MI DoT 518 2017 free printable template

Show details

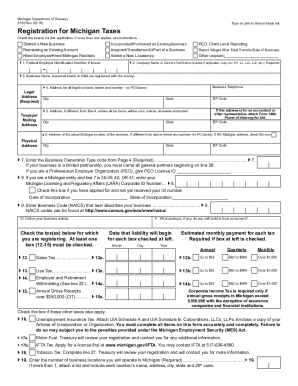

Michigan Department of Treasury

518 (Rev. 0218)STATE OF MICHIGANMICHIGAN BUSINESS TAXES

Registration Booklet more information regarding Michigan Treasury

Taxes, go online to www.michigan.gov/taxes.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI DoT 518

Edit your MI DoT 518 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI DoT 518 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI DoT 518 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MI DoT 518. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 518 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI DoT 518

How to fill out MI DoT 518

01

Download the MI DoT 518 form from the Michigan Department of Transportation website.

02

Begin by filling out your personal information in the designated sections, including your name, address, and contact details.

03

Provide information about the vehicle, such as the make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the purpose of the request clearly in the relevant field.

05

If applicable, attach any required documentation as specified in the guidelines.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the bottom as required.

08

Submit the form according to the instructions, either by mail or electronically if available.

Who needs MI DoT 518?

01

Individuals applying for certain permits or registrations related to transportation.

02

Businesses that require special permits for vehicle use on Michigan roads.

03

Organizations seeking permissions for vehicle modifications or exemptions.

Fill

form

: Try Risk Free

People Also Ask about

What is employer and retirement withholding Michigan?

The withholding rate is. 4.25 percent of compensation after deducting the personal and dependency exemption allowance. Pension and Retirement Benefits Withholding. The withholding rate is 4.25 percent after deducting the personal exemption allowance claimed on the MI W-4P.

How much do I have to pay in taxes for unemployment in Michigan?

Michigan Taxes on Unemployment Benefits State Taxes on Unemployment Benefits: Michigan taxes unemployment compensation to the same extent that it's taxed under federal law. State Income Tax Range: Michigan has a flat tax rate of 4.25%.

How do I get a MI UIA account number?

The online registration eliminates the need to complete and mail in the 'Form 518, Michigan Business Tax Registration' booklet. After completing this on-line application, you will receive a confirmation number of your electronic submission. You can receive your UIA Employer Account Number in less than 3 days.

Do you have to claim unemployment on your taxes in Michigan?

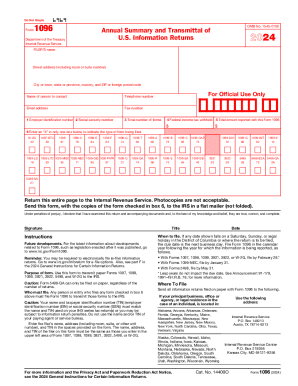

Unemployment benefits are taxable, so any unemployment compensation received during the year must be reported on federal tax return. If you received unemployment benefits in 2021, you will receive Form 1099-G Certain Government Payments.

Do you have to register with Michigan Works for unemployment?

Unemployed workers filing a new claim for benefits will be required to register for work with Michigan Works! staff and verify their registration with either an in person or virtual appointment.

Do I need to register for Michigan unemployment taxes?

As a Michigan employer, you need to establish a Michigan UI tax account with the state's Unemployment Insurance Agency (UIA). You obtain the required UIA Employer Account Number by registering with the Michigan Department of Treasury (DOT) either online or on paper.

How do I find my Michigan employer account number?

You can find your employers FEIN on your W-2 form.

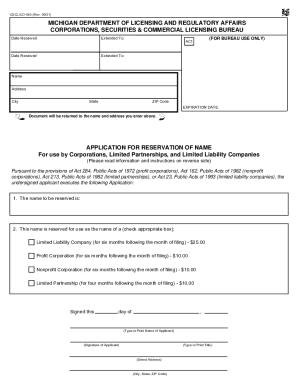

How do you get a sales license in Michigan?

A sales tax license can be obtained by registering the E-Registration for Michigan Taxes or submitting Form 518. This registration will also allow a business to register for their Employer Account Number.

How do I create a MiWAM account?

0:23 2:40 How to Set up a MiWAM! Account - YouTube YouTube Start of suggested clip End of suggested clip On the my login homepage you will click on sign up which will take you to the page to create yourMoreOn the my login homepage you will click on sign up which will take you to the page to create your profile. Complete the required. Information. After you have agreed to the Terms & Conditions.

How to apply for sales tax license in Michigan?

You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website. If you have quetions about the online permit application process, you can contact the Department of Treasury via the sales tax permit hotline (517) 636-6925 or by checking the permit info website .

What is Form 518 Michigan?

The online registration eliminates the need to complete and mail in the 'Form 518, Michigan Business Tax Registration' booklet. After completing this on-line application, you will receive a confirmation number of your electronic submission. You can receive your UIA Employer Account Number in less than 3 days.

How do I register as an employer in Michigan?

First, you'll need to create an account with Michigan Treasury Online to register with the Michigan Department of Treasury. Once you've logged in, you can click “Start a New Business” to begin the e-Registration process. Next, you'll need to register with the Department of Labor and Economic Opportunity.

Do I need a Michigan sales tax license?

Businesses, who sell tangible personal property in addition to providing labor or a service, are required to obtain a sales tax license. Any property which goes with the customer in connection with the repair or service is considered a sale at retail and subject to sales tax.

How do I get a Michigan sales tax license number?

You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website. If you have quetions about the online permit application process, you can contact the Department of Treasury via the sales tax permit hotline (517) 636-6925 or by checking the permit info website .

How much is a sale license in Michigan?

A sales tax license in Michigan is free to set up and renew each year (and can be set to auto-renew as well). Other licenses can cost anywhere from $15 to $1,000 a year, depending on the location, profession and type of business.

What is a Michigan business ID number?

Banks, government entities, and companies can use your Michigan tax ID number to identify your business. A Michigan tax ID number is a requirement for all businesses in the state of Michigan. Before you can request a Michigan tax ID number for your business, you will need to acquire an EIN from the IRS.

How do I get a UIA number in Michigan?

Michigan UIA Employer Account Number If you are a new business, register online to retrieve your Michigan UI Employer Account Number. If you already have a Michigan UIA Employer Account Number, look this up online or find it on correspondence received from the Michigan Unemployment Insurance Agency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my MI DoT 518 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your MI DoT 518 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out the MI DoT 518 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign MI DoT 518 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out MI DoT 518 on an Android device?

Use the pdfFiller mobile app and complete your MI DoT 518 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is MI DoT 518?

MI DoT 518 is a Michigan Department of Transportation form used for reporting certain transportation-related information.

Who is required to file MI DoT 518?

Entities involved in specific transportation activities as mandated by Michigan regulations are required to file MI DoT 518.

How to fill out MI DoT 518?

MI DoT 518 should be filled out by following the form's instructions, providing accurate data about transportation activities and relevant information.

What is the purpose of MI DoT 518?

The purpose of MI DoT 518 is to collect data for regulatory compliance and to help in the evaluation of transportation services in Michigan.

What information must be reported on MI DoT 518?

Information that must be reported on MI DoT 518 includes details about transportation activities, organizational information, and other data as specified by the form.

Fill out your MI DoT 518 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI DoT 518 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.