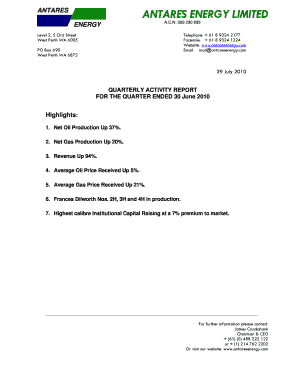

TX AP-133 2017 free printable template

Show details

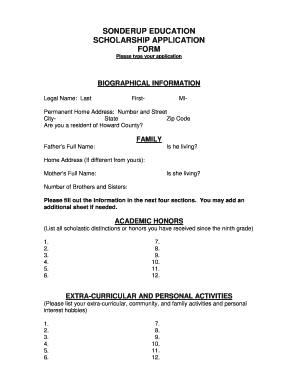

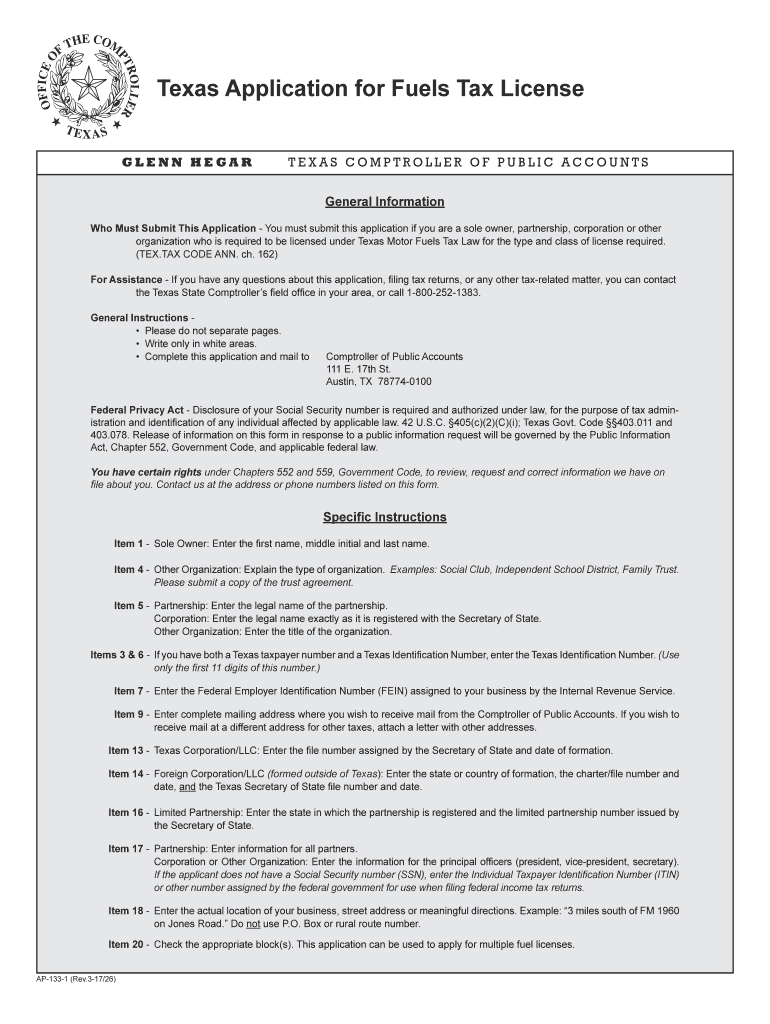

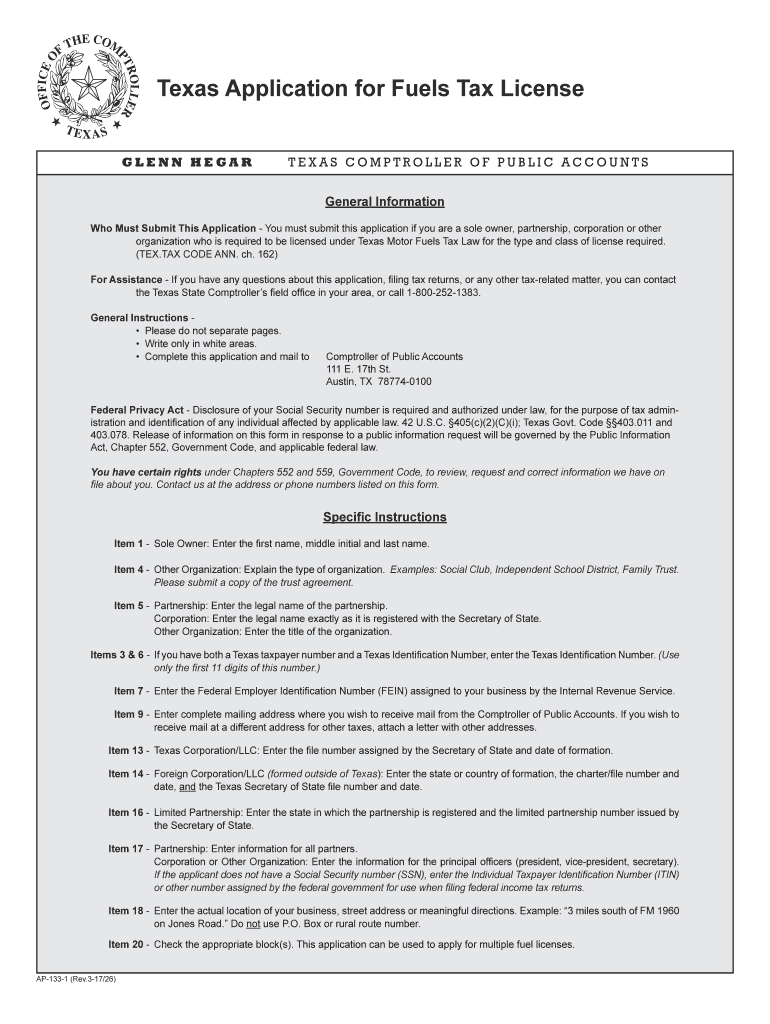

PRINT FORMER FIELDSInstructions in English Texas Application for Fuels Tax License GLENN HEARTENS COMPTROLLER OF PUBLIC ACCOUNTS General Information Must Submit This Application You must submit this

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX AP-133

Edit your TX AP-133 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX AP-133 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX AP-133 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit TX AP-133. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX AP-133 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX AP-133

How to fill out TX AP-133

01

Obtain the TX AP-133 form from the Texas Comptroller's website or your local tax office.

02

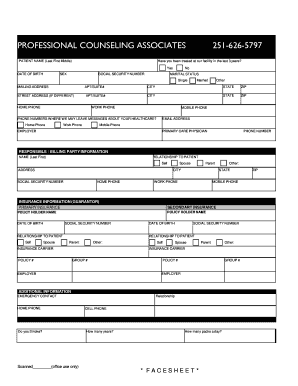

Fill out the top section of the form with your business name, address, and contact information.

03

Provide your Texas taxpayer number in the designated field.

04

Indicate the reporting period for which you are submitting the form.

05

Complete the financial information sections accurately, including gross receipts and any deductions.

06

Review the form for completeness and accuracy.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate department by the due date.

Who needs TX AP-133?

01

Businesses operating in Texas that need to report certain financial information.

02

Tax professionals assisting clients with tax compliance in Texas.

03

Anyone applying for a sales tax permit in Texas.

Fill

form

: Try Risk Free

People Also Ask about

What is the fuel tax law in Texas?

The state of Texas levies a flat 20 cent per gallon tax on gasoline and diesel fuels. Of these 20 cents, 15 cents is dedicated by the Texas Constitution to roadways, with the remaining 5 cents dedicated to public education. The tax is included in the price of fuel you buy at the pump.

How do I get my IFTA license in Texas?

How to Apply for an IFTA License. Motor carriers are encouraged to apply for an IFTA license through the Comptroller's Webfile system. With Webfile it's easy to submit the application electronically from the convenience of a home or office without the delays associated with mailing paper applications.

Who is exempt from motor fuel tax in Texas?

