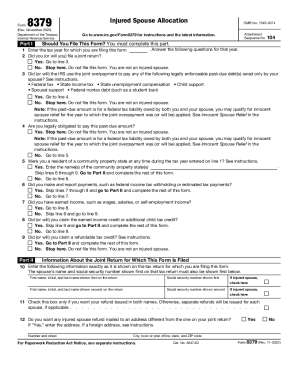

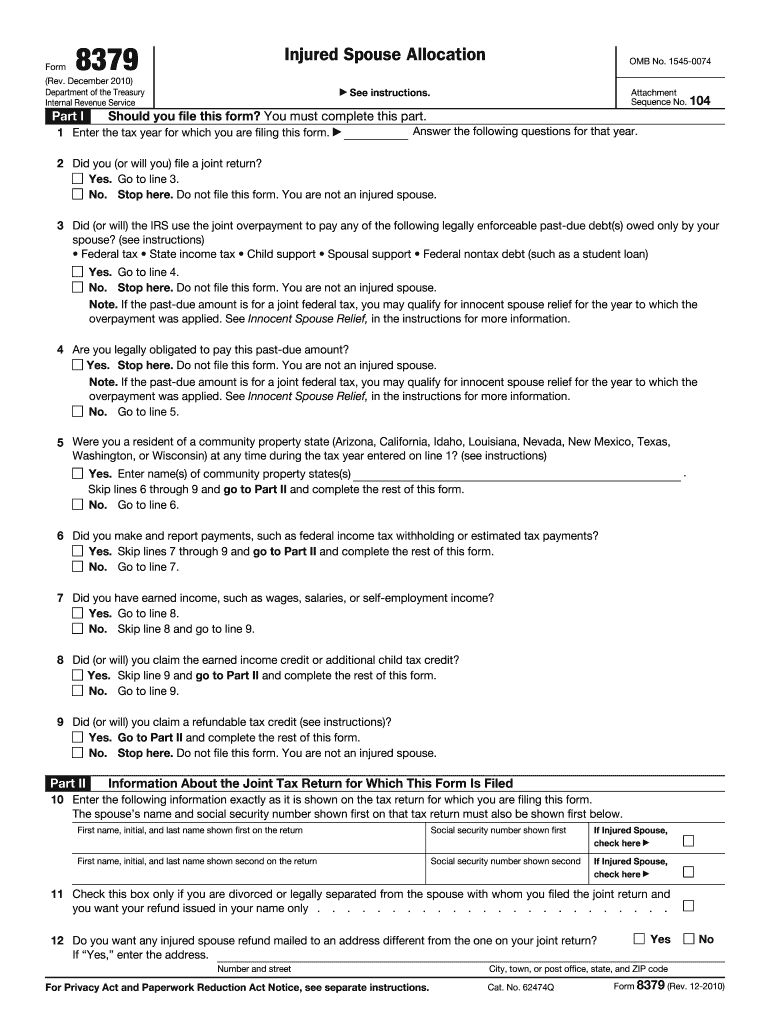

IRS 8379 2010 free printable template

Instructions and Help about IRS 8379

How to edit IRS 8379

How to fill out IRS 8379

About IRS 8 previous version

What is IRS 8379?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8379

What should I do if I discover an error after submitting the 2010 8379 form?

If you find an error after submitting the 2010 8379 form, it's important to correct it promptly. You can submit an amended 2010 8379 form, indicating the corrections clearly. Make sure to include any relevant supporting documentation that justifies the changes to avoid issues during processing.

How can I verify that my submitted 2010 8379 form was received and is being processed?

To verify the receipt and processing status of your 2010 8379 form, you should check with the appropriate agency's online tracking system, if available. Alternatively, contacting their customer service can provide confirmation on your submission. Be prepared with your submission details when inquiring.

Are there specific legal considerations I should be aware of when filing on someone's behalf using the 2010 8379 form?

When filing the 2010 8379 form on someone else's behalf, ensure you have appropriate power of attorney (POA) documents if required. Additionally, you must maintain privacy and security for the individual's information you are handling, adhering to all relevant legal guidelines during the filing process.

What are common mistakes to avoid when submitting the 2010 8379 form?

Common mistakes when submitting the 2010 8379 form include incorrect taxpayer identification numbers and mismatched amounts reported. Double-check all entries to ensure accuracy. Additionally, verify that the form is signed and dated properly to avoid delays in processing.

What happens if my 2010 8379 form is rejected during e-filing?

If your e-filed 2010 8379 form is rejected, you will typically receive an error notification detailing the reasons for rejection. Address the issues indicated in the notification, correct them, and then resubmit your form. Keep in mind that repeated rejections may require more extensive review of your submission details.