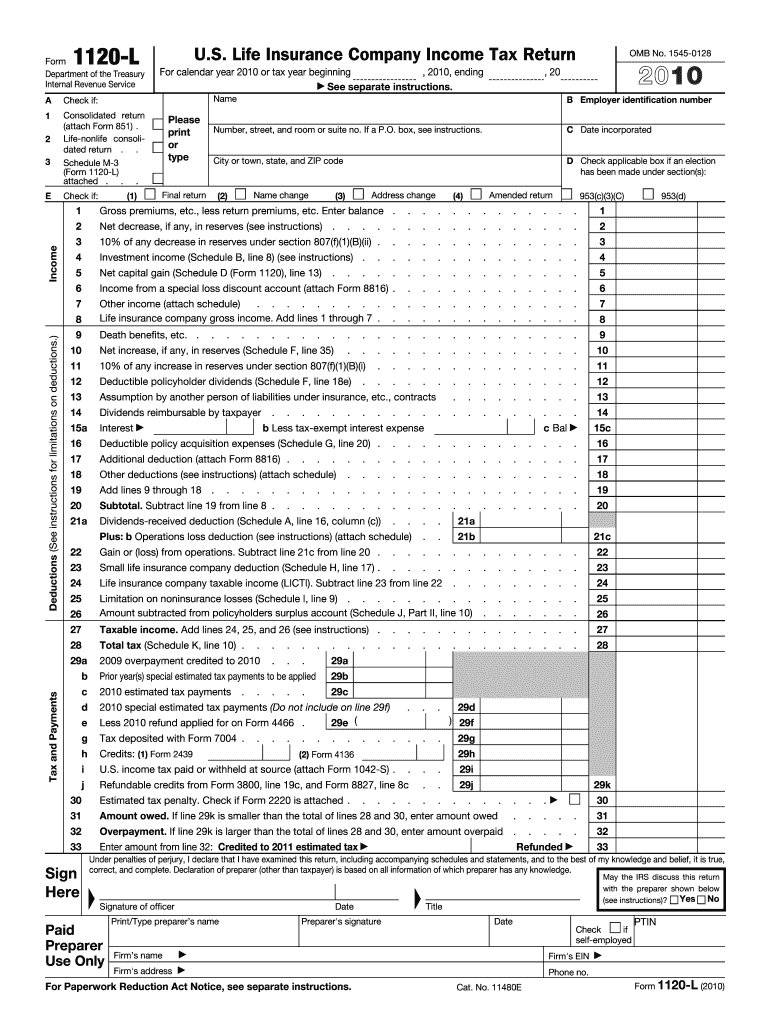

IRS 1120-L 2010 free printable template

Show details

Form Department of the Treasury Internal Revenue Service A 1 2 3 Check if: Consolidated return (attach Form 851). Life-nonlife consolidated return. . Schedule M-3 (Form 1120-L) attached. . . Check

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120-L

How to edit IRS 1120-L

How to fill out IRS 1120-L

Instructions and Help about IRS 1120-L

How to edit IRS 1120-L

To edit IRS 1120-L, you may use pdfFiller’s online tool which allows users to upload the form, make necessary changes, and save the edited PDF. Start by uploading your existing IRS 1120-L form to the pdfFiller platform. Once uploaded, use the editing features to fill in or update any required sections. After completing your edits, ensure to review the document for accuracy before final submission.

How to fill out IRS 1120-L

Filling out IRS 1120-L involves several key steps to ensure compliance and accuracy. Firstly, gather all relevant financial documentation for the tax year, including income statements, expense records, and previous tax filings. Begin by entering your organization's name, employer identification number (EIN), and address at the top of the form. Next, accurately report your organization’s revenues, expenses, and applicable deductions following the provided instructions on the form.

01

Gather all necessary documents and information before starting.

02

Complete the identification section at the top of the form.

03

Fill out each section, ensuring accurate reporting of income and expenses.

04

Review all entries for accuracy and completeness.

05

Sign and date the form before submission.

About IRS 1120-L 2010 previous version

What is IRS 1120-L?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120-L 2010 previous version

What is IRS 1120-L?

IRS 1120-L is a federal tax form used by insurance companies to report their income, deductions, and tax liability for a given tax year. This form specifically applies to life insurance companies and is used to compute the amount of tax owed based on taxable income. Insurance companies must file Form 1120-L annually to comply with federal tax laws.

What is the purpose of this form?

The purpose of IRS 1120-L is to provide a structured format for life insurance companies to report their financial activity to the IRS. This form enables the IRS to assess the company's tax liabilities accurately and ensure compliance with tax regulations. By detailing income from premiums, investment earnings, and allowable deductions, the IRS can evaluate and collect taxes owed from these businesses.

Who needs the form?

Life insurance companies operating within the United States must file IRS 1120-L. This includes both domestic and foreign entities that are classified as life insurance companies under U.S. tax laws. Additionally, companies that provide certain types of insurance coverage and generate revenue from premium payments are required to use this form for their tax filings.

When am I exempt from filling out this form?

Entities that do not qualify as life insurance companies, such as property and casualty insurers, are exempt from filing IRS 1120-L. Furthermore, companies that do not operate in the United States or do not generate taxable income are also not required to submit this form. It’s essential to determine the classification of the insurance entity under U.S. tax guidelines to establish eligibility for exemption.

Components of the form

The IRS 1120-L comprises various sections that require detailed financial information. Key components include the identification section, income and deductions section, and the tax computation area. The form also includes schedules that may require additional disclosures based on specific operational activities or investment income. Each component must be completed accurately to reflect the company's financial position.

What are the penalties for not issuing the form?

Failure to submit IRS 1120-L may result in hefty penalties imposed by the IRS. These penalties can include fines based on the amount of tax owed or due, and the company may also incur interest on unpaid taxes. In serious cases of non-compliance, the IRS may take legal action against the insurance company, affecting its operational license and credibility.

What information do you need when you file the form?

When preparing to file IRS 1120-L, it is crucial to collect comprehensive financial information including, but not limited to, total premiums received, investment income, and detailed expense reports. Additionally, the organization’s EIN, prior year tax returns, and any applicable schedules should be readily available. This information ensures accurate reporting and compliance with IRS requirements.

Is the form accompanied by other forms?

IRS 1120-L may require additional schedules or forms to support the values reported on the main form. Commonly attached forms include Schedule A, which focuses on investment income and associated deductions. Depending on the company's specific circumstances, other schedules may be necessary to report detailed information accurately. Reviewing IRS guidelines for associated forms is crucial to ensure full compliance.

Where do I send the form?

The completed IRS 1120-L form should be mailed to the address specified in the instructions accompanying the form. Generally, the submission is directed to the appropriate processing center based on the company’s location and filing status. It's important to confirm the correct mailing address on the IRS website or within the form instructions to avoid delays in processing.

See what our users say