IRS 2032 2010 free printable template

Show details

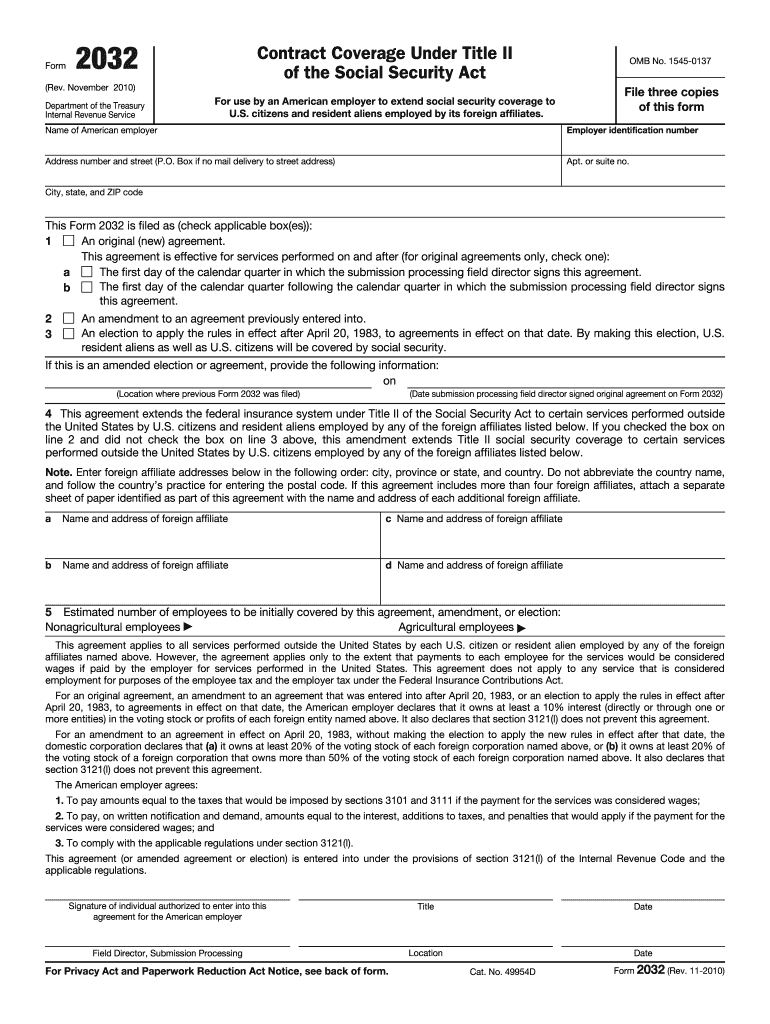

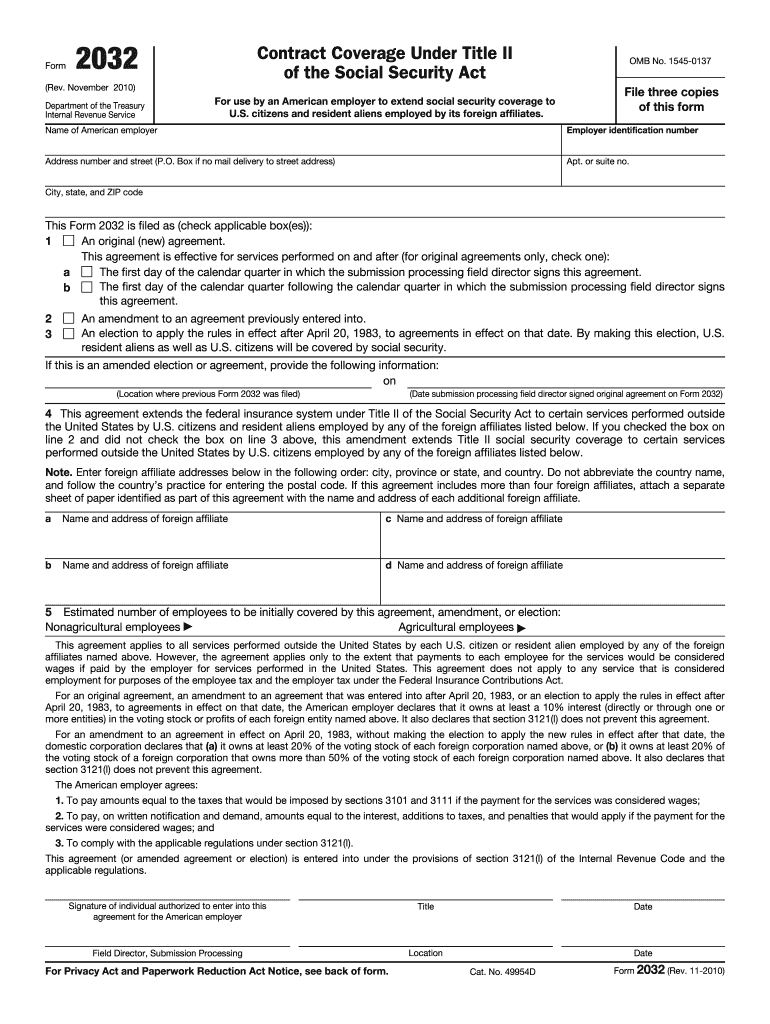

For electronic Form 941 filers send Form 2032 to Internal Revenue Service Cincinnati OH 45999-0038. Enter on Form 2032 the employer identification number EIN as shown on Form 941. This will help the IRS process your form faster. The IRS will return one copy of Form 2032 to the Security Administration and keep one copy with all related papers. Original agreements. A old agreement. File Form 2032 in triplicate and If you make this election it will be effective for all foreign entities covered...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs form 2032

Edit your 2032 of the form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2032 coverage download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 2032 pdf online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 2032 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 2032 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2032 rev form

How to fill out IRS 2032

01

Obtain IRS Form 2032 from the IRS website or your local IRS office.

02

Read the instructions carefully to understand the requirements.

03

Fill in your entity's name and address at the top of the form.

04

Provide the Employer Identification Number (EIN) of the entity.

05

Indicate the type of entity (e.g., partnership, corporation) in the appropriate section.

06

Complete the election statement, detailing the tax year for the election.

07

Sign and date the form.

08

Mail the completed Form 2032 to the appropriate address listed in the instructions.

Who needs IRS 2032?

01

Businesses and entities that wish to change their tax classification for federal tax purposes, such as partnerships or corporations looking to be taxed differently.

Fill

2032 the irs

: Try Risk Free

People Also Ask about irs 2032

What is DS in immigration?

D/S on your Form I-94/admissions stamp means that you may remain in the United States so long as you maintain your nonimmigrant student status, which includes finishing your program by the program date listed on your Form I-20, "Certificate of Eligibility for Nonimmigrant Status." If you need more time to finish your

Who should fill out DS-260 form?

The principal applicant and all family members applying for a diversity visa program must complete Form DS-260. You will need to enter your DV case number into the online DS-260 form to access and update the information about yourself and your family that you included in your DV entry.

What is DS form for?

