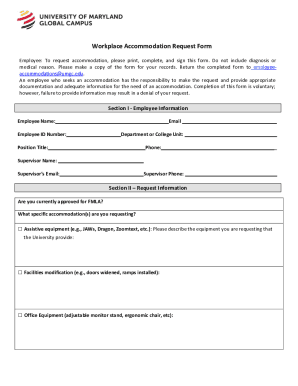

IN Form 11274 2018 free printable template

Show details

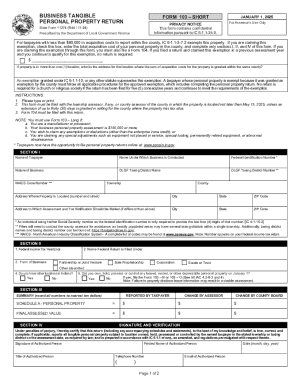

Reset Agribusiness TANGIBLE PERSONAL PROPERTY RETURN State Form 11274 (R37 / 1018) Prescribed by the Department of Local Government FinanceFORM 103 SHORT PRIVACY NOTICE This form contains information

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN Form 11274

Edit your IN Form 11274 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN Form 11274 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IN Form 11274 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IN Form 11274. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN Form 11274 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN Form 11274

How to fill out IN Form 11274

01

Gather all necessary documents required for the application.

02

Start by downloading the IN Form 11274 from the official website.

03

Fill in your personal information in the designated sections, including your name, address, and contact details.

04

Provide the details of your immigration status and the purpose of the form.

05

If applicable, include information about your spouse or dependents.

06

Sign and date the form at the bottom.

07

Review the form for accuracy and completeness.

08

Submit the form along with any required fees and supporting documents as instructed.

Who needs IN Form 11274?

01

Individuals seeking to adjust their immigration status.

02

Those applying for a change of conditions on their visa.

03

Applicants requesting a specific immigration-related objective that falls under the form's mandate.

Fill

form

: Try Risk Free

People Also Ask about

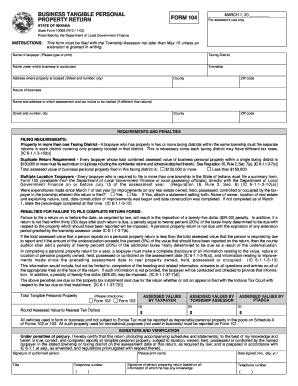

What is the difference between assessed value and market value in Indiana?

While assessed value will be calculated annually or every five years depending on your municipality, market value can fluctuate throughout the year — and even from one month to the next. Market value is the price that a buyer is willing to pay for a home or the price that the seller is willing to accept.

How do I find the assessed value of my property in Indiana?

You will receive notice of your property's value in one of two ways: the county assessor may send you a notice of assessment, known as a Form 11. Otherwise, the assessed value of your property can be found on your tax bill. This document is known as the TS-1 tax comparison statement.

How do I appeal property taxes in Indiana?

An appeal begins with filing a Form 130 – Taxpayer's Notice to Initiate an Appeal with the local assessing official. The appeal should detail the pertinent facts of why the assessed value is being disputed. A taxpayer may only request a review of the current year's assessed valuation.

What is the PPT exemption in Indiana?

Licensed motor vehicles, trailers, motorized boats, most airplanes, campers, recreational vehicles, and other registered vehicles that are subject to excise tax collected at the time of licensure by the Indiana Bureau of Motor Vehicles are not subject to personal property tax.

How do I find my Indiana property tax bill?

Call 317-327-4444 if you have any questions. Enter your parcel number, name, or street name to view your invoice. Use an e-Check or credit card to make a payment. After you make an online payment, it can take up to five business days for your tax bill to be updated with your new balance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IN Form 11274?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific IN Form 11274 and other forms. Find the template you need and change it using powerful tools.

How do I fill out IN Form 11274 using my mobile device?

Use the pdfFiller mobile app to complete and sign IN Form 11274 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete IN Form 11274 on an Android device?

On Android, use the pdfFiller mobile app to finish your IN Form 11274. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is IN Form 11274?

IN Form 11274 is a tax form used in India for the assessment of income and reporting of certain information to the tax authorities.

Who is required to file IN Form 11274?

Individuals, businesses, and organizations who meet specific income criteria or engage in particular financial activities are required to file IN Form 11274.

How to fill out IN Form 11274?

To fill out IN Form 11274, taxpayers should gather the necessary financial documents, report relevant income details, and complete the sections of the form according to the instructions provided by the tax authorities.

What is the purpose of IN Form 11274?

The purpose of IN Form 11274 is to ensure accurate reporting of income and compliance with tax regulations, facilitating proper assessment and taxation.

What information must be reported on IN Form 11274?

The information that must be reported on IN Form 11274 includes personal identification details, income sources, deductions, and any other financial information relevant to the tax year.

Fill out your IN Form 11274 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN Form 11274 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.