Texas law provides a variety of exemptions from gasoline and diesel taxes. Federal agencies and Texas public school districts, or their bus contractors, are exempted.

What form is Texas claim for refund of gasoline fuel taxes?

Gasoline and Diesel Fuel Refund Claims When requesting a refund directly from the Comptroller, claimants who are not licensed for motor fuels must submit Form 06-106, Texas Claim for Refund of Gasoline or Diesel Fuel Taxes (PDF).

Does Texas have a fuel tax license requirement?

All licensees have to complete the Texas Application for Fuels Tax License. You need to provide your business papers for sole proprietorship, partnership or corporation, and fill in the respective parts of the application for your type of business entity.

How long does it take to get an IFTA sticker in Texas?

The application takes about 10 minutes to complete. Once your application is reviewed, approved, and processed, the IFTA license and decal(s) will be mailed to the address provided.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify TX AP-133 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including TX AP-133, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete TX AP-133 online?

Completing and signing TX AP-133 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I fill out TX AP-133 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your TX AP-133. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is TX AP-133?

TX AP-133 is a form used by businesses in Texas to report and pay their franchise tax to the state.

Who is required to file TX AP-133?

Entities including corporations, limited liability companies, and other types of businesses that meet certain income thresholds or operational criteria in Texas are required to file TX AP-133.

How to fill out TX AP-133?

To fill out TX AP-133, businesses must provide information such as their entity name, tax identification number, revenue figures, and any relevant deductions or credits according to the instructions provided with the form.

What is the purpose of TX AP-133?

The purpose of TX AP-133 is to assess the amount of franchise tax owed by a business and ensure compliance with state tax regulations.

What information must be reported on TX AP-133?

Information reported on TX AP-133 includes the entity's legal name, address, revenue, deductions, and any other relevant financial data required by the Texas Comptroller.

Fill out your TX AP-133 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX AP-133 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.