IRS 1040 - Schedule F 2010 free printable template

Show details

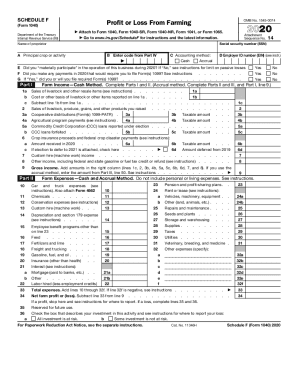

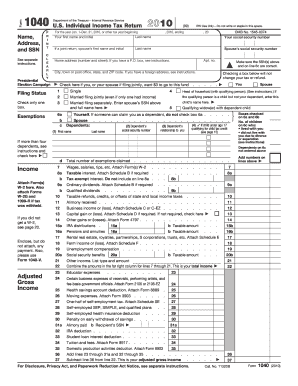

Profit or Loss From Farming SCHEDULE F (Form 1040) Department of the Treasury Internal Revenue Service (99) OMB No. 1545-0074 2010 Attach to Form 1040, Form 1040NR, Form 1041, Form 1065, or Form 1065-B.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule F

How to edit IRS 1040 - Schedule F

How to fill out IRS 1040 - Schedule F

Instructions and Help about IRS 1040 - Schedule F

How to edit IRS 1040 - Schedule F

To edit the IRS 1040 - Schedule F form, use a PDF editing tool. Upload the completed form to pdfFiller, where you can make necessary changes, add text, or correct any errors before finalizing your submission.

How to fill out IRS 1040 - Schedule F

To fill out the IRS 1040 - Schedule F, follow these steps:

01

Begin by entering your name and Social Security number at the top of the form.

02

Detail your farming income, including sales of livestock, produce, and other products on line 1.

03

List all applicable expenses related to your farming operation in the designated sections.

04

Calculate your total income and expenses to determine your net profit or loss.

05

Ensure all mathematical calculations are accurate before submitting the form.

About IRS 1040 - Schedule F 2010 previous version

What is IRS 1040 - Schedule F?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule F 2010 previous version

What is IRS 1040 - Schedule F?

IRS 1040 - Schedule F is a form used by U.S. taxpayers to report income or loss from farming operations. It is part of the individual tax return process, specifically for those who operate a farm as a business or reach significant income from farming.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule F is to allow farmers to declare their income and expenses for accurate tax calculation. This form helps determine any profits or losses incurred from farming activities, which consequently affects overall tax liabilities.

Who needs the form?

Individuals who earn income from farming and meet the IRS criteria for filing need to complete Schedule F. This typically includes sole proprietors of farms, partnerships, and corporations earning farm income.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out IRS 1040 - Schedule F if they do not meet the minimum income threshold from farming or do not operate a farm for profit. Those with farming activity deemed as hobby income are not required to report using this schedule.

Components of the form

The IRS 1040 - Schedule F consists of sections for reporting income, expenses, and calculations for net profit or loss from farming. Key components include gross income from farming sales, specific expense categories such as fertilizer and utilities, and final net income calculations.

What are the penalties for not issuing the form?

Failure to file IRS 1040 - Schedule F when required can result in penalties, including late filing fees and interest on owed taxes. The IRS may impose fines based on the severity of the neglect or deliberate disregard of the filing requirement.

What information do you need when you file the form?

When filing IRS 1040 - Schedule F, you need several details, including:

01

Documentation of farming income sources and amounts.

02

Records of all farming-related expenses.

03

Your identity verification details, such as your Social Security number.

Is the form accompanied by other forms?

Schedule F may need to be accompanied by additional forms, such as the main IRS 1040 and possibly other schedules related to your overall income sources. Ensure all relevant documents are included to prevent delays in processing.

Where do I send the form?

To submit IRS 1040 - Schedule F, send it to the appropriate IRS mailing address based on your location and whether you are enclosing a payment. Consult the IRS instructions for mailing addresses for specific guidance.

See what our users say