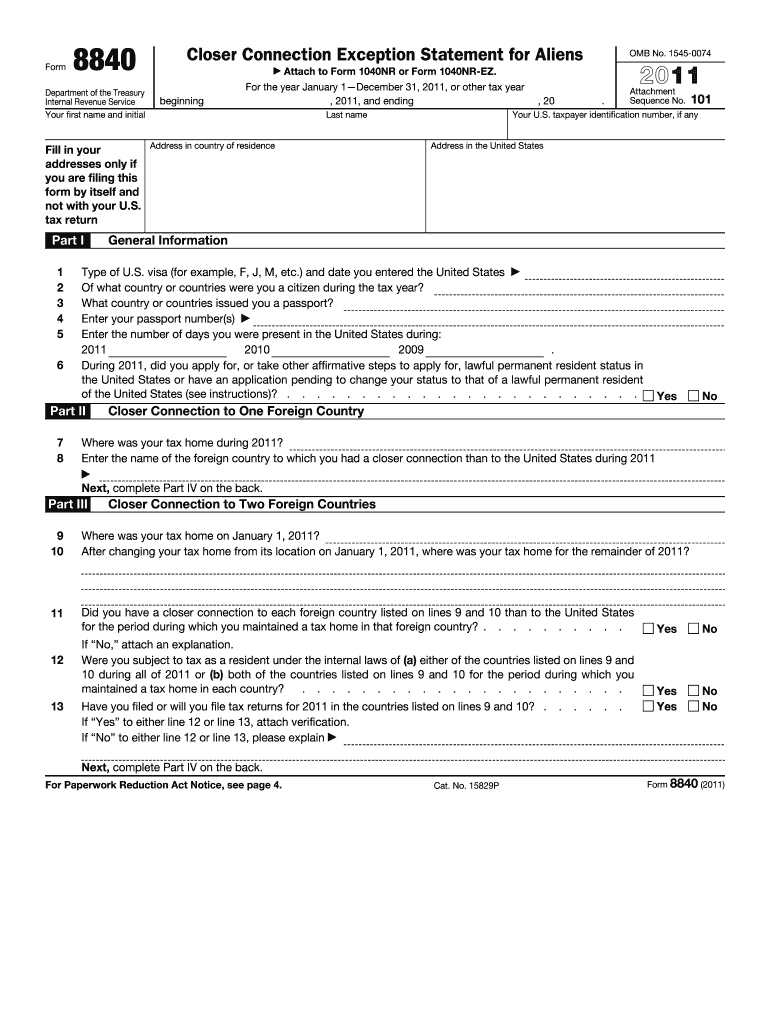

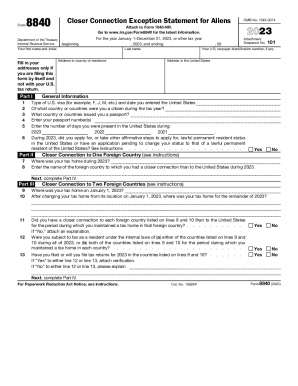

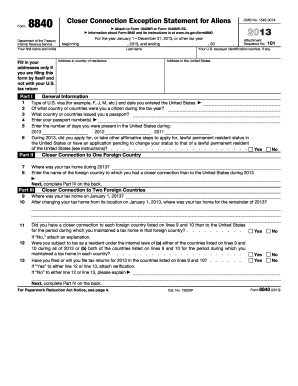

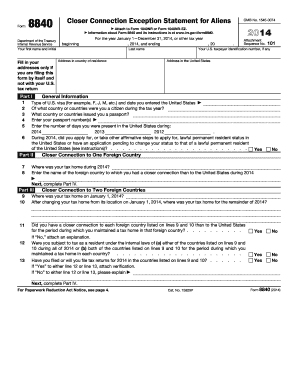

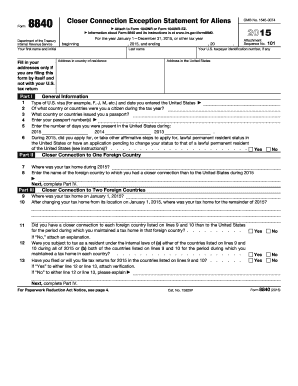

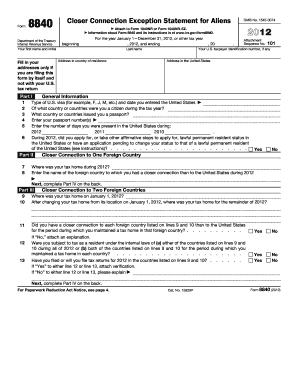

What is form 8840?

Form 8840 is a Closer Connection Exception Statement for foreign citizens. It's an IRS tax report for US non-residents to claim the closer connection to one or two foreign countries exception to the substantial presence test.

Who should file form 8840 2011?

Foreigners who comply with the requirements of the exceptions described in the form 8840 instructions must submit this document to be considered a USA non-resident because of that exception.

A person is considered a resident of the United States subject to the following conditions:

- if they resided in the USA for 31 days, and

- if they spent 183 days in the US during the period 2021, 2020, and 2019 – calculating all days they were physically present in the US in 2021, but only 1/3 the number of days in 2020, and only 1/6 the number of days in 2019.

You will be recognized as a non-resident if you show that you were connected with a foreign country during the reporting period. You can apply for a closer connection to no more than two foreign countries by reporting the IRS form 8840.

Those who qualify to exclude days of presence in the USA because they are an exempt individual or because of certain health conditions should also report their form 8843 (see the form 8840 instructions, page 3).

What information do you need when you file form 8840?

The IRS form 8840 consists of 4 sections of information to provide. Here's what you need to report in your document:

- General information (your passport details, type of US visa you hold, date you entered the USA, number of days you were present in the USA during the last three years)

- Closer connection to one or two foreign countries (name of the country to which you had a closer connection in the previous year and where your tax home was - the main place of your business and employment during the tax year)