The DS-160, Online Nonimmigrant Visa Application form, is for temporary travel to the United States, and for K (fiancé(e)) visas. Form DS-160 is submitted electronically to the Department of State website via the Internet.

What is form DS 260 used for?

After you pay your fees and the status in CEAC is updated to 'PAID', you and each qualified family member immigrating with you must complete the Application for Immigrant Visa and Alien Registration (Form DS-260).

What is the DS form for immigrant visa?

What Is Form DS-260? Form DS-260 is the Immigrant Visa Electronic Application that you will use to apply for your green card if you are applying from outside the United States. Filing will go through U.S. Citizenship and Immigration Services (USCIS) and the National Visa Center (NVC).

Can I download a visa application form?

Filling your application form number and your passport, you can still download the form to your local computer. Then you can print the form again. **Due to the pandemic, please contact us by email if you need to apply for visa.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get 2032 of the template?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the irs 2032 form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I sign the 2032 of the pdf electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out the 2032 ii form on my smartphone?

Use the pdfFiller mobile app to fill out and sign 2032 title on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is IRS 2032?

IRS Form 2032, titled 'Entity Classification Election,' allows an eligible entity to choose how it will be classified for federal tax purposes.

Who is required to file IRS 2032?

Newly formed eligible entities that wish to change their default classification or entities seeking to elect to be treated as a corporation or partnership must file IRS 2032.

How to fill out IRS 2032?

To fill out IRS 2032, provide the entity's name, address, employer identification number (EIN), and the chosen classification. Complete any additional information as required in the form instructions.

What is the purpose of IRS 2032?

The purpose of IRS 2032 is to allow eligible entities to elect their classification for federal tax purposes, affecting how they will report income and pay taxes.

What information must be reported on IRS 2032?

The information that must be reported on IRS 2032 includes the entity's name, address, EIN, the type of election being made, and the date of the election.

Fill out your IRS 2032 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2032 Contract is not the form you're looking for?Search for another form here.

Keywords relevant to 2032 of the form

Related to form 2032 the online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.