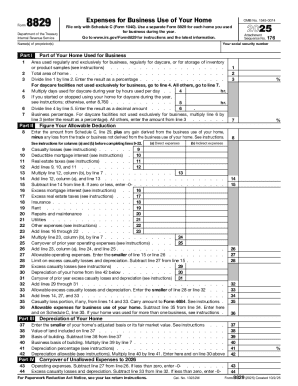

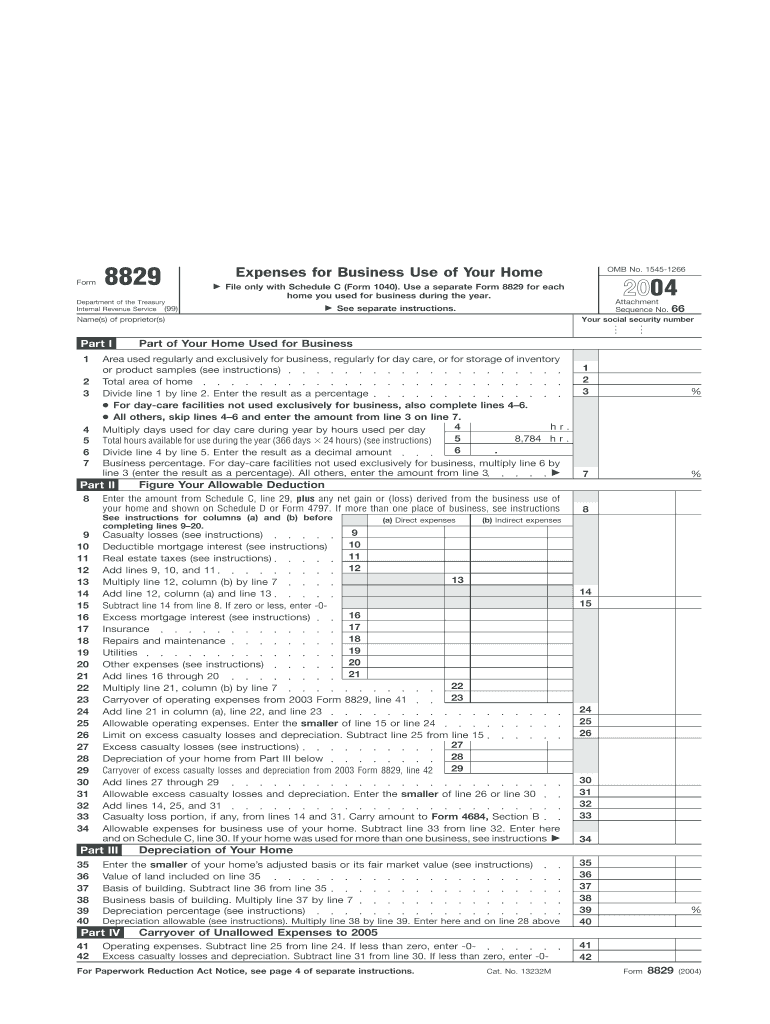

IRS 8829 2004 free printable template

Instructions and Help about IRS 8829

How to edit IRS 8829

How to fill out IRS 8829

About IRS 8 previous version

What is IRS 8829?

Who needs the form?

Components of the form

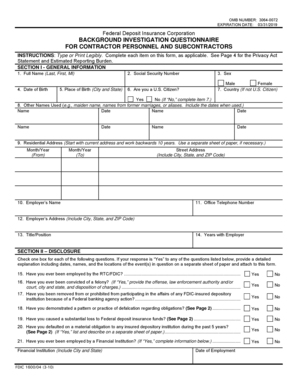

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

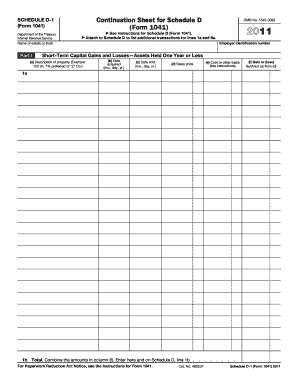

Is the form accompanied by other forms?

FAQ about IRS 8829

What are some common errors to avoid when submitting the 2004 form 8829?

One of the common errors is miscalculating the expenses related to the home office, which can lead to incorrect deductions. Ensure that you track all relevant expenses accurately and keep detailed records. Additionally, make sure that all personal information is filled out correctly to avoid processing delays.

How can I confirm the status of my submitted 2004 form 8829?

To verify the receipt or processing of your 2004 form 8829, you can use the IRS online tools or contact their helpline. It's important to have your submission details handy, such as date of filing and confirmation numbers if you e-filed. If you receive an e-file rejection code, further information is provided to help you correct the issue.

What should I do if I receive a notice or audit related to my 2004 form 8829?

If you receive an IRS notice regarding your 2004 form 8829, carefully review the details specified in the letter. Gather supporting documents that validate your deductions and respond promptly, addressing any concerns raised. If needed, consider consulting a tax professional to assist in your response.

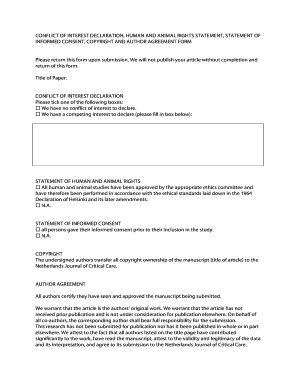

Is an e-signature acceptable for the 2004 form 8829 when filing electronically?

Yes, an e-signature is acceptable when filing the 2004 form 8829 electronically. Ensure that you follow the IRS guidelines for e-signatures, as this will streamline your filing process. Maintain all correspondence and confirmations as part of your record retention efforts.

See what our users say