NY DTF CT-399 2019 free printable template

Show details

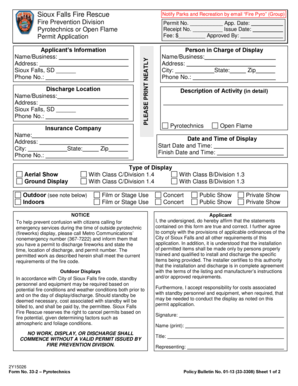

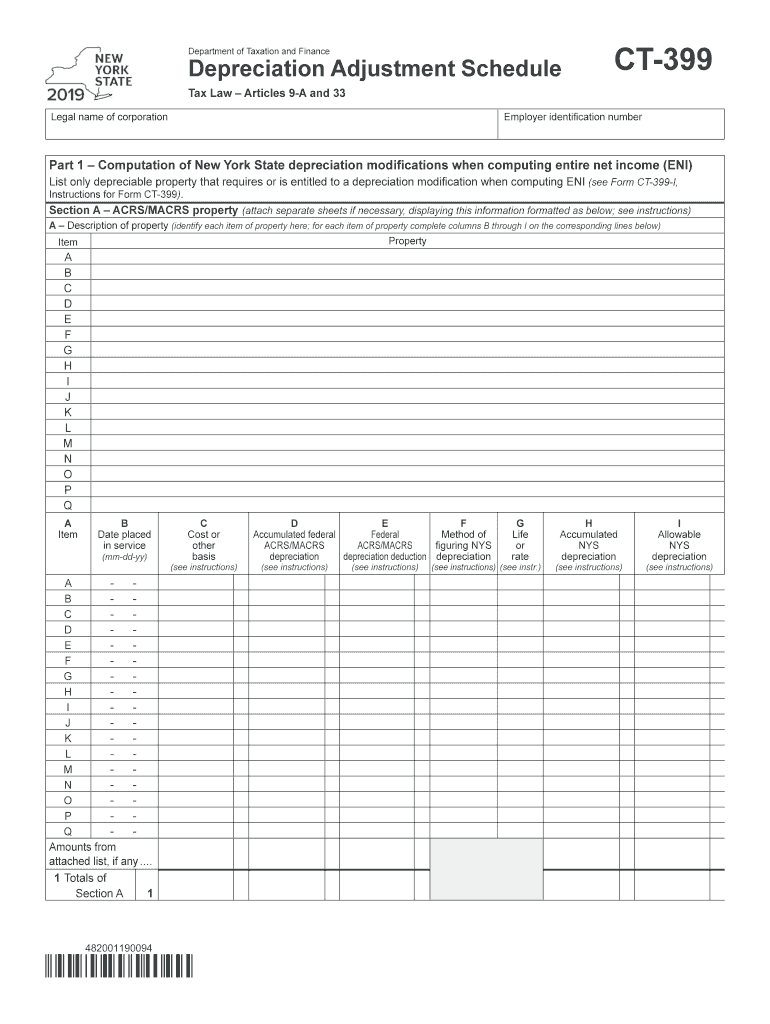

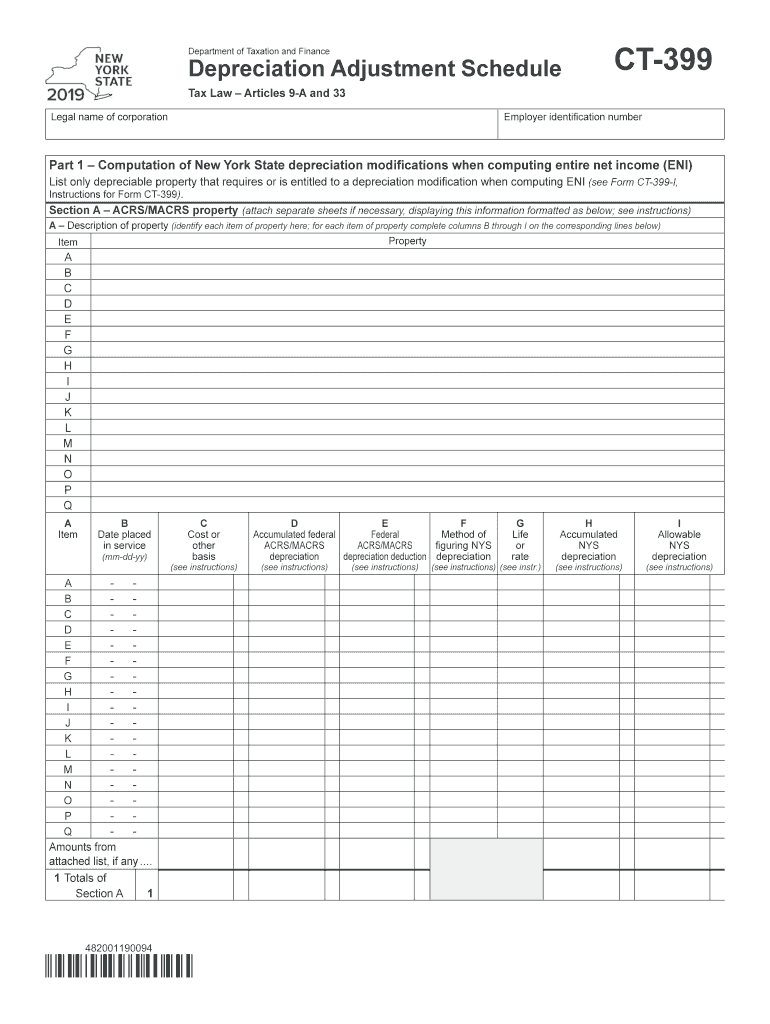

Department of Taxation and Finance Depreciation Adjustment Schedule CT-399 Tax Law Articles 9-A and 33 Legal name of corporation Employer identification number Part 1 Computation of New York State depreciation modifications when computing entire net income ENI List only depreciable property that requires or is entitled to a depreciation modification when computing ENI see Form CT-399-I Instructions for Form CT-399. 1 Totals of Section A 1 482001180094 Cost or other basis see instructions...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF CT-399

Edit your NY DTF CT-399 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF CT-399 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF CT-399 online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY DTF CT-399. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF CT-399 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF CT-399

How to fill out NY DTF CT-399

01

Obtain the NY DTF CT-399 form from the New York State Department of Taxation and Finance website or a local office.

02

Fill in your name and address in the designated fields at the top of the form.

03

Provide your taxpayer identification number (TIN) or Social Security number (SSN).

04

Fill out the specific exemptions or deductions you are claiming, following the instructions provided on the form.

05

Calculate the total amount based on the information provided, ensuring accuracy to avoid delays.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form as directed, either electronically or by mail.

Who needs NY DTF CT-399?

01

Individuals or entities claiming exemptions from withholding on New York state income tax.

02

Applicants applying for a refund of New York state income tax withheld in error.

03

Businesses that need to report specific tax information to the state of New York.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean to take 100% special depreciation allowance?

Key Findings. 100 percent bonus depreciation allows firms an immediate tax deduction for investments in qualifying short-lived assets.

What is the difference between Section 179 and special depreciation allowance?

Key differences Section 179 depreciation is capped by the IRS ($1,040,000 in 2020) and is reduced by the dollar amount of purchases that exceeds the IRS threshold ($2,580,000 in 2020). Bonus depreciation has no annual limit on the deduction.

What are the rules for bonus depreciation in CT?

