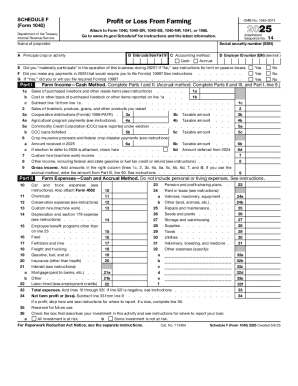

IRS 1040 - Schedule F 2023 free printable template

Instructions and Help about IRS 1040 - Schedule F

How to edit IRS 1040 - Schedule F

How to fill out IRS 1040 - Schedule F

About IRS 1040 - Schedule F 2023 previous version

What is IRS 1040 - Schedule F?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

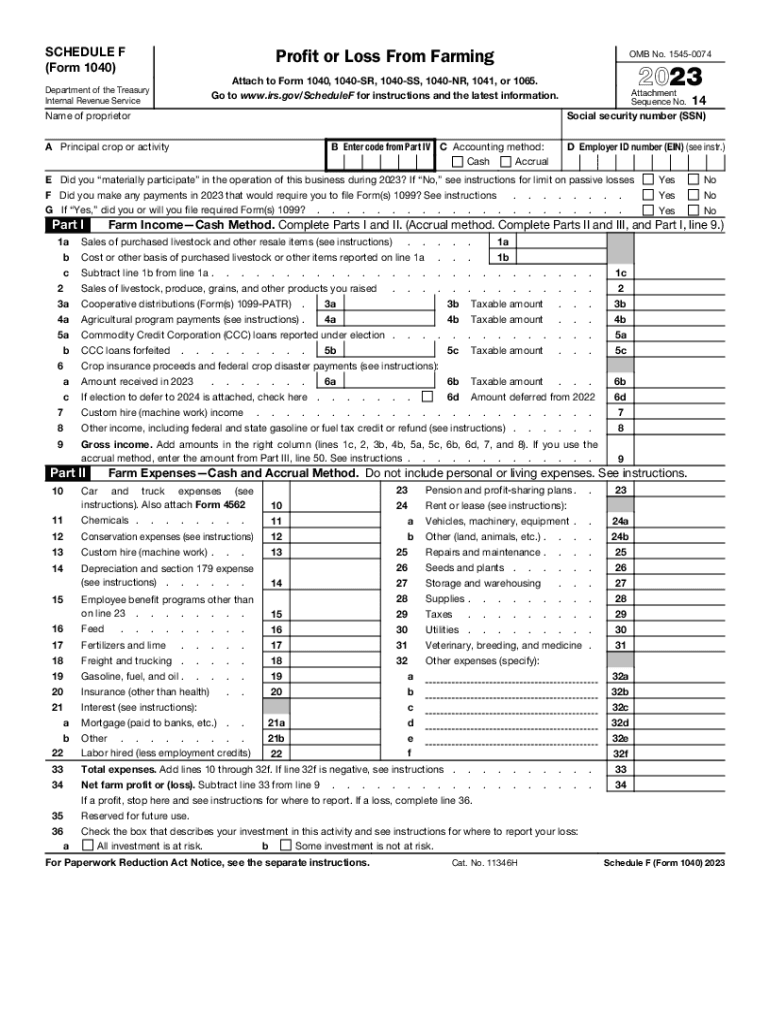

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040 - Schedule F

What should I do if I realize I made a mistake on my IRS 1040 - Schedule F after filing?

If you've filed your IRS 1040 - Schedule F and notice an error, you can submit an amended return using Form 1040-X. Make sure to include the corrected information from your Schedule F and clearly explain the changes made. It's advisable to keep copies of both the original and amended forms for your records.

How can I check the status of my IRS 1040 - Schedule F filing?

To check the status of your IRS 1040 - Schedule F, you can use the IRS 'Where’s My Refund?' tool if you are expecting a refund. If filed electronically, you may receive updates on processing status. Be aware of common e-file rejection codes and ensure that any issues are promptly addressed to avoid delays.

What should I do if I receive a notice from the IRS regarding my Schedule F?

If you receive an IRS notice concerning your IRS 1040 - Schedule F, carefully review the information presented. Gather any relevant documentation to support your case and respond within the specified timeframe. If required, consult a tax professional to ensure that you are adequately prepared to address the issue.

Are there any common errors to avoid when filing IRS 1040 - Schedule F?

Common errors when filing the IRS 1040 - Schedule F include incorrect reporting of income, failure to include all necessary expenses, and mismatching figures with the main 1040 form. Double-check your calculations and ensure all supporting documentation is accurate to minimize the risk of rejection or audit.

What are the privacy and data security measures I should consider when filing IRS 1040 - Schedule F electronically?

When electronically filing your IRS 1040 - Schedule F, prioritize using secure connections and reputable tax software that complies with IRS guidelines. Ensure that your device has up-to-date security software to protect your personal information. Additionally, maintain secure records of your filings and any correspondence with the IRS.

See what our users say