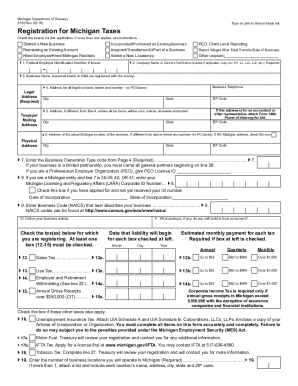

MI DoT 518 2013 free printable template

Show details

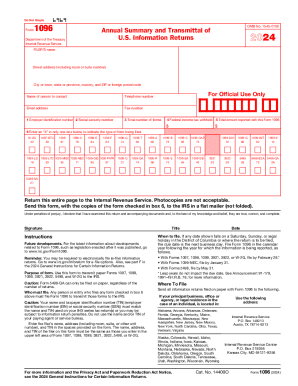

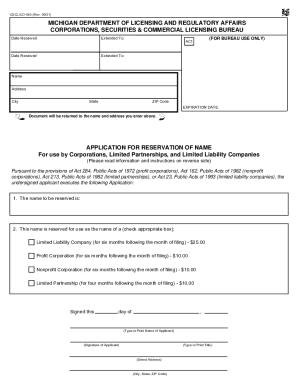

You may also fax your forms to 517-636-4520. Instructions for Completing Form 518 Registration for Michigan Taxes Treasury will mail your personalized Sales Use and Withholding Tax returns. When any one of the above criteria is met you must submit Form 518 Registration for Michigan Taxes and UIA Schedule A Liability Questionnaire and UIA Schedule B - Successorship Questionnaire. Form 518 Page 2 21. Enter the month numerically that you close your tax books for example enter 08 for August. For...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI DoT 518

Edit your MI DoT 518 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI DoT 518 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI DoT 518 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI DoT 518. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI DoT 518 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI DoT 518

How to fill out MI DoT 518

01

Obtain the MI DoT 518 form from the Michigan Department of Transportation website or your local office.

02

Fill in your personal information at the top of the form, including your name, address, and contact information.

03

Indicate the purpose of the form by checking the appropriate box or providing details as required.

04

Provide details regarding the vehicle, such as the make, model, year, and vehicle identification number (VIN).

05

If applicable, include information about any previous registrations or titles associated with the vehicle.

06

Review the information for accuracy before signing and dating the form at the bottom.

07

Submit the completed form to the designated office or attach it to your application as instructed.

Who needs MI DoT 518?

01

Individuals applying for a vehicle registration or title transfer in Michigan.

02

Those who need to report changes in vehicle ownership or status.

03

Residents who are looking to obtain or update a Michigan title for a vehicle.

Fill

form

: Try Risk Free

People Also Ask about

What is employer and retirement withholding Michigan?

The withholding rate is. 4.25 percent of compensation after deducting the personal and dependency exemption allowance. Pension and Retirement Benefits Withholding. The withholding rate is 4.25 percent after deducting the personal exemption allowance claimed on the MI W-4P.

How much do I have to pay in taxes for unemployment in Michigan?

Michigan Taxes on Unemployment Benefits State Taxes on Unemployment Benefits: Michigan taxes unemployment compensation to the same extent that it's taxed under federal law. State Income Tax Range: Michigan has a flat tax rate of 4.25%.

How do I get a MI UIA account number?

The online registration eliminates the need to complete and mail in the 'Form 518, Michigan Business Tax Registration' booklet. After completing this on-line application, you will receive a confirmation number of your electronic submission. You can receive your UIA Employer Account Number in less than 3 days.

Do you have to claim unemployment on your taxes in Michigan?

Unemployment benefits are taxable, so any unemployment compensation received during the year must be reported on federal tax return. If you received unemployment benefits in 2021, you will receive Form 1099-G Certain Government Payments.

Do you have to register with Michigan Works for unemployment?

Unemployed workers filing a new claim for benefits will be required to register for work with Michigan Works! staff and verify their registration with either an in person or virtual appointment.

