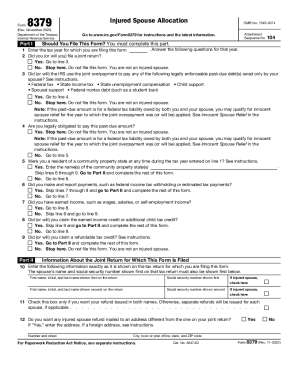

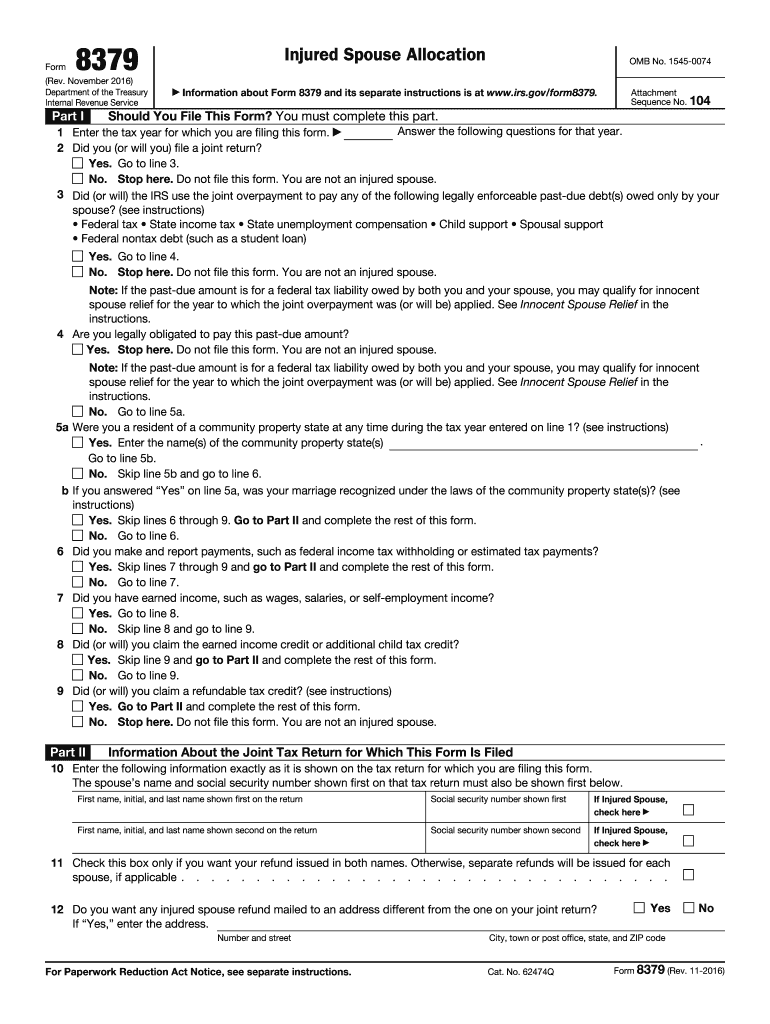

IRS 8379 2016 free printable template

Instructions and Help about IRS 8379

How to edit IRS 8379

How to fill out IRS 8379

About IRS 8 previous version

What is IRS 8379?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8379

What should I do if I realize I made a mistake on my submitted injured spouse form?

If you discover an error after filing your injured spouse form, it's important to correct it promptly. You can submit an amended version of the form to the IRS, clearly indicating that it is a correction. Ensure that you follow any specific guidelines provided by the IRS for amendments to prevent any delays in processing your request.

How can I track the status of my injured spouse form after I have submitted it?

To track the status of your injured spouse form, you can use the IRS online tools available on their website. You'll need your Social Security number and the exact details of your return for verification. If you filed electronically, be aware of common e-file rejection codes and take the necessary steps to address them.

Are there any legal considerations I should be aware of when filing the injured spouse form on behalf of someone else?

When filing the injured spouse form on someone else's behalf, you must ensure that you have the proper authority, such as a power of attorney. Additionally, it's vital to maintain the privacy and data security of the individual's information. Legal nuances may vary, so consider consulting with a tax professional for guidance.

What should I do if I receive a notice from the IRS regarding my injured spouse form?

If you receive a notice or letter from the IRS concerning your injured spouse form, read it carefully to understand the action required. You may need to respond with additional documentation or clarification. It's crucial to maintain records of all correspondence and to act promptly to avoid further issues.