TX AP-133 2019-2025 free printable template

Show details

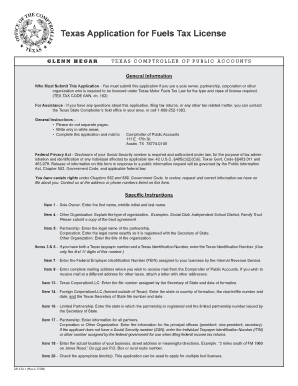

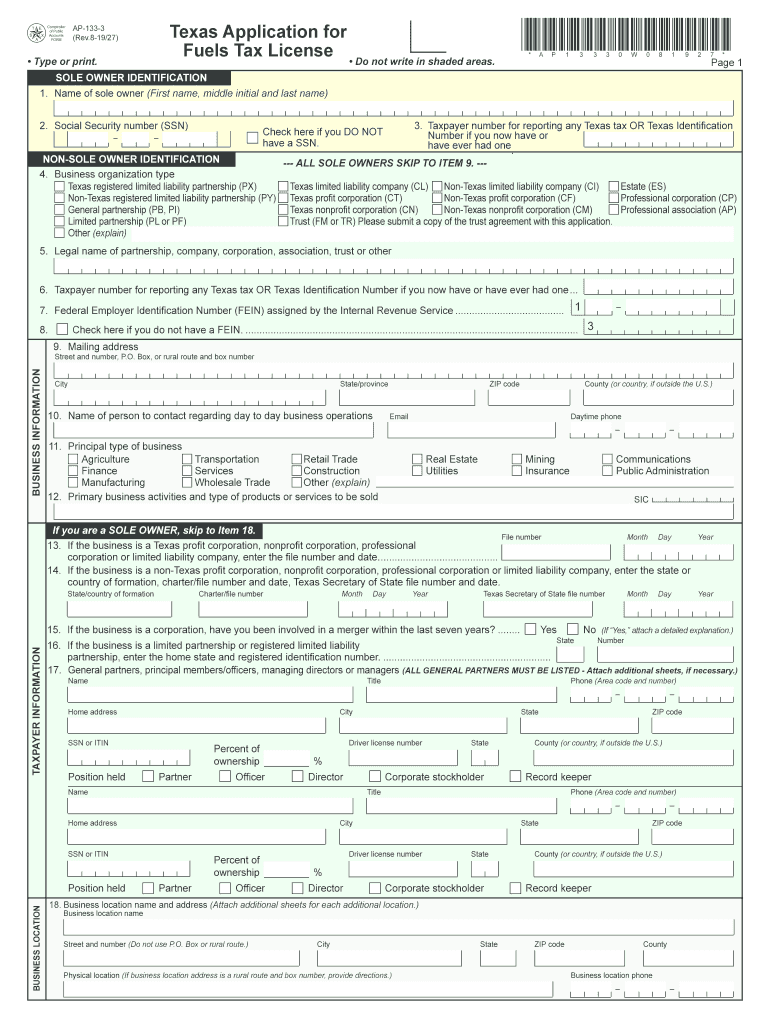

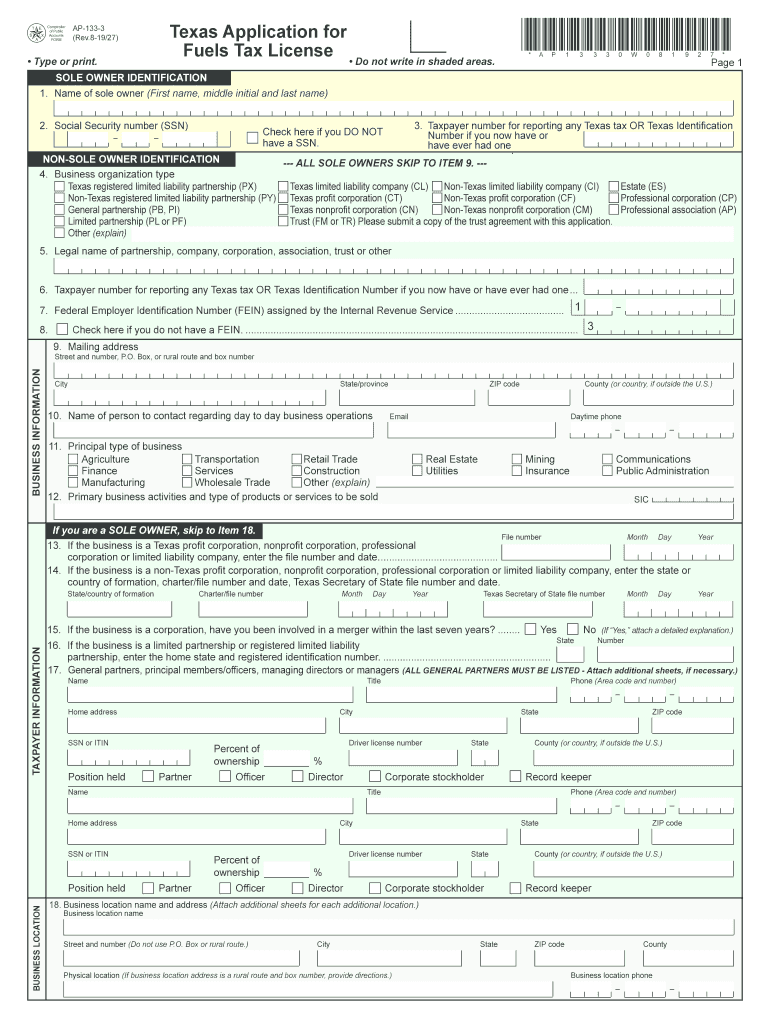

PRINT FORM CLEAR FIELDS Texas Application for Fuels Tax License GLENN HEGAR TEXAS COMPTROLLER OF PUBLIC ACCOUNTS General Information Who Must Submit This Application - You must submit this application if you are a sole owner partnership corporation or other organization who is required to be licensed under Texas Motor Fuels Tax Law for the type and class of license required. TEX. Type or print. Fuels Tax License Do not write in shaded areas. AP13330W081927 CLEAR FORM A P W Page 1 SOLE OWNER...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas ap 133 form

Edit your ap application fuels tax license form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas ap 133 application fuels tax license form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ap 133 form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit texas fuels license get form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX AP-133 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tx ap 133 form

How to fill out TX AP-133

01

Obtain the TX AP-133 form from the Texas Comptroller's website or your local tax office.

02

Fill in the taxpayer's name, address, and contact information at the top of the form.

03

Provide the Texas account number or the federal employer identification number (FEIN).

04

Indicate the reporting period for the information being submitted.

05

List all applicable items or services and their corresponding amounts in the specified sections.

06

Review the form for accuracy and ensure all required fields are completed.

07

Sign and date the form at the bottom to certify the information provided is true and correct.

08

Submit the completed form to the appropriate Texas tax office either by mail or electronically if applicable.

Who needs TX AP-133?

01

Businesses operating in Texas that need to report specific tax information.

02

Tax professionals filling out forms on behalf of their clients.

03

Organizations that are subject to Texas sales and use tax regulations.

Fill

tx ap 133 form

: Try Risk Free

People Also Ask about texas 133 form printable

What is the fuel tax law in Texas?

The state of Texas levies a flat 20 cent per gallon tax on gasoline and diesel fuels. Of these 20 cents, 15 cents is dedicated by the Texas Constitution to roadways, with the remaining 5 cents dedicated to public education. The tax is included in the price of fuel you buy at the pump.

How do I get my IFTA license in Texas?

