NY DTF CT-399 2012 free printable template

Show details

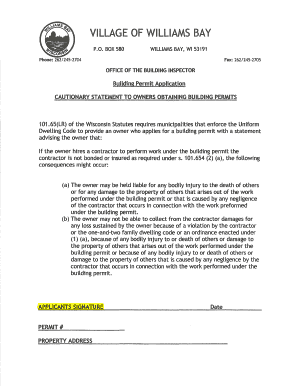

New York State Department of Taxation and Finance CT-399 Tax Law Articles 9-A 32 and 33 Depreciation Adjustment Schedule Legal name of corporation Employer identification number Part 1 Computation of New York State depreciation modifications when computing entire net income ENI List only depreciable property that requires or is entitled to a depreciation modification when computing ENI see Form CT-399-I Instructions for Form CT-399. If you have disposed of any property listed on this form...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF CT-399

Edit your NY DTF CT-399 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF CT-399 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF CT-399 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY DTF CT-399. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF CT-399 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF CT-399

How to fill out NY DTF CT-399

01

Download the NY DTF CT-399 form from the official New York State Department of Taxation and Finance website.

02

Begin by filling out your personal information at the top of the form, including your name, address, and social security number.

03

Provide details about the type of tax credits you are claiming by following the prompts on the form.

04

Enter the amount of your tax credit accurately in the designated fields.

05

Review all the information you’ve entered to ensure it is correct and complete.

06

Sign and date the form at the bottom before submission.

Who needs NY DTF CT-399?

01

Individuals or businesses that have a valid tax credit or benefit in New York.

02

Taxpayers who are claiming specific credits related to their income or expenses.

03

Those required to report tax credits in connection with their New York State taxes.

Instructions and Help about NY DTF CT-399

Fill

form

: Try Risk Free

People Also Ask about

What states conform to bonus depreciation?

State conformity with federal bonus depreciation rules lookup tool Alabama. Alaska. Arizona. Arkansas. California. Colorado. Connecticut. Delaware. Kentucky. Louisiana. Maine. Maryland. Massachusetts. Michigan. Minnesota. Mississippi. North Dakota. Ohio. Oklahoma. Oregon. Pennsylvania. Rhode Island. South Carolina. South Dakota.

Which states have rolling conformity?

State conformity approaches To the extent the IRC changes, state conformity varies based on the manner in which each state's laws interact with the IRC. Rolling conformity states such as Illinois, New Jersey, New York, and Pennsylvania automatically adopt the IRC as currently in place.

What can a state IRC conformity date be used to determine?

A state's conformity date can be used to determine: 1-Qualifications for state tax credits. 2-Whether recent changes to the Internal Revenue Code will carry through to the state return. 3-Whether the starting point for calculation of state taxable income is federal taxable income or federal adjusted gross income.

What is the meaning of tax conformity?

What is tax conformity? Tax conformity is a state's adoption of the federal definitions of income, as contained in the U.S. Internal Revenue Code (IRC). For individuals, it's the calculation of federal adjusted gross income (AGI); for businesses, it's federal taxable income (FTI).

What is state tax conformity with IRC?

Static conformity means that the state conforms to the Internal Revenue Code (IRC) as of a certain date, and legislation is required to change that conformity date.

What is state conformity to federal tax?

No state, of course, conforms to every provision of the Internal Revenue Code. Each state offers its own set of modifications, additions, and subtractions to the code. Each adopts its own set of rules and definitions, frequently layered atop those flowing through from the federal code.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my NY DTF CT-399 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your NY DTF CT-399 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit NY DTF CT-399 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign NY DTF CT-399 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I fill out NY DTF CT-399 on an Android device?

Complete your NY DTF CT-399 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is NY DTF CT-399?

NY DTF CT-399 is a form used by businesses in New York State to report sales and use tax information related to transactions in which the seller is not registered to collect and remit New York State sales tax.

Who is required to file NY DTF CT-399?

Any business that makes purchases in New York State from sellers who do not collect New York sales tax is required to file NY DTF CT-399.

How to fill out NY DTF CT-399?

To fill out NY DTF CT-399, businesses must provide their identifying information, details of the purchases made from unregistered sellers, and the amount of tax owed on those purchases.

What is the purpose of NY DTF CT-399?

The purpose of NY DTF CT-399 is to ensure that businesses report and remit the appropriate amount of sales tax for purchases made from sellers who do not charge sales tax.

What information must be reported on NY DTF CT-399?

The information that must be reported on NY DTF CT-399 includes the name and address of the purchaser, details of the purchases, total purchase amounts, and the calculated sales tax due.

Fill out your NY DTF CT-399 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF CT-399 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.