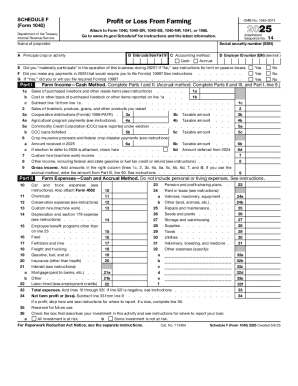

IRS 1040 - Schedule F 2024 free printable template

Instructions and Help about IRS 1040 - Schedule F

How to edit IRS 1040 - Schedule F

How to fill out IRS 1040 - Schedule F

Latest updates to IRS 1040 - Schedule F

About IRS 1040 - Schedule F 2022 previous version

What is IRS 1040 - Schedule F?

When am I exempt from filling out this form?

What payments and purchases are reported?

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040 - Schedule F

What should I do if I realize I've made a mistake on my filed IRS 1040 - Schedule F?

If you've made an error on your filed IRS 1040 - Schedule F, you should file an amended return using Form 1040-X. Make sure to include any necessary corrections and documentation to support your changes. Be mindful of the time limits for filing an amended return, typically within three years from the original filing date.

How can I verify if the IRS has received my IRS 1040 - Schedule F?

To confirm whether the IRS has received your IRS 1040 - Schedule F, utilize the 'Where's My Refund?' tool on the IRS website. You will need your Social Security number, filing status, and the exact amount of your refund to check the status of your return and verify its processing.

What should I do if my e-filed IRS 1040 - Schedule F gets rejected?

If your e-filed IRS 1040 - Schedule F is rejected, you will receive a rejection code indicating the reason for the rejection. Review the error message and make the necessary corrections in your filing software. After rectifications, you can resubmit your return electronically or consider filing a paper return if issues persist.

What are the privacy considerations I should take when filing IRS 1040 - Schedule F?

When filing the IRS 1040 - Schedule F, ensure that sensitive information is transmitted securely, especially when filing electronically. Use reputable e-filing software that complies with data security standards, and avoid sharing your information through unsecured methods. Maintain a secure record retention practice for your tax records.

Are there special considerations for non-residents filing IRS 1040 - Schedule F?

Non-residents filing the IRS 1040 - Schedule F should be aware of specific IRS guidelines and tax treaty provisions that may apply. Consider consulting a tax professional to ensure compliance with filing requirements and to accurately report any income generated in the U.S. while taking advantage of possible tax treaties.

See what our users say