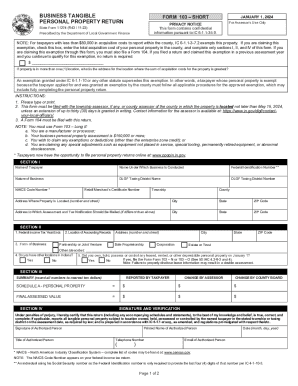

IN Form 11274 2024-2025 free printable template

Get, Create, Make and Sign form 130 indiana

Editing indiana 11274 tangible online

Uncompromising security for your PDF editing and eSignature needs

IN Form 11274 Form Versions

How to fill out indiana tangible personal print form

How to fill out IN Form 11274

Who needs IN Form 11274?

Video instructions and help with filling out and completing 11274 tangible property download

Instructions and Help about state form 11274

Hi YouTube it's your friend Evan Man ship with Maine state property group coming to you live again I just did a Facebook live video and I got a lot of comments and questions on an issue that a lot of investors have especially out-of-state folks who haven't been working around this piece of the pie for that long Indiana property taxes are a fascinating weird most up then are they're a little animal not necessarily complex, but there are some moving pieces that you need to understand, so I wanted to walk you through a couple different online tools that allow you to estimate understand and analyze property taxes here in Indianapolis or anywhere in Indiana that you may invest before I get started I should say the Indiana property taxes are paid in arrears meaning that the taxes that were paying this year in 2018 today's August 1st at 2018 the taxes that were paying in 2018 were paying on 2017 assessment so if your property is assessed for 100000 in 2017 roughly a 2 percent tax rate you're paying 2000 bucks in 2018 for the 2017 assessment, and I'll show you what that looks like the first thing I want to show you guys is what's called the property record card tool that's online and available to anyone just by searching for Marion County Indiana property cards that's Marion County Indiana property cards it's the first thing I hear Marion County assessor online property record cards I'll click great, and I'm going to show you Oh which one should I show you lets see show you we just bought this property back in then a couple of days Daisy actually it's not going how about this one you'll see on here till pop up with once you after you type in the address till pop up whatever you click it downloaded he's easy and this card will show you a couple different things that are ultra important to not only your assessment but also your eventual property tax value, so you hop on here, and you can look and see a couple of things first and foremost the most important thing that the drives your property taxes your assessments only the two pieces property tax rate and assessments so your assessment right here fifty-two thousand four hundred hours that's what it's assessed for as an effective January 1 of 2018 fifty-two thousand four hundred dollars, and we will pay my taxes in 2019 for that assessment, so you can see this is the dilemma that's a lot of investors run into they see an assessment for fifty-three thousand four hundred dollars I think okay not too bad you know you can see I bought it before 55 is it true no I bought it for thirty I don't know why should I believe that I bought it for thirty I don't know what the 55 is for, but I bought it for thirty it's essentially where it's a little over assessed, but you know maybe not enough for me to appeal it, so I'm going to go through and show you another tool how to access your actual tax bill because your accessibility matters a little but your tax bills ultimately what you're paying so lets go ahead and check...

People Also Ask about indiana 11274 personal property print

What is the difference between Schedule D and form 4797?

What is the difference between Schedule D and Form 4797?

What is form 8949 used for?

What is a form 4797 used for?

Who has to fill out Form 4797?

Should I use form 8949 or 4797?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in indiana form 11274 printable?

Can I create an electronic signature for the indiana 11274 fill in Chrome?

How do I fill out indiana 11274 blank on an Android device?

What is IN Form 11274?

Who is required to file IN Form 11274?

How to fill out IN Form 11274?

What is the purpose of IN Form 11274?

What information must be reported on IN Form 11274?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.