IN Form 11274 2012 free printable template

Show details

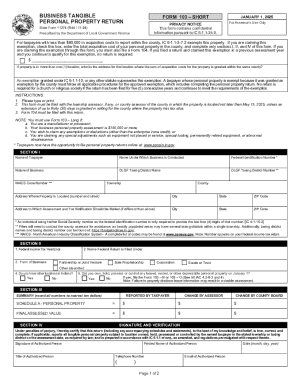

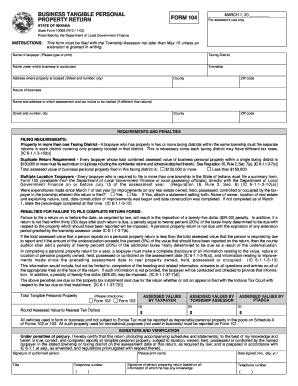

Reset Form BUSINESS TANGIBLE PERSONAL PROPERTY RETURN FORM 103 SHORT State Form 11274 (R30 / 11-12) PRESCRIBED BY THE DEPARTMENT OF LOCAL GOVERNMENT FINANCE INSTRUCTIONS: MARCH 1, 2013, For Assessor's

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign indiana form 103

Edit your indiana form 103 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indiana form 103 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit indiana form 103 online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit indiana form 103. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN Form 11274 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out indiana form 103

How to fill out IN Form 11274

01

Gather the required documents such as identification and proof of residency.

02

Start filling out the form by entering your personal details, including your name, address, and date of birth.

03

Provide information regarding your immigration status and any relevant case numbers.

04

Carefully follow the instructions for each section, ensuring accuracy and completeness.

05

Review the form for any errors or omissions.

06

Sign and date the form at the designated section.

07

Submit the completed form along with any required fees to the appropriate address.

Who needs IN Form 11274?

01

Individuals applying for a specific immigration benefit or status under Canadian immigration law.

02

Those who need to update their personal information with immigration authorities.

03

People who are responding to a request for information from the immigration department.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between Schedule D and form 4797?

Whereas Schedule D forms are used to report personal gains, IRS Form 4797 is used to report profits from real estate transactions centered on business use. IRS Form 4797 has much more specific utilization, while Schedule D is a required form for anyone reporting personal gains in general.

What is the difference between Schedule D and Form 4797?

What Is the Difference Between Schedule D and Form 4797? Schedule D is used to report gains from personal investments, while Form 4797 is used to report gains from real estate dealings—those that are done primarily in relation to business rather than personal transactions.

What is form 8949 used for?

Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099-B or 1099-S (or substitute statements) with the amounts you report on your return.

What is a form 4797 used for?

Use Form 4797 to report: The sale or exchange of property. The involuntary conversion of property and capital assets. The disposition of noncapital assets.

Who has to fill out Form 4797?

If you sold property that was your home and you also used it for business, you may need to use Form 4797 to report the sale of the part used for business (or the sale of the entire property if used entirely for business). Gain or loss on the sale of the home may be a capital gain or loss or an ordinary gain or loss.

Should I use form 8949 or 4797?

Should You Use Form 8949 or Form 4797? When reporting gains from the sale of real estate, Form 4797 will suffice in most scenarios. Form 8949 will need to be used when deferring capital gains through investments in a qualified fund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the indiana form 103 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I edit indiana form 103 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share indiana form 103 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I fill out indiana form 103 on an Android device?

On Android, use the pdfFiller mobile app to finish your indiana form 103. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is IN Form 11274?

IN Form 11274 is a tax form used in Indiana for individuals to report specific financial information required by the state tax authority.

Who is required to file IN Form 11274?

Individuals who have certain types of income or deductions that must be reported to the Indiana state tax authority are required to file IN Form 11274.

How to fill out IN Form 11274?

To fill out IN Form 11274, individuals must provide their personal information, accurately report income, and provide any necessary deductions or credits, following the instructions provided with the form.

What is the purpose of IN Form 11274?

The purpose of IN Form 11274 is to collect information from individuals to ensure accurate tax reporting and compliance with Indiana state tax laws.

What information must be reported on IN Form 11274?

IN Form 11274 requires reporting of personal identification information, income sources, deductions, credits, and any other relevant financial details as specified in the form instructions.

Fill out your indiana form 103 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indiana Form 103 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.