How to Apply for an IFTA License. Motor carriers are encouraged to apply for an IFTA license through the Comptroller's Webfile system. With Webfile it's easy to submit the application electronically from the convenience of a home or office without the delays associated with mailing paper applications.

Who is exempt from motor fuel tax in Texas?

Texas law provides a variety of exemptions from gasoline and diesel taxes. Federal agencies and Texas public school districts, or their bus contractors, are exempted.

What form is Texas claim for refund of gasoline fuel taxes?

Gasoline and Diesel Fuel Refund Claims When requesting a refund directly from the Comptroller, claimants who are not licensed for motor fuels must submit Form 06-106, Texas Claim for Refund of Gasoline or Diesel Fuel Taxes (PDF).

Does Texas have a fuel tax license requirement?

All licensees have to complete the Texas Application for Fuels Tax License. You need to provide your business papers for sole proprietorship, partnership or corporation, and fill in the respective parts of the application for your type of business entity.

How long does it take to get an IFTA sticker in Texas?

The application takes about 10 minutes to complete. Once your application is reviewed, approved, and processed, the IFTA license and decal(s) will be mailed to the address provided.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the ap 133 2019-2025 form in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your ap 133 2019-2025 form in minutes.

How do I edit ap 133 2019-2025 form on an iOS device?

Create, modify, and share ap 133 2019-2025 form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How can I fill out ap 133 2019-2025 form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your ap 133 2019-2025 form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is TX AP-133?

TX AP-133 is a form used in Texas for reporting the allocation of state revenues to maintain transparency and accountability in public finance.

Who is required to file TX AP-133?

Entities that receive state funds and are required to report on the allocation and use of those funds must file TX AP-133.

How to fill out TX AP-133?

To fill out TX AP-133, you need to provide detailed information on the funding sources, expenditures, and any relevant supporting documents as specified in the form's instructions.

What is the purpose of TX AP-133?

The purpose of TX AP-133 is to ensure proper monitoring and reporting of state funding, thereby promoting effective use of public resources.

What information must be reported on TX AP-133?

Information that must be reported includes the amounts received from the state, how those funds were allocated, and any expenditures made with the state funds.

Fill out your ap 133 2019-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ap 133 2019-2025 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.