TX AP-133 2013 free printable template

Show details

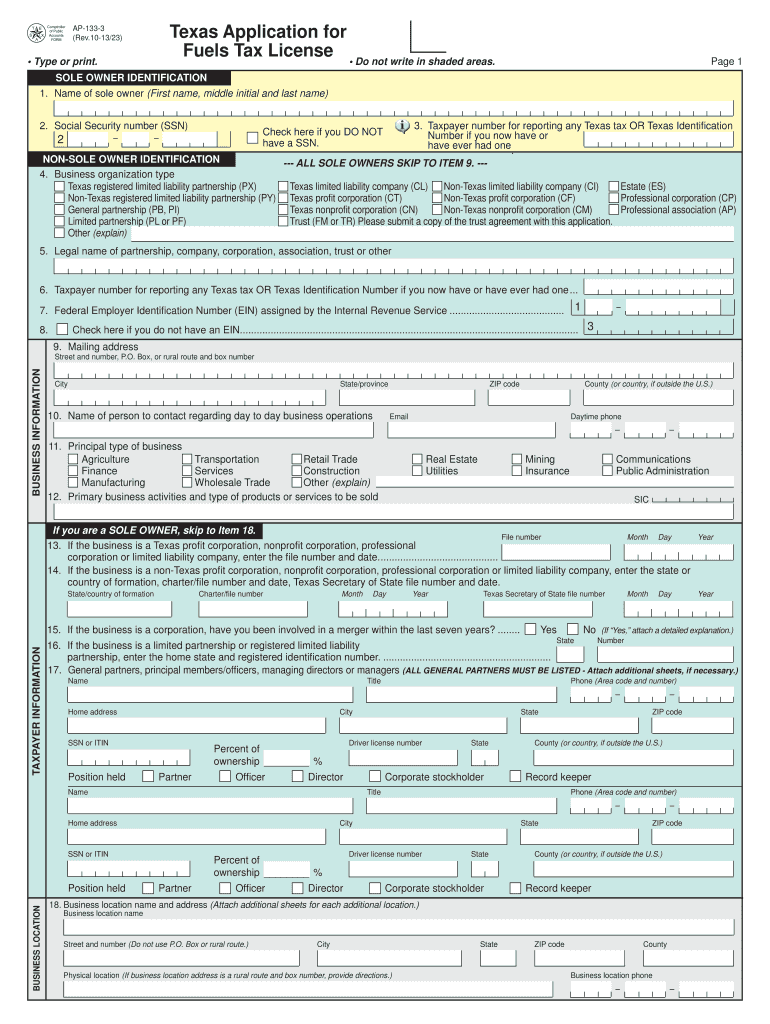

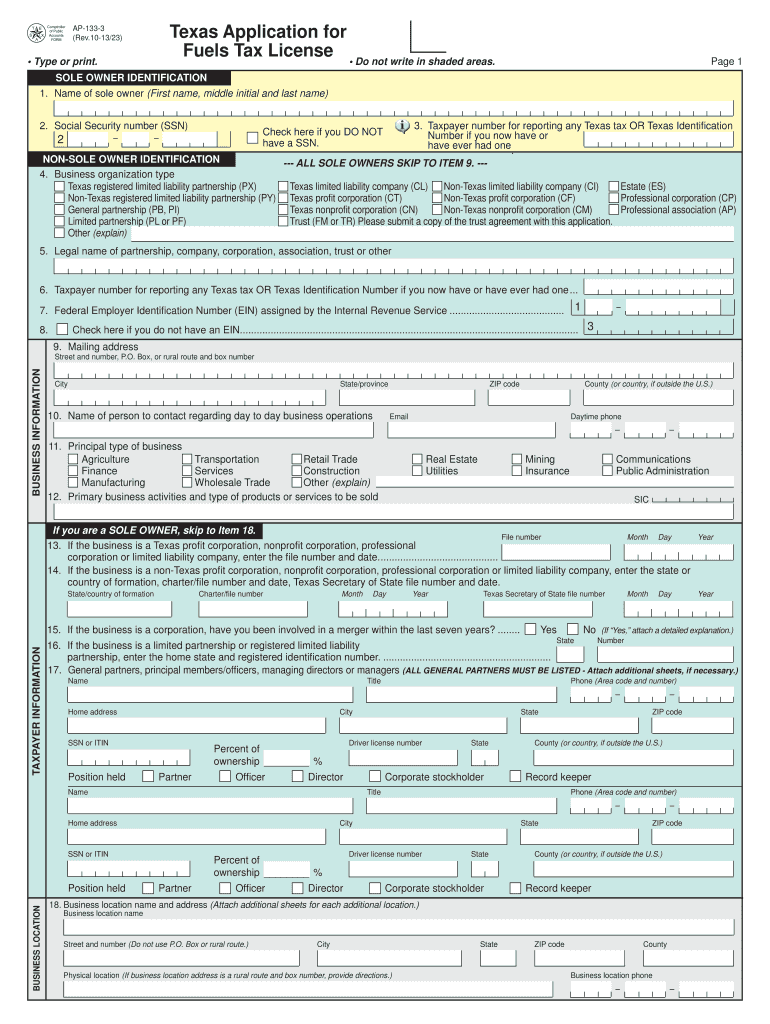

PRINT FORM CLEAR FORM Texas Application for Fuels Tax License GENERAL INFORMATION Instructions Specifics WHO MUST SUBMIT THIS APPLICATION You must submit this application if you are a sole owner,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX AP-133

Edit your TX AP-133 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX AP-133 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX AP-133 online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit TX AP-133. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX AP-133 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX AP-133

How to fill out TX AP-133

01

Download Form TX AP-133 from the official website.

02

Fill in your name and address at the top of the form.

03

Enter the tax period for which you are reporting.

04

Provide the total amount of taxes collected.

05

List any exemptions or deductions you are claiming.

06

Calculate the total amount due based on your entries.

07

Sign and date the form at the bottom.

08

Submit the completed form by mail or electronically as instructed.

Who needs TX AP-133?

01

Businesses operating in Texas that need to report sales and use taxes.

02

Individuals or entities claiming tax exemptions or adjustments.

03

Tax professionals preparing submissions on behalf of clients.

Fill

form

: Try Risk Free

People Also Ask about

What is the fuel tax law in Texas?

The state of Texas levies a flat 20 cent per gallon tax on gasoline and diesel fuels. Of these 20 cents, 15 cents is dedicated by the Texas Constitution to roadways, with the remaining 5 cents dedicated to public education. The tax is included in the price of fuel you buy at the pump.

How do I get my IFTA license in Texas?

How to Apply for an IFTA License. Motor carriers are encouraged to apply for an IFTA license through the Comptroller's Webfile system. With Webfile it's easy to submit the application electronically from the convenience of a home or office without the delays associated with mailing paper applications.

Who is exempt from motor fuel tax in Texas?

Texas law provides a variety of exemptions from gasoline and diesel taxes. Federal agencies and Texas public school districts, or their bus contractors, are exempted.