- Information regarding important contacts with one or two overseas countries – You should provide the details about your permanent home location, the location of your family, banking activities, personal property and possessions, vehicles, etc.

- Whether you have ever completed US tax forms, including W9, W8, and other reports, and whether having any income from the US sources.

How do I fill out the IRS 8840 form in 2012?

To avoid unnecessary printing and paper wasting, you can fill out your form 8840 online with a powerful PDF editor. Follow these simple steps:

- Click Get Form to open the template in the editor.

- Scroll down to pages 3 and 4 to get the detailed form 8840 instructions.

- Click Start to fill out the first blank field and navigate the document with the Next option.

- Add your electronic signature in the related field, but only if sending your IRS form 8840 by itself and not as an accompaniment to your tax return.

- Verify your answers and click Done when finished.

After your document is ready, you can choose what to do next with it: print it out, email it, or mail it via USPS right from the editor.

Is the IRS form 8840 accompanied by other forms?

Form 8840 is not accompanied by other official documents, but it accompanies forms 1040NR or 1040NR-EZ.

When is form 8840 due?

Form 8840 goes as an accompaniment to the IRS form 1040-NR (US Non-resident alien tax return). Therefore, the due date is the same as for the 1040-NR. Generally, for those working or receiving remunerations subject to US income tax withholding, it's the 15th day of the 4th month after the tax year ends (April 15th). In 2022, the due day is April 18th.

For those who are not employees or self-employed receiving wages or non-employee compensations, the due date is June 15th.

Where do I send the form 8840?

If you file the 1040-NR report, you should attach your form 8840 (completed but not signed) and send it to the same address where you report your tax return.

If you don't file a tax return for 2012, you should complete, sign, and send your form 8840 to the address below:

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215

Using pdfFiller, you can send your IRS form 8840 via mailing service right from the editor without printing the document. Simply use the Send via USPS option once your copy is completed.