Taxpayers are required to add back any bonus depreciation deduction taken at the federal level in computing Connecticut net income, but 25% of the amount added back in the prior year may be subtracted in each of the four succeeding years.

What qualifies for the special depreciation allowance?

The special depreciation allowance applies only for the first year the property is placed in service. The allowance is an additional deduction you can take after any section 179 expense deduction and before you figure regular depreciation under MACRS.

What is CT 399?

New York Form CT-399, Depreciation Adjustment Schedule – Support.

How do I claim depreciation on my taxes?

To claim depreciation on property, you must use it in your business or income-producing activity. If you use property to produce income (investment use), the income must be taxable. You cannot depreciate property that you use solely for personal activities. Partial business or investment use.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY DTF CT-399 in Gmail?

NY DTF CT-399 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify NY DTF CT-399 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including NY DTF CT-399, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I fill out NY DTF CT-399 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your NY DTF CT-399 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is NY DTF CT-399?

NY DTF CT-399 is a form used by businesses in New York State to claim a refund for sales and use tax that was previously paid on exempt purchases.

Who is required to file NY DTF CT-399?

Any business or organization that has made exempt purchases and seeks a refund of the sales and use tax previously paid on those purchases is required to file NY DTF CT-399.

How to fill out NY DTF CT-399?

To fill out NY DTF CT-399, provide the business information, detail the exempt purchases for which you are claiming a refund, and include the corresponding sales tax amounts. Make sure to follow the instructions provided on the form carefully.

What is the purpose of NY DTF CT-399?

The purpose of NY DTF CT-399 is to facilitate the process for businesses to obtain refunds for sales and use taxes that were incorrectly paid on purchases that are eligible for exemptions.

What information must be reported on NY DTF CT-399?

The information that must be reported on NY DTF CT-399 includes the details of the exempt purchases, the sales tax amounts, the reason for the exemption, and the business’s identification information such as tax ID number and contact details.

Fill out your NY DTF CT-399 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF CT-399 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.