specific prohibited transaction or excess contribution.

What is the purpose of IRS 5330?

The purpose of IRS Form 5330 is to enable the IRS to collect excise taxes related to certain failures and prohibited transactions in retirement plans and ensure compliance with federal regulations.

What information must be reported on IRS 5330?

IRS Form 5330 requires information such as the name and address of the plan, the type of excise tax being reported, information about the transaction that triggered the excise tax, and the amount of tax due.

Fill out your IRS 5330 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 5330 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.