MI DoT 518 2007 free printable template

Show details

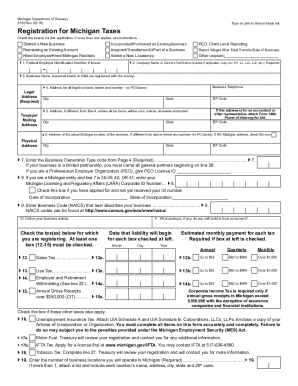

Michigan Department of Treasury 518 (Rev. 12-07) STATE OF MICHIGAN BUSINESS TAXES Registration Booklet NEW TAX LAWS Public Act 36 of 2007, enacted the Michigan Business Tax, effective January 1, 2008.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI DoT 518

Edit your MI DoT 518 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI DoT 518 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI DoT 518 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MI DoT 518. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 518 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI DoT 518

How to fill out MI DoT 518

01

Obtain MI DoT Form 518 from the Michigan Department of Transportation website or local office.

02

Enter your personal information in the designated fields, including your name, address, and contact information.

03

Fill out the details regarding the specific vehicle, including the make, model, year, and VIN (Vehicle Identification Number).

04

Provide information regarding the purpose of the application, such as title transfer or vehicle registration.

05

If applicable, include any relevant supporting documents or fees as required by the application.

06

Review the form for accuracy and completeness.

07

Submit the completed form along with any required documents to the appropriate Michigan DoT office.

Who needs MI DoT 518?

01

Individuals who are registering a vehicle in Michigan.

02

Those transferring a vehicle title in Michigan.

03

Car dealers handling vehicle registrations.

04

Anyone seeking to update vehicle information with the Michigan Department of Transportation.

Fill

form

: Try Risk Free

People Also Ask about

What is employer and retirement withholding Michigan?

The withholding rate is. 4.25 percent of compensation after deducting the personal and dependency exemption allowance. Pension and Retirement Benefits Withholding. The withholding rate is 4.25 percent after deducting the personal exemption allowance claimed on the MI W-4P.

How much do I have to pay in taxes for unemployment in Michigan?

Michigan Taxes on Unemployment Benefits State Taxes on Unemployment Benefits: Michigan taxes unemployment compensation to the same extent that it's taxed under federal law. State Income Tax Range: Michigan has a flat tax rate of 4.25%.

How do I get a MI UIA account number?

The online registration eliminates the need to complete and mail in the 'Form 518, Michigan Business Tax Registration' booklet. After completing this on-line application, you will receive a confirmation number of your electronic submission. You can receive your UIA Employer Account Number in less than 3 days.

Do you have to claim unemployment on your taxes in Michigan?

Unemployment benefits are taxable, so any unemployment compensation received during the year must be reported on federal tax return. If you received unemployment benefits in 2021, you will receive Form 1099-G Certain Government Payments.

Do you have to register with Michigan Works for unemployment?

Unemployed workers filing a new claim for benefits will be required to register for work with Michigan Works! staff and verify their registration with either an in person or virtual appointment.

Do I need to register for Michigan unemployment taxes?

As a Michigan employer, you need to establish a Michigan UI tax account with the state's Unemployment Insurance Agency (UIA). You obtain the required UIA Employer Account Number by registering with the Michigan Department of Treasury (DOT) either online or on paper.

How do I find my Michigan employer account number?

You can find your employers FEIN on your W-2 form.

How do you get a sales license in Michigan?

A sales tax license can be obtained by registering the E-Registration for Michigan Taxes or submitting Form 518. This registration will also allow a business to register for their Employer Account Number.

How do I create a MiWAM account?

0:23 2:40 How to Set up a MiWAM! Account - YouTube YouTube Start of suggested clip End of suggested clip On the my login homepage you will click on sign up which will take you to the page to create yourMoreOn the my login homepage you will click on sign up which will take you to the page to create your profile. Complete the required. Information. After you have agreed to the Terms & Conditions.

How to apply for sales tax license in Michigan?

You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website. If you have quetions about the online permit application process, you can contact the Department of Treasury via the sales tax permit hotline (517) 636-6925 or by checking the permit info website .

What is Form 518 Michigan?

The online registration eliminates the need to complete and mail in the 'Form 518, Michigan Business Tax Registration' booklet. After completing this on-line application, you will receive a confirmation number of your electronic submission. You can receive your UIA Employer Account Number in less than 3 days.

How do I register as an employer in Michigan?

First, you'll need to create an account with Michigan Treasury Online to register with the Michigan Department of Treasury. Once you've logged in, you can click “Start a New Business” to begin the e-Registration process. Next, you'll need to register with the Department of Labor and Economic Opportunity.

Do I need a Michigan sales tax license?

Businesses, who sell tangible personal property in addition to providing labor or a service, are required to obtain a sales tax license. Any property which goes with the customer in connection with the repair or service is considered a sale at retail and subject to sales tax.

How do I get a Michigan sales tax license number?

You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website. If you have quetions about the online permit application process, you can contact the Department of Treasury via the sales tax permit hotline (517) 636-6925 or by checking the permit info website .

How much is a sale license in Michigan?

A sales tax license in Michigan is free to set up and renew each year (and can be set to auto-renew as well). Other licenses can cost anywhere from $15 to $1,000 a year, depending on the location, profession and type of business.

What is a Michigan business ID number?

Banks, government entities, and companies can use your Michigan tax ID number to identify your business. A Michigan tax ID number is a requirement for all businesses in the state of Michigan. Before you can request a Michigan tax ID number for your business, you will need to acquire an EIN from the IRS.

How do I get a UIA number in Michigan?

Michigan UIA Employer Account Number If you are a new business, register online to retrieve your Michigan UI Employer Account Number. If you already have a Michigan UIA Employer Account Number, look this up online or find it on correspondence received from the Michigan Unemployment Insurance Agency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MI DoT 518 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing MI DoT 518 right away.

How do I fill out MI DoT 518 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign MI DoT 518 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit MI DoT 518 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like MI DoT 518. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is MI DoT 518?

MI DoT 518 is a form used in the state of Michigan to report employment information for certain tax purposes, specifically related to the Michigan Department of Treasury.

Who is required to file MI DoT 518?

Employers in Michigan who are liable for unemployment taxes and have wages subject to these taxes must file MI DoT 518.

How to fill out MI DoT 518?

To fill out MI DoT 518, employers need to provide their business information, employee details, and the wage information as required on the form. It's important to follow the provided instructions for accurate completion.

What is the purpose of MI DoT 518?

The purpose of MI DoT 518 is to collect accurate employment and wage information from employers for the assessment and collection of unemployment taxes in Michigan.

What information must be reported on MI DoT 518?

The information that must be reported on MI DoT 518 includes the employer's name and identification number, employee names and social security numbers, wages paid, and any other relevant information as instructed on the form.

Fill out your MI DoT 518 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI DoT 518 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.