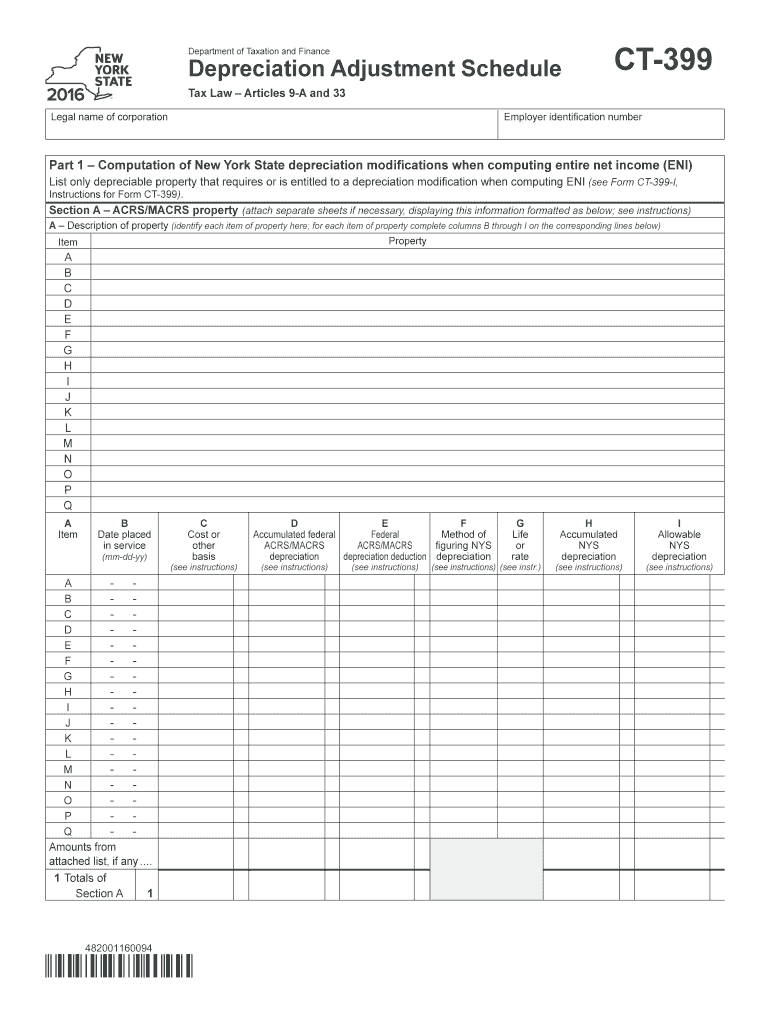

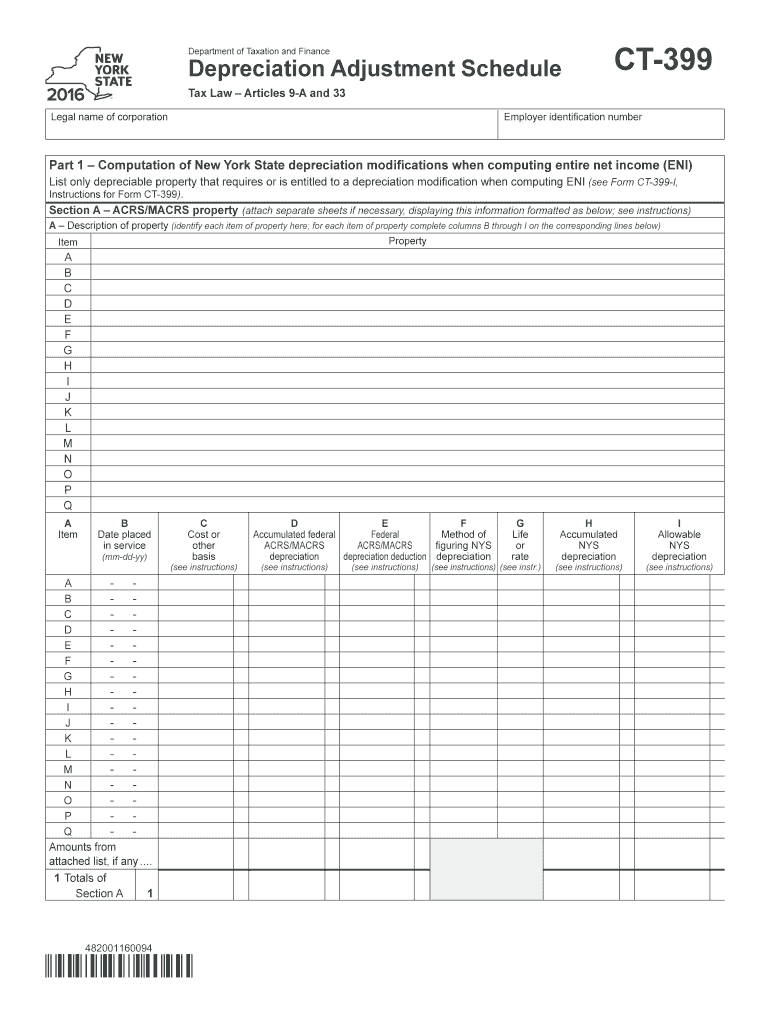

NY DTF CT-399 2016 free printable template

Get, Create, Make and Sign NY DTF CT-399

How to edit NY DTF CT-399 online

Uncompromising security for your PDF editing and eSignature needs

NY DTF CT-399 Form Versions

How to fill out NY DTF CT-399

How to fill out NY DTF CT-399

Who needs NY DTF CT-399?

Instructions and Help about NY DTF CT-399

Law.com legal forms guide form CT 3s New York s corporation franchise tax return s corporations doing business in New York must file their franchise taxes using a form CT 3s this can be used to submit an initial amended or final return the document is found on the website of the New York State Department of Taxation and Finance step 1 enter the beginning and ending dates of your filing period step to enter your employer identification number file number business telephone number and your corporations legal name and trade DBA name step 3 enter your state or country of incorporation and the date of its incorporation if you are a foreign corporation give the date on which you began operating in New York step 4 if your mailing name and address is different enter it where indicated step 5 enter your NAILS code and a description of your principal business activity step 6 indicate if you have revoked your S corporation status if so give the date on which you did this step 7 enter the number of shareholders step 8 enter the amount of the payment and closed online a step 9 give all information requested in response two lines be through m step 10 lines 1 through 13 require you to transfer information from the corresponding lines on your federal form 1120s schedule k step 11 lines 14 through 21 require you to transfer information from the corresponding lines on your federal form 1120s schedule m to step 12 compute your taxes on lines 22 through 51 steps 13 indicate with a check mark if you are filing an amended return step 14 an authorized representative should sign and date the form to watch more videos please make sure to visit laws calm

People Also Ask about

What does it mean to take 100% special depreciation allowance?

What is the difference between Section 179 and special depreciation allowance?

What are the rules for bonus depreciation in CT?

What qualifies for the special depreciation allowance?

What is CT 399?

How do I claim depreciation on my taxes?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NY DTF CT-399 without leaving Google Drive?

How do I execute NY DTF CT-399 online?

How do I fill out NY DTF CT-399 using my mobile device?

What is NY DTF CT-399?

Who is required to file NY DTF CT-399?

How to fill out NY DTF CT-399?

What is the purpose of NY DTF CT-399?

What information must be reported on NY DTF CT-399?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.