Do I need to register for Michigan unemployment taxes?

As a Michigan employer, you need to establish a Michigan UI tax account with the state's Unemployment Insurance Agency (UIA). You obtain the required UIA Employer Account Number by registering with the Michigan Department of Treasury (DOT) either online or on paper.

How do I find my Michigan employer account number?

You can find your employers FEIN on your W-2 form.

How do you get a sales license in Michigan?

A sales tax license can be obtained by registering the E-Registration for Michigan Taxes or submitting Form 518. This registration will also allow a business to register for their Employer Account Number.

How do I create a MiWAM account?

0:23 2:40 How to Set up a MiWAM! Account - YouTube YouTube Start of suggested clip End of suggested clip On the my login homepage you will click on sign up which will take you to the page to create yourMoreOn the my login homepage you will click on sign up which will take you to the page to create your profile. Complete the required. Information. After you have agreed to the Terms & Conditions.

How to apply for sales tax license in Michigan?

You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website. If you have quetions about the online permit application process, you can contact the Department of Treasury via the sales tax permit hotline (517) 636-6925 or by checking the permit info website .

What is Form 518 Michigan?

The online registration eliminates the need to complete and mail in the 'Form 518, Michigan Business Tax Registration' booklet. After completing this on-line application, you will receive a confirmation number of your electronic submission. You can receive your UIA Employer Account Number in less than 3 days.

How do I register as an employer in Michigan?

First, you'll need to create an account with Michigan Treasury Online to register with the Michigan Department of Treasury. Once you've logged in, you can click “Start a New Business” to begin the e-Registration process. Next, you'll need to register with the Department of Labor and Economic Opportunity.

Do I need a Michigan sales tax license?

Businesses, who sell tangible personal property in addition to providing labor or a service, are required to obtain a sales tax license. Any property which goes with the customer in connection with the repair or service is considered a sale at retail and subject to sales tax.

How do I get a Michigan sales tax license number?

You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website. If you have quetions about the online permit application process, you can contact the Department of Treasury via the sales tax permit hotline (517) 636-6925 or by checking the permit info website .

How much is a sale license in Michigan?

A sales tax license in Michigan is free to set up and renew each year (and can be set to auto-renew as well). Other licenses can cost anywhere from $15 to $1,000 a year, depending on the location, profession and type of business.

What is a Michigan business ID number?

Banks, government entities, and companies can use your Michigan tax ID number to identify your business. A Michigan tax ID number is a requirement for all businesses in the state of Michigan. Before you can request a Michigan tax ID number for your business, you will need to acquire an EIN from the IRS.

How do I get a UIA number in Michigan?

Michigan UIA Employer Account Number If you are a new business, register online to retrieve your Michigan UI Employer Account Number. If you already have a Michigan UIA Employer Account Number, look this up online or find it on correspondence received from the Michigan Unemployment Insurance Agency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MI DoT 518 to be eSigned by others?

When you're ready to share your MI DoT 518, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my MI DoT 518 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your MI DoT 518 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I fill out MI DoT 518 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your MI DoT 518. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is MI DoT 518?

MI DoT 518 is a document used in Michigan for reporting certain tax-related information, specifically for the Department of Treasury.

Who is required to file MI DoT 518?

Entities that must report tax information relevant to Michigan and meet specific criteria set by the Michigan Department of Treasury are required to file MI DoT 518.

How to fill out MI DoT 518?

To fill out MI DoT 518, follow the instructions provided on the form, ensuring all required fields are completed accurately with the necessary financial and identification information.

What is the purpose of MI DoT 518?

The purpose of MI DoT 518 is to collect tax information from applicable entities to ensure compliance with Michigan tax laws.

What information must be reported on MI DoT 518?

The information that must be reported on MI DoT 518 includes details such as entity identification, financial figures, and specific tax-related data required by the Michigan Department of Treasury.

Fill out your MI DoT 518 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI DoT 518 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.