IRS 2032 2002 free printable template

Show details

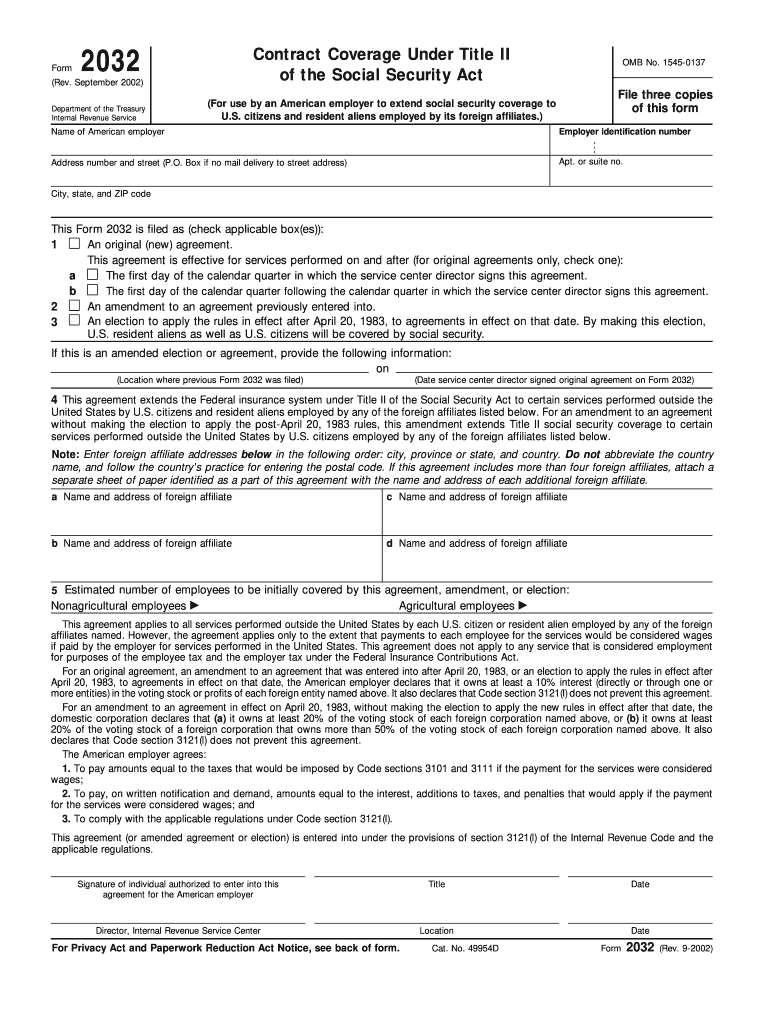

Rev. September 2002 Contract Coverage Under Title II of the Social Security Act Department of the Treasury Internal Revenue Service For use by an American employer to extend social security coverage to U.S. citizens and resident aliens employed by its foreign affiliates. Form OMB No. 1545-0137 File three copies of this form Name of American employer Employer identification number Address number and street P. O. Box if no mail delivery to street a...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 2032

Edit your IRS 2032 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 2032 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 2032 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS 2032. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 2032 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 2032

How to fill out IRS 2032

01

Obtain IRS Form 2032 from the IRS website or your tax preparer.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in the basic information about your organization including name, address, and employer identification number (EIN).

04

Indicate the type of entity the organization is (e.g., corporation, partnership).

05

Provide details about the tax year for which the election is being made.

06

Complete the section describing the type of tax treatment you are electing.

07

Have an authorized official sign and date the form.

08

Submit the completed form to the designated IRS address as per the instructions.

Who needs IRS 2032?

01

Any organization that wishes to elect to be treated as an S corporation or make certain tax classifications.

02

Newly formed entities looking to establish tax status with the IRS.

03

Businesses needing to notify the IRS of a change in entity classification.

Fill

form

: Try Risk Free

People Also Ask about

What is DS in immigration?

D/S on your Form I-94/admissions stamp means that you may remain in the United States so long as you maintain your nonimmigrant student status, which includes finishing your program by the program date listed on your Form I-20, "Certificate of Eligibility for Nonimmigrant Status." If you need more time to finish your

Who should fill out DS-260 form?

The principal applicant and all family members applying for a diversity visa program must complete Form DS-260. You will need to enter your DV case number into the online DS-260 form to access and update the information about yourself and your family that you included in your DV entry.

What is DS form for?

The DS-160, Online Nonimmigrant Visa Application form, is for temporary travel to the United States, and for K (fiancé(e)) visas. Form DS-160 is submitted electronically to the Department of State website via the Internet.

What is form DS 260 used for?

After you pay your fees and the status in CEAC is updated to 'PAID', you and each qualified family member immigrating with you must complete the Application for Immigrant Visa and Alien Registration (Form DS-260).

What is the DS form for immigrant visa?

What Is Form DS-260? Form DS-260 is the Immigrant Visa Electronic Application that you will use to apply for your green card if you are applying from outside the United States. Filing will go through U.S. Citizenship and Immigration Services (USCIS) and the National Visa Center (NVC).

Can I download a visa application form?

Filling your application form number and your passport, you can still download the form to your local computer. Then you can print the form again. **Due to the pandemic, please contact us by email if you need to apply for visa.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in IRS 2032?

With pdfFiller, it's easy to make changes. Open your IRS 2032 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit IRS 2032 straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing IRS 2032, you can start right away.

How do I edit IRS 2032 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share IRS 2032 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is IRS 2032?

IRS 2032 is a form used by partnerships to elect to be treated as a different type of entity for tax purposes.

Who is required to file IRS 2032?

Partners in a partnership wanting to change their tax classification to a different form of business entity must file IRS 2032.

How to fill out IRS 2032?

To fill out IRS 2032, you need to provide information about the partnership, including the name, address, taxpayer identification number, and the classification option being elected.

What is the purpose of IRS 2032?

The purpose of IRS 2032 is to allow a partnership to elect a different tax treatment, facilitating flexible tax planning and compliance.

What information must be reported on IRS 2032?

The form must report the name and address of the partnership, the taxpayer identification number, the date of the election, and the classification being elected.

Fill out your IRS 2032 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 2032 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.