What form is Texas claim for refund of gasoline fuel taxes?

Gasoline and Diesel Fuel Refund Claims When requesting a refund directly from the Comptroller, claimants who are not licensed for motor fuels must submit Form 06-106, Texas Claim for Refund of Gasoline or Diesel Fuel Taxes (PDF).

Does Texas have a fuel tax license requirement?

All licensees have to complete the Texas Application for Fuels Tax License. You need to provide your business papers for sole proprietorship, partnership or corporation, and fill in the respective parts of the application for your type of business entity.

How long does it take to get an IFTA sticker in Texas?

The application takes about 10 minutes to complete. Once your application is reviewed, approved, and processed, the IFTA license and decal(s) will be mailed to the address provided.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TX AP-133 to be eSigned by others?

Once your TX AP-133 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make changes in TX AP-133?

With pdfFiller, it's easy to make changes. Open your TX AP-133 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit TX AP-133 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing TX AP-133 right away.

What is TX AP-133?

TX AP-133 is a form used in Texas for reporting and remitting state sales and use taxes for certain transactions.

Who is required to file TX AP-133?

Businesses and individuals who sell taxable goods or services in Texas and have sales tax obligations are required to file TX AP-133.

How to fill out TX AP-133?

To fill out TX AP-133, taxpayers must provide information including their Texas sales tax permit number, total sales amount, taxable sales amount, and calculate the total sales tax owed, following the instructions provided by the Texas Comptroller.

What is the purpose of TX AP-133?

The purpose of TX AP-133 is to enable the state of Texas to collect sales and use tax from businesses and individuals, ensuring compliance with state tax law.

What information must be reported on TX AP-133?

The information that must be reported on TX AP-133 includes the taxpayer's name and address, Texas sales tax permit number, gross sales, taxable sales, tax due, and any applicable exemptions.

Fill out your TX AP-133 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX AP-133 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.